ADT 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.own recommendation for the Board to review and discuss. The independent members of our Board

have the sole authority to approve compensation decisions made with respect to the Chief Executive

Officer, and the Board has established the scorecard against which the performance of the Chief

Executive Officer is measured. The basis of the scorecard is the financial plan, as approved by the

Board. However, the Compensation Committee reviews and approves the performance goals and

objectives relevant to the Chief Executive Officer’s compensation, evaluates his performance in light of

those goals and objectives, and, based upon this evaluation, recommends his compensation for approval

by the independent members of the Board.

With respect to the Company’s other Senior Officers and employees, it is the Chief Executive

Officer and the Senior Vice President, Human Resources and Internal Communications, who develop

the pay strategies and recommendations, which the Compensation Committee then reviews. However,

the authority to approve those strategies and recommendations resides with different parties according

to the employee’s level. For Senior Officers, decisions must be approved by the independent members

of the Board, subject to the Compensation Committee’s authority regarding performance measures. For

employees below the level of Senior Officer, the Board has granted the Chief Executive Officer and his

designees the authority to approve pay actions. However, the Compensation Committee is responsible

for approving actions related to other aspects of the compensation of these employees, such as the size

of bonus pools, annual incentive plan performance goals, equity award design, equity value ranges and

share pools, and compensation packages for highly compensated employees who are not Senior

Officers.

Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code imposes a limit of $1.0 million on the amount of

compensation that can be deducted by Tyco with respect to each named executive officer (other than

Mr. Coughlin, our Chief Financial Officer), unless the compensation over $1.0 million qualifies as

‘‘performance-based’’ under federal tax law. It is our policy to structure compensation arrangements

with our named executive officers to qualify as performance-based so that compensation payments are

deductible under U.S. federal tax law, unless the benefit of such deductibility is outweighed by the need

for flexibility or the attainment of other corporate objectives. Potentially non-deductible forms of

compensation include payments in connection with the recruitment and retention of key employees,

base salary over $1.0 million, discretionary bonus payments and grants of time-based RSUs. In addition,

stock options granted to Mr. Breen when he was hired in July 2002 may not qualify for deduction

under Section 162(m).

Change in Control and Severance Benefits

We believe that our severance arrangements are essential in attracting and retaining the executive

talent necessary to manage our diverse businesses, and are competitive with those provided to executive

officers at other large publicly traded U.S. companies. Mr. Breen’s employment agreement provides for

benefits if he is terminated in connection with a change in control or under other specified

circumstances, and the information in the tables below reflects the terms of the agreement.

For our other named executive officers, who do not have employment agreements, the Tyco

International Severance Plan for U.S. Officers and Executives (the ‘‘Severance Plan’’) and the Tyco

International Change in Control Severance Plan for Certain U.S. Officers and Executives (the ‘‘CIC

Severance Plan’’) generally govern the benefits that accrue upon termination. As described below, a

‘‘double trigger’’ is required under the CIC Severance Plan before most benefits become available to

the executives covered by that plan. Effective January 1, 2009, these plans were amended to comply

with certain provisions of the Internal Revenue Code. In addition, certain changes were made to

reduce the period during which Tyco must provide employer-sponsored health and dental benefits.

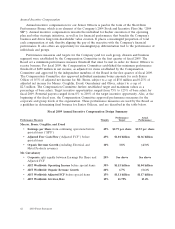

The table below summarizes the key terms and provisions of the severance plans that are currently

in effect. Refer to the ‘‘Potential Payments Upon Termination and Change in Control’’ table for the

estimated dollar value of the benefits available under the severance plans in effect as of our fiscal year-

end.

48 2010 Proxy Statement