ADT 2009 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290

|

|

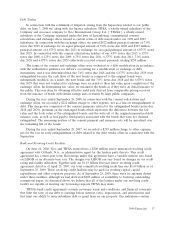

During 2009, 2008 and 2007 we paid out $154 million, $187 million and $70 million, respectively,

in cash related to restructuring activities. See Note 3 to the Consolidated Financial Statements for

further information regarding our restructuring activities.

Income taxes paid, net of refunds, related to continuing operations was $291 million, $501 million,

and $649 million in 2009, 2008, and 2007, respectively.

During 2009, 2008 and 2007, Tyco paid $543 million, $376 million and $409 million of cash,

respectively, to acquire approximately 512,000, 370,000 and 415,000 customer contracts for electronic

security services through the ADT dealer program.

As previously discussed, effective June 29, 2007, we completed the Separation. In connection with

the Separation, we paid $68 million and $349 million in Separation costs during 2008 and 2007

respectively. Of these amounts, $36 million and $256 million were included in cash flows from

discontinued operating activities, respectively.

During the second quarter of 2008, Tyco released $2,960 million of funds placed in escrow during

the third quarter of 2007 as well as $60 million of interest earned on those funds for the benefit of the

class as stipulated in the Court’s final order related to the class action settlement.

We will continue to divest businesses that do not align with our overall strategy. We expect to use

the proceeds from these sales, as well as the cash generated by our operations, to continue to make

investments in our businesses that are intended to grow revenue and improve productivity, including

our restructuring actions. We expect to also use cash to selectively pursue acquisitions.

Pursuant to our share repurchase program, we may repurchase Tyco shares from time to time in

open market purchases at prevailing market prices, in negotiated transactions off the market, or

pursuant to an approved 10b5-1 trading plan in accordance with applicable regulations.

Management believes that cash generated by or available to us should be sufficient to fund our

capital and liquidity needs for the foreseeable future, including quarterly dividend payments. We intend

to continue to repurchase shares under our existing $1.0 billion share repurchase program approved by

our Board of Directors on July 10, 2008 depending on credit market conditions, macroeconomic factors

and expectations regarding future cash flows.

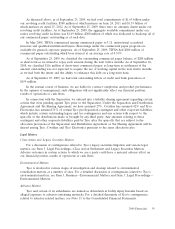

Capitalization

Shareholders’ equity was $12.9 billion or $27.30 per share, as of September 25, 2009, compared to

$15.5 billion or $32.76 per share, as of September 26, 2008. Shareholders’ equity decreased primarily

due to a net loss of $1.8 billion, which was primarily driven by goodwill and intangible asset

impairments, dividends declared of $472 million, a $220 million current period change relating to the

Company’s retirement plans and unfavorable changes in foreign currency exchange rates of

$203 million.

Total debt was $4.3 billion as of September 25, 2009 and September 26, 2008, respectively. Total

debt as a percentage of capitalization (total debt and shareholders’ equity) was 25% as of

September 25, 2009 and 22% as of September 26, 2008, respectively.

Our cash balance increased to $2.4 billion as of September 25, 2009, as compared to $1.5 billion as

of September 26, 2008. This increase in cash was primarily due to cash generated by the operating

segments as well as proceeds from issuance of long-term debt.

56 2009 Financials