ADT 2009 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290

|

|

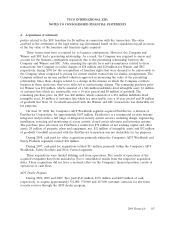

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

6. Income Taxes (Continued)

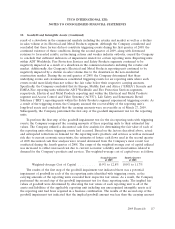

accrued related to unrecognized tax benefits in income tax expense. Tyco had accrued interest and

penalties related to the unrecognized tax benefits of $50 million and $49 million as of September 25,

2009 and September 26, 2008, respectively. Tyco recognized $1 million and $9 million of income tax

expense for interest and penalties accrued related to unrecognized tax benefits as of September 25,

2009 and September 26, 2008, respectively.

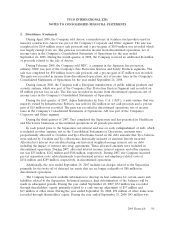

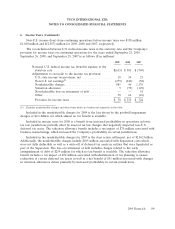

A reconciliation of the beginning and ending amount of unrecognized tax benefit is as follows ($ in

millions):

Balance as of September 26, 2008 ................................ $369

Additions based on tax positions related to the current year ............ 10

Additions based on tax positions related to prior years ................ 6

Reductions based on tax positions related to prior years ............... (90)

Reduction related to settlements ................................ (4)

Reductions related to lapse of the applicable statute of limitations ....... (6)

Foreign currency translation adjustments .......................... (1)

Balance as of September 25, 2009 ................................ $284

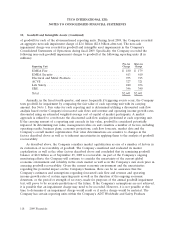

Many of Tyco’s uncertain tax positions relate to tax years that remain subject to audit by the taxing

authorities in the U.S. federal, state and local or foreign jurisdictions. Open tax years in significant

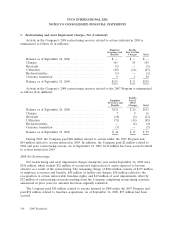

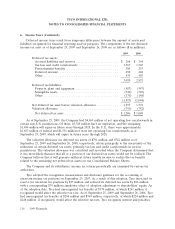

jurisdictions are as follows:

Years Open

Jurisdiction To Audit

United States ........................................... 1997-2008

Australia ............................................... 2004-2008

France ................................................ 1999-2008

Germany ............................................... 1998-2008

United Kingdom ......................................... 2000-2008

Canada ................................................ 2000-2008

Based on the current status of its income tax audits, the Company does not anticipate a significant

change to its unrecognized tax benefits in the next twelve months.

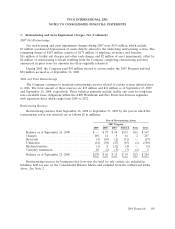

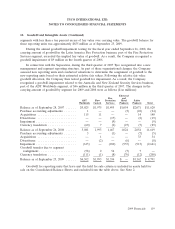

Tax Sharing Agreement

In connection with the spin-offs of Covidien and Tyco Electronics from Tyco, Tyco entered into a

Tax Sharing Agreement that generally governs Covidien’s, Tyco Electronics’ and Tyco’s respective rights,

responsibilities, and obligations after the Separation with respect to taxes, including ordinary course of

business taxes and taxes, if any, incurred as a result of any failure of the distribution of all of the shares

of Covidien or Tyco Electronics to qualify as a tax-free distribution for U.S. federal income tax

purposes within the meaning of Section 355 of the Code or certain internal transactions undertaken in

anticipation of the spin-offs to qualify for tax-favored treatment under the Code.

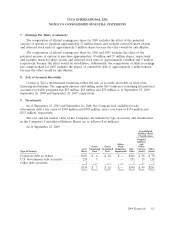

Under the Tax Sharing Agreement, the Company shares responsibility for certain of Tyco’s,

Covidien’s and Tyco Electronics’ income tax liabilities, which result in cash payments, based on a

sharing formula for periods prior to and including June 29, 2007. More specifically, Tyco, Covidien and

Tyco Electronics share 27%, 42% and 31%, respectively, of shared income tax liabilities that arise from

2009 Financials 111