ADT 2009 Annual Report Download - page 151

Download and view the complete annual report

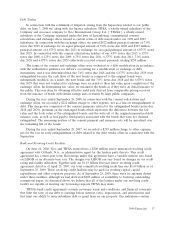

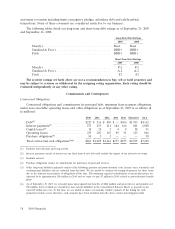

Please find page 151 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As discussed above, as of September 25, 2009, we had total commitments of $1.69 billion under

our revolving credit facilities, $500 million of which matures on June 24, 2011 and $1.19 billion of

which matures on April 25, 2012. As of September 25, 2009, there were no amounts drawn under our

revolving credit facilities. As of September 25, 2009, the aggregate available commitment under our

senior revolving credit facilities was $1.69 billion, $200 million of which was dedicated to backstop all of

our commercial paper outstanding as of such date.

In May 2008, TIFSA commenced issuing commercial paper to U.S. institutional accredited

investors and qualified institutional buyers. Borrowings under the commercial paper program are

available for general corporate purposes. As of September 25, 2009, TIFSA had $200 million of

commercial paper outstanding which bore interest at an average rate of 0.33%.

As of September 25, 2009, we classified the outstanding commercial paper balance of $200 million

as short-term as we intend to repay such amount during the next twelve months. As of September 26,

2008, we classified $116 million of short-term commercial paper as long-term as settlement of the

amount outstanding was not expected to require the use of working capital in the next twelve months

as we had both the intent and the ability to refinance this debt on a long-term basis.

As of September 25, 2009, we had total outstanding letters of credit and bank guarantees of

$659 million.

In the normal course of business, we are liable for contract completion and product performance.

In the opinion of management, such obligations will not significantly affect our financial position,

results of operations or cash flows.

In connection with the Separation, we entered into a liability sharing agreement regarding certain

actions that were pending against Tyco prior to the Separation. Under the Separation and Distribution

Agreement and Tax Sharing Agreement, we have assumed 27%, Covidien has assumed 42% and Tyco

Electronics has assumed 31% of certain Tyco pre-Separation contingent and other corporate liabilities,

which include certain outstanding legacy and tax contingencies and any actions with respect to the

spin-offs or the distributions made or brought by any third party. Any amounts relating to these

contingent and other corporate liabilities paid by Tyco after the spin-offs that are subject to the

allocation provisions of the Separation and Distribution Agreement or Tax Sharing Agreement will be

shared among Tyco, Covidien and Tyco Electronics pursuant to the same allocation ratio.

Legal Matters

Class Action and Legacy Securities Matters

For a discussion of contingencies related to Tyco’s legacy securities litigation and various legal

matters, see Item 3. Legal Proceedings—Class Action Settlement and Legacy Securities Matters.

Adverse outcomes in certain actions to which we are a party could have a material adverse effect on

our financial position, results of operations or cash flows.

Environmental Matters

Tyco is involved in various stages of investigation and cleanup related to environmental

remediation matters at a number of sites. For a detailed discussion of contingencies related to Tyco’s

environmental matters, see Item 1. Business—Environmental Matters and Item 3. Legal Proceedings—

Environmental Matters.

Asbestos Matters

Tyco and certain of its subsidiaries are named as defendants in bodily injury lawsuits based on

alleged exposure to asbestos-containing materials. For a detailed discussion of Tyco’s contingencies

related to asbestos-related matters, see Note 15 to the Consolidated Financial Statements.

2009 Financials 59