ADT 2009 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

10. Goodwill and Intangible Assets (Continued)

of goodwill for each of the aforementioned reporting units. During fiscal 2009, the Company recorded

an aggregate non-cash impairment charge of $2.6 billion ($2.6 billion after-tax). The non-cash

impairment charge was recorded in goodwill and intangible asset impairments in the Company’s

Consolidated Statements of Operations during fiscal 2009. Specifically, the Company recorded the

following non-cash goodwill impairment charges to goodwill at the following reporting units ($ in

millions):

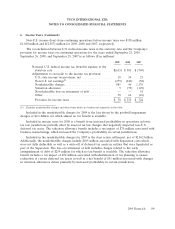

Pre-tax After-tax

Reporting Unit Charge Charge

EMEA Fire ........................................ $ 180 $ 179

EMEA Security ..................................... 613 610

Electrical and Metal Products ........................... 935 915

ACVS ............................................ 327 321

Life Safety ......................................... 240 236

SRS.............................................. 346 340

Total ............................................. $2,641 $2,601

Annually, in the fiscal fourth quarter, and more frequently if triggering events occur, the Company

tests goodwill for impairment by comparing the fair value of each reporting unit with its carrying

amount. See Note 1. Fair value for each reporting unit is determined utilizing a discounted cash flow

analysis based on the Company’s forecasted cash flows and revenue and operating income growth rates,

discounted using an estimated weighted-average cost of capital of market participants. A market

approach is utilized to corroborate the discounted cash flow analysis performed at each reporting unit.

If the carrying amount of a reporting unit exceeds its fair value, goodwill is considered potentially

impaired. In determining fair value, management relies on and considers a number of factors, including

operating results, business plans, economic projections, cash flow forecasts, market data and the

Company’s overall market capitalization. Fair value determinations are sensitive to changes in the

factors described above as well as to inherent uncertainties in applying them to the analysis of goodwill

recoverability.

As described above, the Company considers market capitalization as one of a number of factors in

its evaluation of recoverability of goodwill. The Company considered and evaluated its market

capitalization as well as the other factors described above and concluded that its remaining goodwill

balance of $8.8 billion as of September 25, 2009 is recoverable. As part of the Company’s ongoing

monitoring efforts, the Company will continue to consider the uncertainty of the current global

economic environment and volatility in the stock market as well as in the Company’s own stock price in

assessing goodwill recoverability. Given the current economic environment and the uncertainties

regarding the potential impact on the Company’s business, there can be no assurance that the

Company’s estimates and assumptions regarding forecasted cash flow and revenue and operating

income growth rates of certain reporting units as well as the duration of the ongoing economic

downturn, or the period or strength of recovery, made for purposes of the annual goodwill impairment

test, will prove to be accurate predictions of the future. If the Company’s assumptions are not achieved,

it is possible that an impairment charge may need to be recorded. However, it is not possible at this

time to determine if an impairment charge would result or if such a charge would be material. The

Company has certain reporting units within the Company’s ADT Worldwide and Safety Products

118 2009 Financials