ADT 2009 Annual Report Download - page 128

Download and view the complete annual report

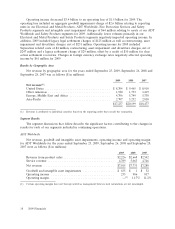

Please find page 128 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.which saw historically low volumes in 2009. The impact of the weakened global economy on product

and systems installation revenue also significantly contributed to the year-over-year decline. On the

other hand, service revenue continued to grow as a percentage of our overall revenue, from 35% in

2008 to 39% in 2009. Our service revenues are principally derived from our ADT Worldwide and Fire

Protection Services businesses, and represent a predictable and consistent source of revenue. Recurring

revenue in our ADT Worldwide business now represents approximately 55% of ADT’s total revenue

compared to approximately 50% in 2008. In the Fire Protection Services business, service revenue

increased as a percentage of Fire Protection’s total revenue from 48% in 2008 to 49% in 2009.

Operating income declined in 2009 compared to 2008 due in large part to non-cash goodwill and

intangible asset impairment charges of approximately $2.7 billion during 2009. Operating income was

also negatively affected by charges related to restructuring, asset impairment and divestiture activity of

approximately $251 million and charges related to legacy legal matters of approximately $125 million.

To a lesser degree, operating income was negatively impacted by reduced volumes due to the economic

downturn. Operating income benefited from a number of key cost containment actions taken in 2009

and 2008, as well as restructuring actions taken in prior periods. We continue to be aggressive in

identifying cost saving opportunities and restructuring activities that should benefit the Company when

the economy improves. During 2010, we expect to incur an additional $100 million to $150 million of

charges related to restructuring activity.

As of September 25, 2009, the Company’s cash balance was $2.4 billion, as compared to

$1.5 billion as of September 26, 2008. The increase from 2008 to 2009 was primarily due to cash flow

from operating activities and proceeds received from the issuance of long-term debt. In 2010, we expect

to continue to use our cash to fund internal growth opportunities, improve productivity across all of

our businesses, make acquisitions that strategically fit within our ADT Worldwide, Fire Protection

Services and Flow Control businesses and return capital to shareholders. In 2010, we expect to continue

our portfolio refinement efforts by exiting areas that have not provided, and are not expected to

provide, an adequate return on investment. Finally, in 2010, we will continue to focus on growing

revenue in key emerging markets and, as noted above, taking advantage of restructuring opportunities

that are expected to provide significant future cost savings.

Goodwill and Intangible Asset Impairments

Annually in the fiscal fourth quarter, and more frequently if triggering events occur, the Company

tests goodwill and indefinite-lived intangible assets for impairment by comparing the fair value of each

reporting unit or indefinite-lived intangible assets with its carrying amount.

During the second quarter of 2009, the Company concluded that its EMEA Security and EMEA

Fire reporting units within the ADT Worldwide and Fire Protection Services segments, respectively,

Electrical and Metal Products reporting unit within the Electrical and Metal Products segment and

Access Control and Video Systems (‘‘ACVS’’), Life Safety and Sensormatic Retail Solutions (‘‘SRS’’)

reporting units within the Safety Products segment experienced triggering events such that the carrying

values of these reporting units likely exceeded their fair values. As a result of the triggering events, the

Company performed long-lived asset, goodwill and intangible asset impairment tests for these reporting

units and certain of the Company’s trade names and franchise rights. The results of the goodwill

impairment tests indicated that the implied goodwill amount was less than the carrying amount of

goodwill for each of the aforementioned reporting units. The Company recorded an aggregate non-cash

impairment charge of $2.6 billion ($2.6 billion after-tax) during the second quarter of 2009. The

non-cash impairment charge was recorded in goodwill and intangible asset impairments in the

Company’s Consolidated Statements of Operations for the quarter ended March 27, 2009.

Also, during the second quarter of 2009, the Company’s estimates of future cash flows used in

determining the fair value of its Safety Products segment Sensormatic tradename as well as certain

36 2009 Financials