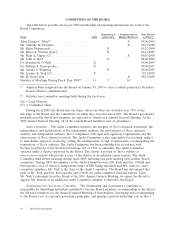

ADT 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Compensation Committee Actions in Fiscal 2009

In 2009, the Compensation Committee continued to address several major themes in executive

compensation plan design:

•The Compensation Committee reaffirmed its commitment to competitive pay levels and ‘‘pay for

performance.’’ The Committee continued implementing its multi-year plan to manage executive

compensation levels to those appropriate to the Company’s business and size following the

spin-off of its electronics and healthcare businesses in fiscal 2007 (the ‘‘Separation’’) as

measured, in part, by executive compensation levels at the peer group of companies determined

by the Compensation Committee. This plan has resulted in no base salary increases for our

‘‘Senior Officers’’ (those officers who are considered ‘‘Section 16’’ officers for purposes of

reporting beneficial stock ownership under the Securities and Exchange Act of 1934, and who

include our named executive officers) in fiscal 2009 and the reduction of long-term incentive

awards granted in connection with the fiscal 2009 program compared with those granted in

connection with the fiscal 2008 program.

•The Compensation Committee enhanced the alignment of incentive pay with shareholder value

creation. The Committee carefully monitors the design of its long-term performance incentives

for Senior Officers. For the fiscal 2009 long-term incentive program, the Company ceased the

practice of granting time-based restricted stock units to its Senior Officers, and began using only

stock options and performance share awards, which tie 100% of long-term incentives to

shareholder value creation. The Company continued this practice for the fiscal 2010 grant. The

Compensation Committee also continued to refine the metrics linked with the key value drivers

in each business segment, as identified in a study commissioned by the Committee in fiscal 2008.

In fiscal 2009, the Compensation Committee directed its independent compensation consultant

to analyze the extent of alignment between the Company’s executive pay levels and shareholder

value. The study indicated that there was a strong correlation between realized total

compensation under existing compensation programs and investor returns.

•The Compensation Committee continued to study developments related to executive compensation

practices, adopting those appropriate for the Company. The Committee eliminated the practice of

paying gross-ups for taxes paid by Senior Officers in connection with supplemental benefits paid

on or after January 1, 2010. In addition, Mr. Breen, our CEO, agreed to waive the benefits

available to him under his employment agreement for New York City/State tax gross-up

payments for compensation that is awarded to him after January 1, 2009. The Compensation

Committee also negotiated the phase-down of severance and change in control benefits payable

to Mr. Breen under his employment contract executed in December 2008.

For equity awards granted in fiscal year 2009 and later years, the Compensation Committee

introduced the so-called double trigger for accelerated vesting of awards following a change in

control. Now, for an employee (other than the CEO) to have equity vest on an accelerated basis

following a change in control, that employee must be actually or constructively terminated within

two years following the change in control.

Recognizing the importance of risk review in developing and administering executive

compensation plans, the Compensation Committee instituted a review of compensation programs

to ensure that they appropriately drive behaviors that are demonstrably within the risk

management parameters it deems prudent. The Committee also continued to review the

developing landscape of ‘‘say on pay’’ proposals and the most appropriate avenue for

communicating with shareholders about executive compensation philosophy and programs.

38 2010 Proxy Statement