ADT 2009 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

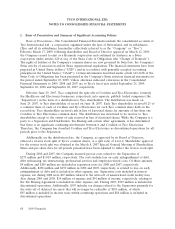

1. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation—The Consolidated Financial Statements include the consolidated accounts of

Tyco International Ltd., a corporation organized under the laws of Switzerland, and its subsidiaries

(Tyco and all its subsidiaries, hereinafter collectively referred to as the ‘‘Company’’ or ‘‘Tyco’’).

Effective March 17, 2009, following shareholder and Board of Director approval on March 12, 2009,

the Company ceased to exist as a Bermuda corporation and continued its existence as a Swiss

corporation under articles 620 et seq. of the Swiss Code of Obligations (the ‘‘Change of Domicile’’).

The rights of holders of the Company’s common shares are now governed by Swiss law, the Company’s

Swiss articles of association and its Swiss organizational regulations. The financial statements have been

prepared in United States dollars (‘‘USD’’) and in accordance with generally accepted accounting

principles in the United States (‘‘GAAP’’). Certain information described under article 663-663h of the

Swiss Code of Obligations has been presented in the Company’s Swiss statutory financial statements for

the period ended September 25, 2009. Unless otherwise indicated, references in the Consolidated

Financial Statements to 2009, 2008 and 2007 are to Tyco’s fiscal year ended September 25, 2009,

September 26, 2008 and September 28, 2007, respectively.

Effective June 29, 2007, Tyco completed the spin-offs of Covidien and Tyco Electronics, formerly

the Healthcare and Electronics businesses, respectively, into separate, publicly traded companies (the

‘‘Separation’’) in the form of a distribution to Tyco shareholders. The distribution was made on

June 29, 2007, to Tyco shareholders of record on June 18, 2007. Each Tyco shareholder received 0.25 of

a common share of each of Covidien and Tyco Electronics for each Tyco common share held on the

record date. Tyco shareholders received cash in lieu of fractional shares for amounts of less than one

Covidien or Tyco Electronics common share. The distribution was structured to be tax-free to Tyco

shareholders except to the extent of cash received in lieu of fractional shares. While the Company is a

party to a Separation and Distribution, Tax Sharing and certain other agreements, it has determined

that there is no significant continuing involvement between it and Covidien or Tyco Electronics.

Therefore, the Company has classified Covidien and Tyco Electronics as discontinued operations for all

periods prior to the Separation.

Additionally, on the distribution date, the Company, as approved by its Board of Directors,

effected a reverse stock split of Tyco’s common shares, at a split ratio of 1-for-4. Shareholder approval

for the reverse stock split was obtained at the March 8, 2007 Special General Meeting of Shareholders.

Share and per share data for all periods presented have been adjusted to reflect the reverse stock split.

During 2008 and 2007, the Company incurred pre-tax costs related to the Separation of

$275 million and $1,083 million, respectively. The costs include loss on early extinguishment of debt,

debt refinancing, tax restructuring, professional services and employee-related costs. Of these amounts,

$4 million and $105 million are included in separation costs for 2008 and 2007, respectively.

Additionally, $258 million and $259 million in 2008 and 2007, respectively, is related to loss on early

extinguishment of debt and is included in other expense, net. Separation costs included in interest

expense, net during 2008 were $47 million related to the write-off of unamortized credit facility fees.

Also during 2009 and 2008, $14 million of expense and $34 million of income, respectively, relating to

the Tax Sharing Agreement is included in other expense, net. During 2007, $719 million is included in

discontinued operations. Additionally, 2007 includes tax charges related to the Separation primarily for

the write-off of deferred tax assets that will no longer be realizable of $183 million, of which

$95 million is included in income taxes within continuing operations and $88 million is included in

discontinued operations.

88 2009 Financials