ADT 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROPOSAL NUMBER FIVE—ALLOCATION OF FISCAL YEAR 2009 RESULTS AND APPROVAL

OF A DIVIDEND IN THE FORM OF A CAPITAL REDUCTION

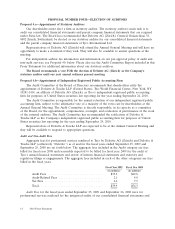

Proposal 5.a—Allocation of Fiscal Year 2009 Results

The Board of Directors proposes that the Company’s loss in its statutory accounts as shown below

be carried forward to fiscal year 2010. The following table shows the appropriation of loss in Swiss

francs and U.S. dollars (converted from Swiss francs as of September 25, 2009) as proposed by the

Board:

Swiss francs U.S. dollars

(in millions) (in millions)

Net loss ................................... CHF 1,025.5 $ 998.8

Balance, beginning of period .................... 31,815.7 30,988.3

Balance carried forward ........................ CHF32,841.2 $31,987.1

The Board of Directors proposes that the Company’s loss of CHF 1,025.5 million be carried

forward in accordance with the table above. The dividend to be paid in the form of a capital reduction

is proposed below as proposal 5.b. Under Swiss law, the allocation of the Company’s balance sheet

results is customarily submitted to shareholders for resolution at each annual general meeting.

The Board recommends that the shareholders vote FOR carrying the fiscal year 2009 loss forward.

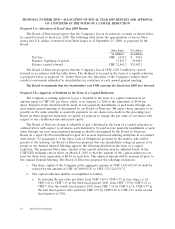

Proposal 5.b—Approval of Dividend in the Form of a Capital Reduction

The Company is seeking approval to pay a dividend in the form of a capital reduction in an

amount equal to CHF 0.85 per share, which, as of January 11, 2010 is the equivalent of $0.84 per

share. Payment of the dividend will be made in four quarterly installments at such times through our

next annual general meeting as determined by our Board of Directors. We expect these amounts to be

payable on the same schedule as quarterly payments on our shares were made in the preceding year.

Based on these proposed reductions of capital, we propose to change the par value of our shares with

respect to our conditional and authorized capital.

The Board of Directors deems it advisable to pay a dividend in the form of a capital reduction as

outlined above with respect to all shares, such dividend to be paid in four quarterly installments at such

times through our next annual general meeting as shall be determined by the Board of Directors.

Based on a report by PricewaterhouseCoopers AG as state supervised auditing enterprise in accordance

with Article 732 paragraph 2 of the Swiss Code of Obligations provided by the auditor, who will be

present at the meeting, our Board of Directors proposes that our shareholders voting (in person or by

proxy) at our Annual General Meeting approve the following dividend in the form of a capital

reduction. The proposed Swiss franc amount of the capital reduction may be adjusted based on the

CHF/USD exchange rate in effect on March 8, 2010 so that the amount of the capital reduction is at

least the Swiss franc equivalent of $0.84 on such date. The adjusted amount will be announced prior to

the Annual General Meeting. The Board of Directors proposes the following resolutions:

1. The share capital of the Company in the aggregate amount of CHF 3,642,642,767.60 shall be

reduced by the amount of CHF 407,400,835.85 to CHF 3,235,241,931.75.

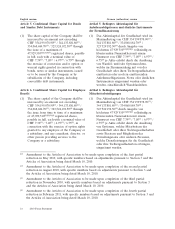

2. The capital reduction shall be accomplished as follows:

a. by reducing the par value per share from CHF 7.60 to CHF 6.75 in four steps, i.e. by

CHF 0.21 to CHF 7.39 in the third fiscal quarter 2010, from CHF 7.39 by CHF 0.21 to

CHF 7.18 in the fourth fiscal quarter 2010, from CHF 7.18 by CHF 0.21 to CHF 6.97 in

the first fiscal quarter 2011 and from CHF 6.97 by CHF 0.22 to CHF 6.75 in the second

fiscal quarter of 2011;

16 2010 Proxy Statement