ADT 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

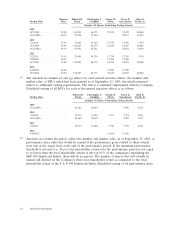

over the applicable vesting period for the award. Assumptions used in the calculation of these

compensation costs are discussed in Note 18 to the Company’s audited consolidated financial

statements included in the Company’s Form 10-K for the fiscal year ended September 25, 2009.

However, the table above does not reflect equity compensation expense net of a forfeiture

assumption. A description of the material terms of the 2009 awards appears in the narrative

following the ‘‘Grants of Plan-Based Awards’’ table.

(4) Non-Equity Incentive Plan Compensation: The amounts reported in column (g) for each named

executive officer reflect annual cash incentive compensation for the applicable fiscal year. Annual

incentive compensation is discussed in further detail above under the heading ‘‘Elements of

Compensation—Annual Incentive Compensation.’’

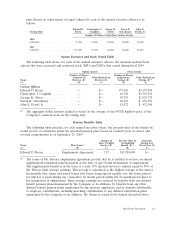

(5) Change in Pension Value and Non-Qualified Deferred Compensation Earnings: The amounts

reported in column (h) for Mr. Breen reflect the aggregate increase in the actuarial present value

of his accumulated benefits under all pension plans during fiscal 2009, 2008 and 2007, determined

using interest rate and mortality rate assumptions consistent with those used in the Company’s

financial statements. Information regarding the pension plans is set forth in further detail below

following the ‘‘Pension Benefits’’ table.

(6) All Other Compensation: The amounts reported in column (i) for each named executive officer

represent cash perquisites, insurance premiums paid by the Company for the benefit of the officer

(and, in some cases, the officer’s spouse), costs related to personal use of Company aircraft, tax

gross-up payments, Company contributions to 401(k) plans and non-qualified plans of the

Company and its subsidiaries providing similar benefits, and other miscellaneous benefits. The

components of All Other Compensation for each named executive officer are shown in the

following table.

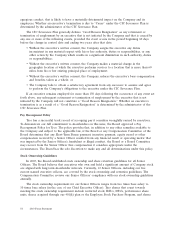

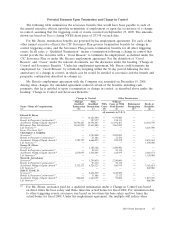

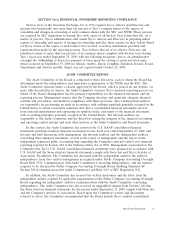

All Other Compensation Table

Supplemental Executive Insurance

Benefits(b)

Personal

Variable Use of Retirement Total All

Fiscal Cash Universal Supplemental Long-Term Company Tax Plan Other

Named Executive Year Perquisite(a) Life Disability Care Aircraft(c) Gross-Ups(d) Contributions(e) Miscellaneous(f) Compensation

Current Officers

Edward D. Breen ....... 2009 $70,000 $50,405 $37,689 $15,428 $238,795 $478,964 $236,396 — $1,127,677

2008 $70,000 $50,405 $36,021 $15,429 $246,347 $632,091 $243,083 $ 307 $1,293,683

2007 $70,000 $50,405 $34,825 $15,428 $249,431 $330,200 $155,729 $ 5,500 $ 911,518

Christopher J. Coughlin .... 2009 $70,000 $28,262 $17,990 $21,210 — $ 39,959 $116,667 $15,100 $ 309,188

2008 $70,000 $28,262 $17,990 $21,211 — $ 64,375 $120,250 $10,109 $ 332,197

2007 $70,000 $28,262 $17,990 $21,210 — — $ 82,291 $10,000 $ 229,753

George R. Oliver ....... 2009 $60,000 $14,839 $14,837 $20,346 — $ 21,011 $ 84,049 $16,750 $ 231,832

2008 $59,375 $14,839 $17,248 $20,347 — $ 18,617 $ 71,478 $11,207 $ 213,111

2007 — — — — — — — — —

Naren K. Gursahaney .... 2009 $56,000 $10,109 $15,008 $19,274 — $ 23,782 $ 57,567 $ 7,369 $ 189,109

2008 $56,000 $10,109 $17,418 $19,275 — $ 21,700 $ 72,000 $ 3,125 $ 199,627

2007 $51,500 $10,109 $12,598 $19,274 — $ 10,315 $ 65,606 $ 5,960 $ 175,362

John E. Evard, Jr. ...... 2009 $46,000 $20,798 $ 6,217 $18,344 — $ 13,472 $ 55,000 — $ 159,831

2008 $45,504 $20,798 $ 6,217 $18,344 — $ 33,519 $ 54,920 $ 137 $ 179,439

2007 $44,016 $20,798 $17,639 $18,343 — $ 23,692 $ 36,398 $ 5,262 $ 166,148

(a) Cash Perquisites reflect an annual cash perquisite payment equal to the lesser of 10% of the

executive’s base salary and $70,000. Payments are made quarterly and are adjusted to reflect

changes in salary.

(b) Supplemental Executive Insurance Benefits reflect premiums paid by the Company for insurance

benefits for the executive and, in the case of long-term care, for the executive’s spouse as well.

These benefits are provided to certain Senior Officers of the Company upon the approval of the

Compensation Committee.

(c) For security purposes, the Chief Executive Officer is encouraged to use Company-owned or -leased

aircraft for personal travel. Other named executive officers are permitted to use Company-owned

2010 Proxy Statement 57