Vodafone 2016 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

95

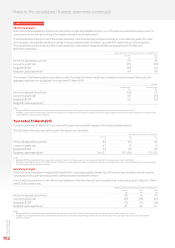

New accounting pronouncements to be adopted on 1 April 2016

The following pronouncements which are potentially relevant to the Group have been issued by the IASB are effective for annual periods beginning

on or after 1 January 2016 and have been endorsed for use in the EU:

a Amendments to IAS 1 “Disclosure Initiative”;

a Amendments to IAS 16 and IAS 38 “Clarication of Acceptable Methods of Depreciation and Amortisation”;

a Amendments to IFRS 11 “Accounting for Acquisitions of Interests in Joint Operations”; and

a “Improvements to IFRS: 2012–2014 cycle”.

The Group’s nancial reporting will be presented in accordance with the new standards above, which are not expected to have a material impact

on the consolidated results, nancial position or cash ows of the Group, from 1 April 2016.

New accounting pronouncements to be adopted on or after 1 April 2017

On 1 April 2017 the Group will adopt “Recognition of Deferred Tax Assets for Unrealised Losses, Amendments to IAS 12” and “Disclosure Initiative,

Amendments to IAS 7” which are effective for accounting periods on or after 1 January 2017 and which have not yet been endorsed by the EU.

The Group is currently conrming the impacts of the above new pronouncements on its results, nancial position and cash ows, which are not

expected to be material.

IFRS 15 “Revenue from Contracts with Customers”

IFRS 15 “Revenue from Contracts with Customers” was issued in May 2014 and subsequent amendments, “Clarications to IFRS 15”, were issued

in April 2016. IFRS 15, as amended, is effective for accounting periods beginning on or after 1 January 2018; it has not yet been adopted by the EU.

IFRS 15 will have a material impact on the Group’s reporting of revenue and costs as follows:

a IFRS 15 will require the Group to identify deliverables in contracts with customers that qualify as “performance obligations”. The transaction price

receivable from customers must be allocated between the Group’s performance obligations under the contracts on a relative stand-alone selling

price basis. Currently revenue allocated to deliverables is restricted to the amount that is receivable without the delivery of additional goods

or services; this restriction will no longer be applied under IFRS 15. The primary impact on revenue reporting will be that when the Group sells

subsidised devices together with airtime service agreements to customers, revenue allocated to equipment and recognised when control of the

device passes to the customer will increase and revenue recognised as services are delivered will reduce. Where additional up-front unbilled

revenue is recorded for the sale of devices, this will be reected in the balance sheet as a contract asset.

a Under IFRS 15, certain incremental costs incurred in acquiring a contract with a customer will be deferred on the balance sheet and amortised

as revenue is recognised under the related contract; this will generally lead to the later recognition of charges for some commissions payable

to third party dealers and employees.

a Certain costs incurred in fullling customer contracts will be deferred on the balance sheet under IFRS 15 and recognised as related revenue

is recognised under the contract. Such deferred costs are likely to relate to the provision of deliverables to customers that do not qualify

as performance obligations and for which revenue is not recognised; currently such costs are generally expensed as incurred.

The Group is continuing to assess the impact of these and other accounting changes that will arise under IFRS 15; however, the changes highlighted

above will have a material impact on the consolidated income statement and consolidated statement of nancial position after the Group adopts

IFRS 15 on 1 April 2018.

When IFRS 15 is adopted, it can be applied either on a fully retrospective basis, requiring the restatement of the comparative periods presented

in the nancial statements, or with the cumulative retrospective impact of IFRS 15 applied as an adjustment to equity on the date of adoption; when

the latter approach is applied it is necessary to disclose the impact of IFRS 15 on each line item in the nancial statements in the reporting period.

The Group currently intends to reect the cumulative impact of IFRS 15 in equity on the date of adoption.

IFRS 9 “Financial Instruments”

IFRS 9 “Financial Instruments” was issued in July 2014 to replace IAS 39 “Financial Instruments: Recognition and Measurement”. The standard

is effective for accounting periods beginning on or after 1 January 2018 with early adoption permitted but has not yet been endorsed for use in the

EU. The standard will impact the classication and measurement of the Group’s nancial instruments and will require certain additional disclosures.

The changes to recognition and measurement of nancial instruments and changes to hedge accounting rules are not currently considered likely

to have any major impact on the Group’s current accounting treatment or hedging activities. The Group will not consider early adoption of IFRS 9

until the standard has been endorsed by the EU which is currently expected in the second half of 2016.

IFRS 16 “Leases”

IFRS 16 “Leases” was issued in January 2016 to replace IAS 17 “Leases”. The standard is effective for accounting periods beginning on or after

1 January 2019 with early adoption permitted if IFRS 15 “Revenue from Contracts with Customers” has been adopted. IFRS 16 has not yet been

adopted by the EU.

IFRS 16 will primarily change lease accounting for lessees; lease agreements will give rise to the recognition of an asset representing the right to use the

leased item and a loan obligation for future lease payables. Lease costs will be recognised in the form of depreciation of the right to use asset and interest

on the lease liability. Lessee accounting under IFRS 16 will be similar to existing IAS 17 accounting for finance leases, but will be substantively different for

operating leases where rental charges are currently recognised on straight-line basis and no lease asset or lease loan obligation is recognised.

Lessor accounting under IFRS 16 is similar to existing IAS 17 accounting.

The Group is assessing the impact of the accounting changes that will arise under IFRS 16; however, the changes are expected to have a material

impact on the consolidated income statement and consolidated statement of nancial position.

The Group has not yet decided whether to adopt IFRS 16 when IFRS 15 is adopted, on 1 April 2018, or on 1 April 2019.