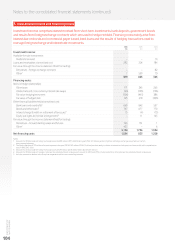

Vodafone 2016 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2016

98

Notes to the consolidated nancial statements (continued)

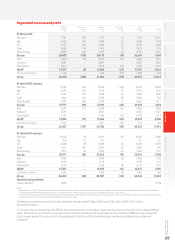

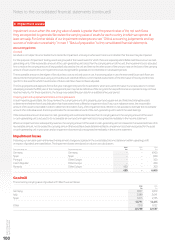

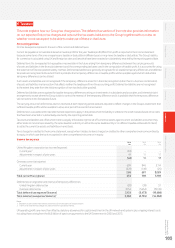

2. Segmental analysis (continued)

2016 2015 2014

£m £m £m

EBITDA 11,612 11,915 11,084

Depreciation, amortisation and loss on disposal of xed assets (8,539) (8,345) (7,098)

Share of results in associates and joint ventures 44 (63) 324

Adjusted operating prot 3,117 3,507 4,310

Impairment loss (450) –(6,600)

Restructuring costs (236) (157) (355)

Amortisation of acquired customer based and brand intangible assets (979) (1,269) (551)

Other income and expense (75) (114) (717)

Operating prot/(loss) 1,377 1,967 (3,913)

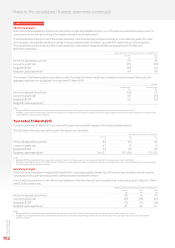

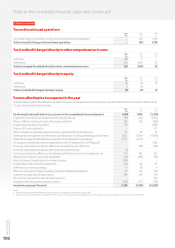

Segmental assets and cash ow

Other Depreciation Restated

Non-current Capital expenditure on and Operating

assets1expenditure2 intangible assets amortisation Impairment loss free cash ow3

£m £m £m £m £m £m

31 March 2016

Germany 22,306 1,737 1,501 2,443 – 651

Italy 7,74 8 1,12 3 170 1,223 – 373

UK 7, 5 0 8 890 103 1,393 – 265

Spain 9,14 8 867 355 1,060 – (111)

Other Europe 5,984 1,015 6 1,004 450 409

Europe 52,694 5,632 2 ,135 7,12 3 450 1,587

India 11,115 812 2,731 937 – 544

Vodacom 4,183 621 17 530 – 792

Other AMAP 5,381 864 593 859 – 385

AMAP 20,679 2,297 3,341 2,326 – 1,721

Common Functions 1,477 670 – 49 – (424)

Group 74,850 8,599 5,476 9,498 450 2,884

31 March 2015

Germany 19,521 2,003 3 2,574 – 992

Italy 6,938 1,105 95 1,334 – 542

UK 7,759 980 15 1,363 – 185

Spain 8,154 858 – 954 – (30)

Other Europe 8 ,18 9 1,083 193 1, 017 – 541

Europe 50,561 6,029 306 7,2 4 2 – 2,230

India 8,599 882 140 863 – 332

Vodacom 4,712 745 2 566 – 762

Other AMAP 4,915 919 35 900 – 398

AMAP 18,226 2,546 177 2,329 – 1,492

Common Functions 1,306 622 1 (6) – (859)

Group 70,093 9,197 484 9,565 – 2,863

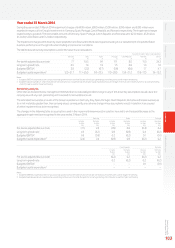

31 March 2014

Germany 22,780 1,312 3 2,036 4,900 1,695

Italy 7,9 8 4 180 – 164 – 251

UK 8,031 932 – 1,290 – 602

Spain 3,653 511 – 587 800 254

Other Europe 8,736 800 273 1,047 900 978

Europe 51,184 3,735 276 5 ,124 6,600 3,780

India 7, 824 633 1,938 828 – 811

Vodacom 4,560 663 3 593 – 1,174

Other AMAP 4,850 711 11 932 – 605

AMAP 17,234 2,007 1,952 2,353 – 2,590

Common Functions 1,121 571 – 83 – 209

Group 69,539 6,313 2,228 7,560 6,600 6,579

Notes:

1 Comprises goodwill, other intangible assets and property, plant and equipment.

2 Includes additions to property, plant and equipment and computer software, reported within intangibles. Excludes licences and spectrum additions.

3 The Group’s measure of segment cash ow is reconciled to the closest equivalent GAAP measure cash generated by operations, on page 191.