Vodafone 2016 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2016

132

Notes to the consolidated nancial statements (continued)

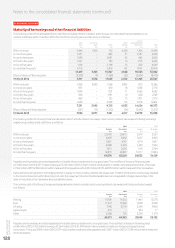

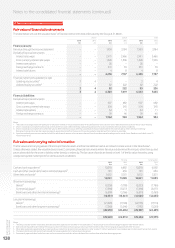

22. Liquidity and capital resources (continued)

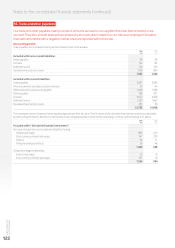

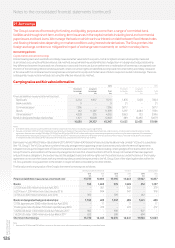

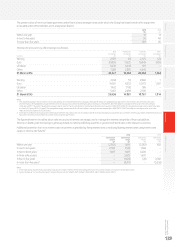

Committed facilities

In aggregate we have committed facilities of approximately £13,141 million, of which £8,197 million was undrawn and £4,944 million was drawn

at 31 March 2016. The following table summarises the committed bank facilities available to us at 31 March 2016.

Committed bank facilities Amounts drawn Terms and conditions

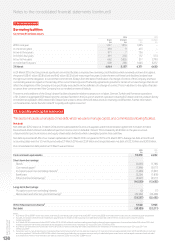

28 March 2014

€4.0 billion syndicated

revolvingcredit facility,

maturing 28 March 2021.

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

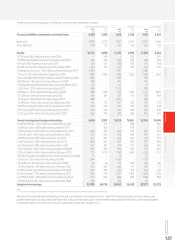

Lenders have the right, but not the obligation, to cancel their

commitments and have outstanding advances repaid no sooner than

30 days after notication of a change of control. This is in addition to

the rights of lenders to cancel their commitment if we commit an event

of default; however, it should be noted that a material adverse change

clause does not apply.

The facility matures on 28 March 2021. From 28 March 2020 the facility

size will be €3.9 billion as one lender did not extend the facility as per the

request from the Company.

27 February 2015

US$4.1 billion syndicated

revolving credit facility,

maturing 27 February 2021.

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

Lenders have the right, but not the obligation, to cancel their

commitments and have outstanding advances repaid no sooner than

30 days after notication of a change of control. This is in addition to

the rights of lenders to cancel their commitment if we commit an event

of default; however, it should be noted that a material adverse change

clause does not apply.

The facility matures on 27 February 2021, with each lender having

the option to extend the facility for a further year prior to the second

anniversary of the facility, if requested by the Company. From

27 February 2020 the facility size will be US$3.9 billion as one lender did

not extend the facility as per the request from the Company.

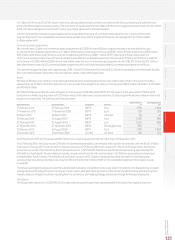

27 November 2013

£0.5 billion loan facility,

maturing 12 December 2021.

This facility was drawn down in full in

euros, as allowed by the terms of the

facility, on 12 December 2014.

As per the syndicated revolving credit facilities with the addition that,

should our UK and Irish operating companies spend less than the

equivalent of £0.9 billion on capital expenditure, we will be required

to repay the drawn amount of the facility that exceeds 50% of the

capitalexpenditure.

15 September 2009

€0.4 billion loan facility,

maturing 30 July 2017.

This facility was drawn down in full on

30 July 2010.

As per the syndicated revolving credit facilities with the addition that,

should our German operating company spend less than the equivalent

of €0.8 billion on VDSL related capital expenditure, we will be required

to repay the drawn amount of the facility that exceeds 50% of the VDSL

capital expenditure.

29 September 2009

US$0.7 billion export credit

agency loan facility, nal

maturity date 19 September

2018.

This facility is fully drawn down and

isamortising.

As per the syndicated revolving credit facilities with the addition that the

Company was permitted to draw down under the facility based upon the

eligible spend with Ericsson up until the nal draw down date of 30 June

2011. Quarterly repayments of the drawn balance commenced on

30 June 2012 with a nal maturity date of 19 September 2018.

8 December 2011

€0.4 billion loan facility,

maturing on 5 June 2020.

This facility was drawn down in full on

5 June 2013.

As per the syndicated revolving credit facilities with the addition that,

should our Italian operating company spend less than the equivalent of

€1.3 billion on capital expenditure, we will be required to repay the drawn

amount of the facility that exceeds 50% of the capital expenditure.

20 December 2011

€0.3 billion loan facility,

maturing 18 September 2019.

This facility was drawn down in full on

18 September 2012.

As per the syndicated revolving credit facilities with the addition that,

should our Turkish and Romanian operating companies spend less than

the equivalent of €1.3 billion on capital expenditure, we will be required

to repay the drawn amount of the facility that exceeds 50% of the

capitalexpenditure.

4 March 2013

€0.1 billion loan facility,

maturing 4 December 2020.

This facility was drawn down in full on

4 December 2013.