Vodafone 2016 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

99

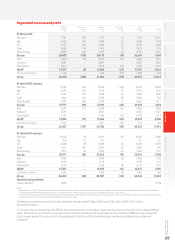

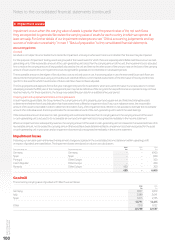

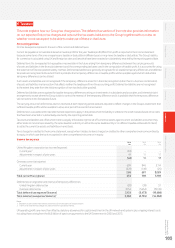

3. Operating prot/(loss)

Detailed below are the key amounts recognised in arriving at our operating prot/(loss)

2016 2015 2014

£m £m £m

Net foreign exchange (gains)/losses (2) 816

Depreciation of property, plant and equipment (note 11):

Owned assets 5,189 5,002 3,990

Leased assets 57 44 48

Amortisation of intangible assets (note 10) 4,252 4,519 3,522

Impairment of goodwill in subsidiaries, associates and joint arrangements (note 4) 450 –6,600

Staff costs (note 25) 4,411 4,194 3,875

Operating lease rentals payable 2,315 2,303 2,153

Loss on disposal of property, plant and equipment and intangible assets 20 49 85

Own costs capitalised attributable to the construction or acquisition of property, plant and equipment (562) (547) (455)

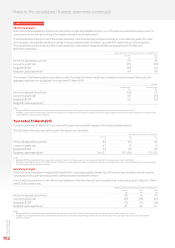

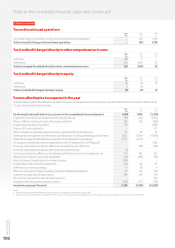

The total remuneration of the Group’s auditor, PricewaterhouseCoopers LLP and other member rms of PricewaterhouseCoopers International

Limited, for services provided to the Group during the year ended 31 March 2016 is analysed below.

PricewaterhouseCoopers LLP was appointed as the Group’s auditor for the year ended 31 March 2015. Accordingly, comparative gures in the table

below for the year ended 31 March 2014 are in respect of remuneration paid to the Group’s previous auditor, Deloitte LLP and other member rms

of Deloitte Touche Tohmatsu Limited.

2016 2015 2014

£m £m £m

Parent company 2 2 1

Subsidiaries 10 10 8

Audit fees: 12 12 9

Audit-related fees1 1 1 1

Other assurance services2, 3 –13

Tax fees3–2–

Non-audit fees: 144

Total fees 13 16 13

Notes:

1 Relates to fees for statutory and regulatory lings.

2 Amount for 2014 primarily arose from regulatory lings and shareholder documentation requirements in respect of the disposal of Verizon Wireless and the acquisition of the outstanding

minority stake in Vodafone Italy.

3 At the time of the Board decision to recommend PricewaterhouseCoopers LLP as the statutory auditor for the year ended 31 March 2015 in February 2014, PricewaterhouseCoopers LLP were

providing a range of services to the Group. All services that were prohibited by the Securities and Exchange Commission (‘SEC’) for a statutory auditor to provide, ceased by 31 March 2014.

All engagements that are not prohibited by the SEC, but would not have met the Group’s own internal approval policy for non-audit services, ceased by 30 June 2014 to enable a transition

to alternative suppliers, where required. These services had a value of approximately £3 million through to completion and are included in the table above.