Vodafone 2016 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report on remuneration (continued)

At 17 May 2016 there had been no change to the Directors’ interests in share options from 31 March 2016.

Other than those individuals included in the table above, at 17 May 2016 members of the Group’s Executive Committee held options for 26,501

ordinary shares at prices ranging from 156.1 pence to 189.2 pence per ordinary share, with a weighted average exercise price of 174.3 pence per

ordinary share exercisable at dates ranging from 1 September 2017 to 1 September 2020.

Hannes Ametsreiter, Paolo Bertoluzzo, Aldo Bisio, António Coimbra, Warren Finegold, Ronald Schellekens, Robert Shuter and Serpil Timuray held

no options at 17 May 2016.

Loss of ofce payments (audited)

Stephen Pusey retired on 31 July 2015 having worked 9 months of his 12 month notice period. Stephen was entitled to receive payments in lieu

of notice each month for the remainder of his notice period subject to mitigation. In total, Stephen received the equivalent of 3 months salary

(£150,000) and an amount equivalent to the pro-rated annual leave that had not been taken during his employment in the year (£16,846).

Since Stephen was employed for part of the 2016 nancial year his annual bonus payment (as disclosed on page 67) was pro-rated for time served

(i.e. to 31 July 2015). Stephen’s 2014 GLTI award, the nal vesting of which is described on page 67, will also be pro-rated for time worked and will vest

at the normal vesting date.

Stephen’s outstanding 2015 GLTI award will be pro-rated on a time worked basis and will vest, subject to performance, at the normal vesting date,

in accordance with our share plan rules.

Stephen will receive no further benets aside from the provision of a SIM card for his personal use at the Company’s expense for a period of three

years commencing on 1 August 2015.

Payments to past Directors (audited)

During the 2016 nancial year Lord MacLaurin received benet payments in respect of security costs as per his contractual arrangements.

These costs exceeded our de minimis threshold of £5,000 p.a. and, including the tax paid, were £9,411.

Fees retained for external non-executive directorships

Executive Directors may hold positions in other companies as non-executive directors and retain the fees.

With effect from 1 July 2015, Vittorio Colao was appointed to the boards of Unilever N.V. and Unilever PLC as a non-executive director. During the

year ended 31 March 2016 Vittorio retained fees of £63,783 in respect of this role.

With effect from 1 April 2015, Stephen Pusey was appointed to the board of Centrica plc as a non-executive director. During the period up to his

retirement on 31 July 2015, Stephen retained fees of £24,000 in respect of this role.

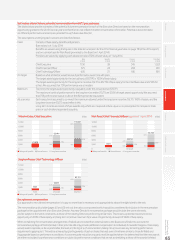

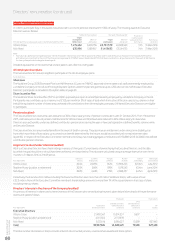

Assessing pay and performance

In the table below we summarise the Chief Executive’s single gure remuneration over the past seven years, as well as how our variable pay plans

have paid out in relation to the maximum opportunity. This can be compared with the historic TSR performance over the same period. The chart

below shows the performance of the Company relative to the STOXX Europe 600 Index over a six year period. The STOXX Europe 600 Index was

selected as this is a broad-based index that includes many of our closest competitors. It should be noted thatthepayout from the long-term

incentive plan is based on the TSRperformance shown in the chart on page 67 and not this chart.

Seven-year historical TSR performance

(growth in the value of a hypothetical €100 holding over seven years)

325

275

175

225

125

75

100 137

155 170

168

190

167

215

193

267

227

310

245

322

279

Vodafone Group STOXX Europe 600 Index

03/09 03/10 03/11 03/12 03/13 03/14 03/1603/15

Financial year remuneration for Chief Executive (Vittorio Colao) 201012011 2012 2013 2014 2015 2016

Single gure of total remuneration £’000 3,350 7,022 15,767 11,099 8,014 2,810 5,270

Annual variable element (actual award versus maximum opportunity) 64% 62% 47% 33% 44% 56% 58%

Long-term incentive (vesting versus maximum opportunity) 25% 31% 100% 57% 37% 0% 23%

Note:

1 The single gure reects share awards which were granted in 2006 and 2007, prior to his appointment to Chief Executive in 2008.

Directors’ remuneration (continued)

Vodafone Group Plc

Annual Report 2016

70