Vodafone 2016 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2016

170

Notes to the Company nancial statements (continued)

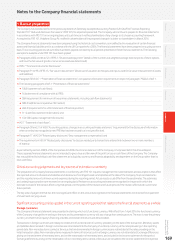

1. Basis of preparation (continued)

Borrowing costs

All borrowing costs are recognised in the income statement in the period in which they are incurred.

Taxation

Current tax, including UK corporation tax and foreign tax, is provided at amounts expected to be paid (or recovered) using the tax rates and laws

thathave been enacted or substantively enacted by the reporting period date.

Deferred tax is provided in full on timing differences that exist at the reporting period date and that result in an obligation to pay more tax, or a right

to pay less tax in the future. The deferred tax is measured at the rate expected to apply in the periods in which the timing differences are expected

to reverse, based on the tax rates and laws that are enacted or substantively enacted at the reporting period date. Timing differences arise from the

inclusion of items of income and expenditure in taxation computations in periods different from those in which they are included in the Company

nancial statements. Deferred tax assets are recognised to the extent that it is regarded as more likely than not that they will be recovered.

Deferredtax assets and liabilities are not discounted.

Financial instruments

Financial assets and nancial liabilities, in respect of nancial instruments, are recognised on the Company statement of nancial position when the

Company becomes a party to the contractual provisions of the instrument.

Financial liabilities and equity instruments

Financial liabilities and equity instruments issued by the Company are classied according to the substance of the contractual arrangements

entered into and the denitions of a nancial liability and an equity instrument. An equity instrument is any contract that evidences a residual

interest in the assets of the Company after deducting all of its liabilities and includes no obligation to deliver cash or other nancial assets.

The accounting policies adopted for specic nancial liabilities and equity instruments are set out below.

Derivative nancial instruments and hedge accounting

The Company’s activities expose it to the nancial risks of changes in foreign exchange rates and interest rates which it manages using derivative

nancial instruments.

The use of derivative nancial instruments is governed by the Group’s policies approved by the Board of Directors, which provide written

principles on the use of derivative nancial instruments consistent with the Group’s risk management strategy. Changes in values of all derivative

nancial instruments are included within the income statement unless designated in an effective cash ow hedge relationship when changes

in value are deferred to other comprehensive income or equity respectively. The Company does not use derivative nancial instruments for

speculative purposes.

Derivative nancial instruments are initially measured at fair value on the contract date and are subsequently remeasured to fair value at each

reporting date. The Company designates certain derivatives as hedges of the change of fair value of recognised assets and liabilities (‘fair value

hedges’) or hedges of highly probable forecast transactions or hedges of foreign currency or interest rate risks of rm commitments (‘cash ow

hedges’). Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated or exercised, no longer qualies for hedge

accounting or the Company chooses to end the hedgingrelationship.

Fair value hedges

The Company’s policy is to use derivative nancial instruments (primarily interest rate swaps) to convert a proportion of its xed rate debt to oating

rates in order to hedge the interest rate risk arising, principally, from capital market borrowings. The Company designates these as fair value hedges

of interest rate risk with changes in fair value of the hedging instrument recognised in the income statement for the period together with the

changes in the fair value of the hedged item due to the hedged risk, to the extent the hedge is effective. Gains and losses relating to any ineffective

portion are recognised immediately in the income statement.

Cash ow hedges

Cash ow hedging is used by the Company to hedge certain exposures to variability in future cash ows. The portion of gains or losses relating

to changes in the fair value of derivatives that are designated and qualify as effective cash ow hedges is recognised in other comprehensive income;

gains or losses relating to any ineffective portion are recognised immediately in the income statement. However, when the hedged transaction

results in the recognition of a non-nancial asset or a non-nancial liability, the gains and losses previously recognised in other comprehensive

income and accumulated in equity are transferred from equity and included in the initial measurement of the cost of the non-nancial asset or non-

nancial liability. When the hedged item is recognised in the income statement, amounts previously recognised in other comprehensive income

and accumulated in equity for the hedging instrument are reclassied to the income statement. When hedge accounting is discontinued, any gain

or loss recognised in other comprehensive income at that time remains in equity and is recognised in the income statement when the hedged

transaction is ultimately recognised in the income statement. If a forecast transaction is no longer expected to occur, the gain or loss accumulated

in equity is recognised immediately in the income statement.

Pensions

The Company is the sponsoring employer of the Vodafone Group pension scheme, a dened benet pension scheme. There is insufcient

information available to enable the scheme to be accounted for as a dened benet scheme because the Company is unable to identify its share

of the underlying assets and liabilities on a consistent and reasonable basis. Therefore, the Company has applied the guidance within IAS 19

to account for dened benet schemes as if they were dened contribution schemes and recognise only the contribution payable each year.

The Company had no contributions payable for the years ended 31 March 2016 and 31 March 2015.

New accounting pronouncements

To the extent applicable the Company will adopt new accounting policies as set out in note 1 “Basis for preparation” in the consolidated

nancial statements.