Vodafone 2016 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

119

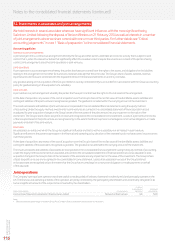

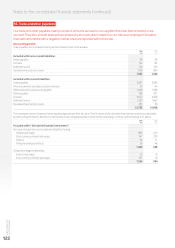

13. Other investments

We hold a number of other listed and unlisted investments, mainly comprising US$5.0 billion of loan notes from

Verizon Communications Inc.

Accounting policies

Other investments are recognised and derecognised on a trade date where a purchase or sale of an investment is under a contract whose terms

require delivery of the investment within the timeframe established by the market concerned, and are initially measured at fair value, including

transaction costs.

Other investments classied as held for trading and available-for-sale are stated at fair value. Where securities are held for trading purposes, gains

and losses arising from changes in fair value are included in net prot or loss for the period. For available-for-sale investments, gains and losses

arising from changes in fair value are recognised directly in equity, until the security is disposed of or is determined to be impaired, at which time the

cumulative gain or loss previously recognised in equity, determined using the weighted average cost method, is included in the net prot or loss for

the period.

Other investments classied as loans and receivables are stated at amortised cost using the effective interest method, less any impairment.

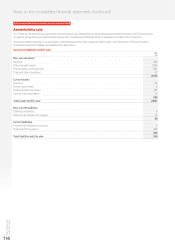

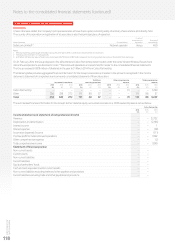

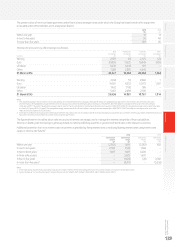

2016 2015

£m £m

Included within non-current assets:

Equity securities:

Listed 3 4

Unlisted 82 222

Debt securities:

Public debt and bonds 95 148

Other debt and bonds 3,482 3,383

3,662 3,757

The listed and unlisted securities are classied as available-for-sale. Public debt and bonds are classied as held for trading, and other debt and bonds

which are not quoted in an active market, are classied as loans and receivables.

Unlisted equity investments are recorded at fair value where appropriate.

Other debt and bonds includes loan notes of US$5.0 billion (£3,481 million) issued by Verizon Communications Inc. as part of the Group’s disposal

of its interest in Verizon Wireless all of which is recorded within non-current assets. The carrying amount of these loan notes approximates fair value.

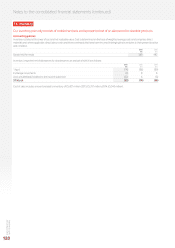

Current other investments comprise the following:

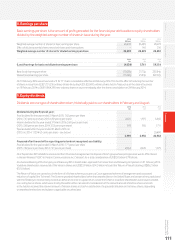

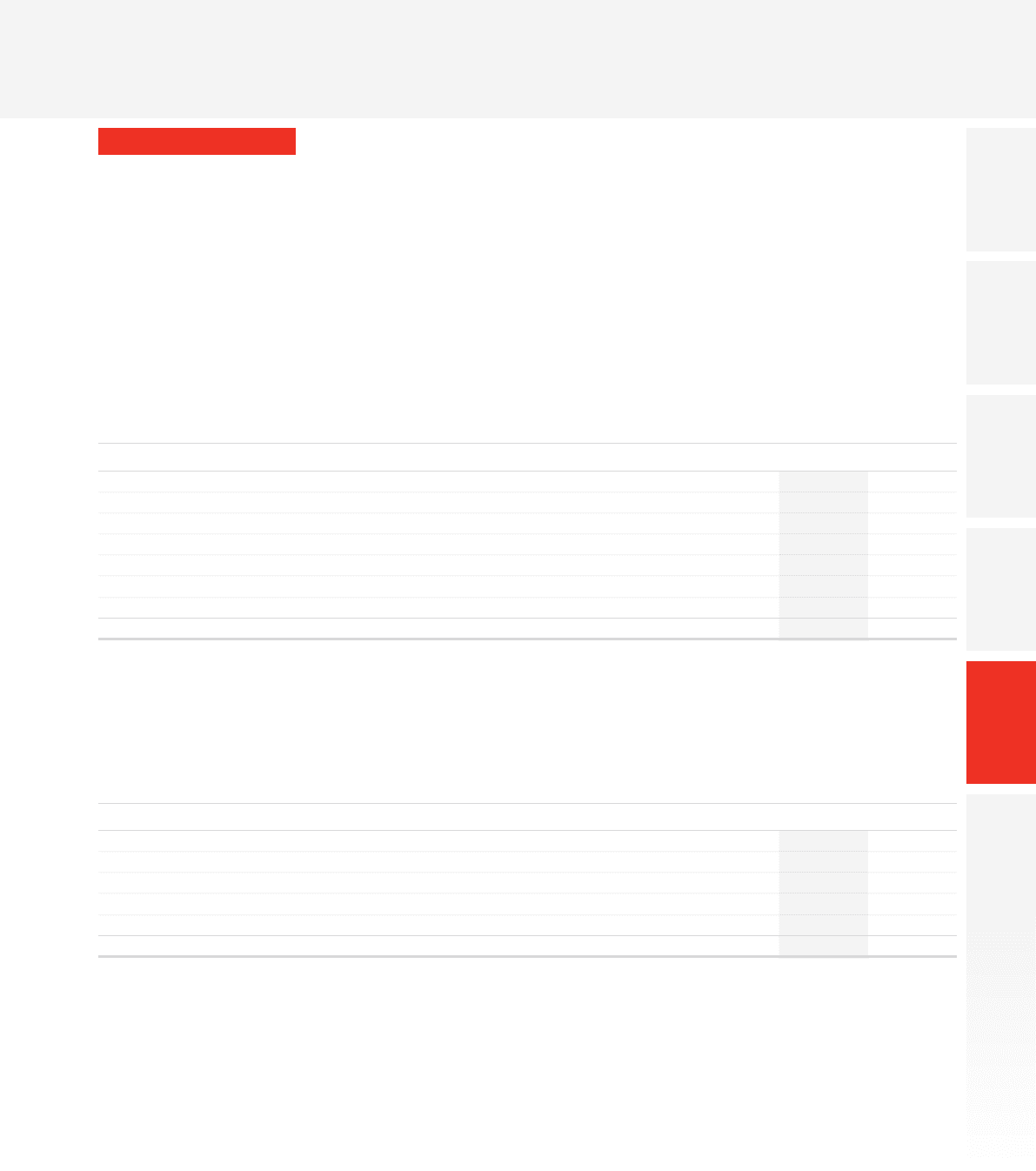

2016 2015

£m £m

Included within current assets:

Debt securities:

Public debt and bonds 888 982

Other debt and bonds 2,541 2,223

Cash and other investments held in restricted deposits 791 650

4,220 3,855

Public debt and bonds are classied as held for trading. Cash held in restricted deposits are classied as loans and receivables and include amounts

held in qualifying assets by Group insurance companies to meet regulatory requirements.

Other debt and bonds includes £967 million (2015: £2,016 million) of assets held for trading in managed investment funds with liquidity of up to 90

days and £1,574 million (2015: £38 million) of assets classied as loans and receivables comprising collateral paid on derivative nancial instruments.

Collateral passed in 2016 includes £1,460 million in relation to put options issued with regard to the mandatory convertible bonds’ hedging strategy.

Current public debt and bonds include government bonds of £659 million (2015: £830 million) which consist of highly liquid index linked gilts with

less than two years to maturity held on an effective oating rate basis.

For public debt and bonds, other debt and bonds and cash held in restricted deposits, the carrying amount approximates fair value.