Vodafone 2016 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

113

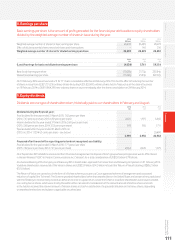

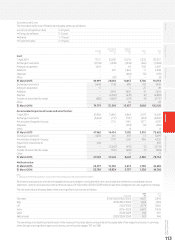

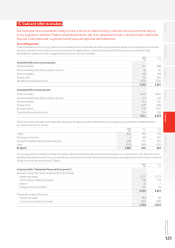

Estimated useful lives

The estimated useful lives of nite lived intangible assets are as follows:

a Licence and spectrum fees 3–25 years

a Computer software 3–5 years

a Brands 1–10 years

a Customer bases 2–10 years

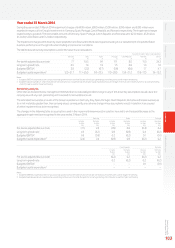

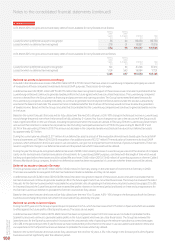

Licences and Computer

Goodwill spectrum software Other Total

£m £m £m £m £m

Cost:

1 April 2014 7 7,12 1 30,592 10, 212 5,332 123, 257

Exchange movements (8,756) (1,235) (1,036) (542) (11,569)

Arising on acquisition 1,634 –48 905 2,587

Additions –467 1,844 17 2,328

Disposals – – (464) (12) (476)

Other –(20) 11 –(9)

31 March 2015 69,999 29,804 10,615 5,700 116,118

Exchange movements 5,443 1,136 688 162 7,429

Arising on acquisition 17 – 5 27 49

Additions –5,474 1,850 10 7,334

Disposal –(2,362)1(445) (2) (2,809)

Transfer of assets held for resale (680) (1,654) (374) (9) (2,717)

Other – – 98 –98

31 March 2016 74,779 32,398 12,437 5,888 125,502

Accumulated impairment losses and amortisation:

1 April 2014 53,806 13,420 6,864 2,479 76, 569

Exchange movements (6,344) (717) (707) (234) (8,002)

Amortisation charge for the year –1,751 1,491 1,277 4,519

Disposals – – (454) (12) (466)

Other – – 8–8

31 March 2015 47,462 14,454 7,202 3,510 72,628

Exchange movements 4,078 467 481 73 5,099

Amortisation charge for the year –1,707 1,559 986 4,252

Impairment losses (note 4) 450 –––450

Disposals –(2,362)1(410) (2) (2,774)

Transfer of assets held for resale –(722) (209) (7) (938)

Other – – 17 –17

31 March 2016 51,990 13,544 8,640 4,560 78,734

Net book value:

31 March 2015 22,537 15,350 3,413 2,190 43,490

31 March 2016 22,789 18,854 3,797 1,328 46,768

Note:

1 Disposals of licences and spectrum comprise the removal of fully amortised assets that have expired.

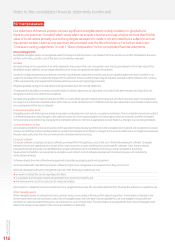

For licences and spectrum and other intangible assets, amortisation is included within the cost of sales line within the consolidated income

statement. Licences and spectrum with a net book value of £1,124 million (2015: £2,059 million) have been pledged as security against borrowings.

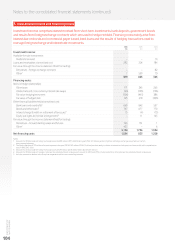

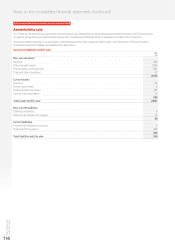

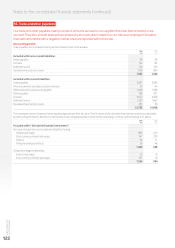

The net book value and expiry dates of the most signicant licences are as follows:

2016 2015

Expiry date £m £m

Germany 2016/2020/2025/2033 4,267 2,843

Italy 2018/2021/2029 1,262 1,094

UK 2023/2033 2,779 3,050

India 2016–2035 6,437 3,994

Qatar 2028/2029 942 987

Netherlands 2020/2029/2030 932 940

The remaining amortisation period for each of the licences in the table above corresponds to the expiry date of the respective licence. A summary

of the Group’s most signicant spectrum licences can be found on pages 187 and 188.