Vodafone 2016 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

165

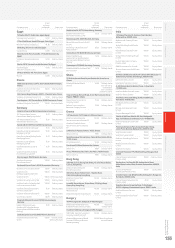

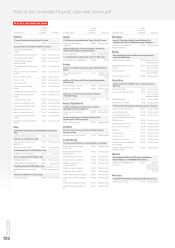

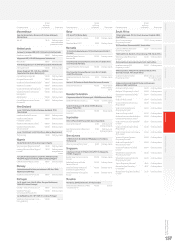

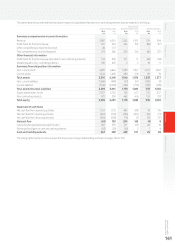

Italy

Service revenue declined 10.2%*. Trends in both mobile and xed

improved in H2, and Q4 service revenue declined 4.1%*.

Mobile service revenue fell 12.1%* as a result of a decline in the prepaid

customer base and lower ARPU following last year’s price cuts. We took

a number of measures to stabilise ARPU during the year, and in Q4,

consumer prepaid ARPU was up 6% year-on-year. We also began

to take a more active stance on stabilising the customer base in the

second half of the year, in what remains a very competitive market.

Enterprise performed strongly, returning to growth in H2. We now have

4G coverage of 84%, and 2.8 million 4G customers at 31 March 2015.

Fixed service revenue was up 1.3%*. Broadband revenue continued

to grow and we added 134,000 broadband customers over the year,

but overall growth was partially offset by an ongoing decline in xed

voice usage. We accelerated our bre roll-out plans in H2, and by March

2015 we had installed more than 5,000 cabinets.

EBITDA declined 15.3%*, with a 2.4* percentage point decline in EBITDA

margin. The decline in service revenue was partially offset by continued

strong cost control, with operating expenses down 3.1%* and customer

investment down 3.0%*.

UK

Service revenue fell 1.8%* as a good performance in consumer mobile

was offset by a decline in xed. The UK returned to service revenue

growth in H2. Q4 service revenue was up 0.6%*.

Mobile service revenue grew 0.5%*. Consumer contract service

revenue grew strongly, supported by customer growth and a successful

commercial strategy bundling content with 4G. Enterprise mobile

revenue returned to growth in H2, as a result of growing data demand.

During the year we acquired 139 stores from the administrator

of Phones 4U, taking our total portfolio to over 500 and accelerating

our direct distribution strategy. 4G coverage reached 63% at 31 March

2015 (or 71% based on the OFCOM denition), and we had 3.0 million 4G

customers at the year end.

Fixed service revenue declined 9.1%*, excluding the one-off

benet of a settlement with another network operator in Q4.

Underlying performance improved from -11.3%* in H1 to -6.8%* in H2,

driven by a strong pick-up in carrier services revenue and improving

enterprise pipeline conversion. We plan to launch our consumer bre

broadband proposition in the coming weeks.

EBITDA declined 12.4%*, with a 2.4* percentage point decline in EBITDA

margin due mainly to a reclassication of some central costs to the

UK business. Reported EBITDA beneted from one-off settlements with

two network operators.

Spain

Service revenue declined 10.9%* excluding Ono, as growth in xed

continued to be offset by price pressure in mobile and converged

services. Q4 service revenue growth was -7.8%*. Ono Q4 local currency

revenue growth was -1.9% excluding wholesale.

Mobile service revenue fell 12.7%*, although there was some

improvement in H2 with the contract customer base stabilising year-on-

year. However, ARPU continued to be under pressure throughout the

year as a result of aggressive convergence offers. During H2, we saw

an increase in the take-up of handset nancing arrangements as a result

of a change in the commercial model. We reduced handset subsidies

in Q4 and introduced bigger data allowances at slightly higher price

points. Our 4G network roll-out has now reached 75% population

coverage, and we had 2.9 million 4G customers at March 2015.

We continue to lead the market in net promoter scores (‘NPS’) in both

consumer and enterprise.

Fixed service revenue rose 7.8%* excluding Ono, supported

by consistently strong broadband net additions. Since its acquisition

in July 2014, Ono contributed £699 million to service revenue and

£267 million to EBITDA. Including our joint bre network build with

Orange, we now reach 8.5 million premises with bre. We have made

good progress with the integration of Ono, and launched in April 2015

a fully converged service, “Vodafone One”, a new ultra high-speed xed

broadband service with Ono Fibre, home landline, 4G mobile telephony

and Vodafone TV.

EBITDA declined 29.5%* year-on-year, with a 4.9* percentage point

decline in EBITDA margin. The margin was impacted by falling mobile

service revenue and growth in lower margin xed revenue, partially

offset by lower direct costs and operating expenses, and the change

in the commercial model described above.

Other Europe

Service revenue declined 2.2%* due to price competition, the generally

weak macroeconomic environment and MTR cuts.

Again, we saw a recovery in H2, with Q3 service revenue -1.1%*

and Q4 service revenue -0.9%*. Hungary grew by 8.6%* for the full

year, the Netherlands and Czech Republic returned to growth in H2,

and Greece and Ireland showed a clear improvement in trends over

the year.

In the Netherlands, we have nationwide 4G coverage, and the return

to growth has been driven by continued contract customer growth,

stabilising ARPU and growth in xed revenue. In Portugal, we continue

to see a decline in mobile service revenue driven by convergence

pricing pressure reecting a prolonged period of intense competition,

partially offset by strong xed revenue growth. We now reach 1.6 million

homes with bre, including our network sharing deal with Portugal

Telecom. In Ireland, 4G coverage has reached 87%, and we have begun

trials on our FTTH roll-out, with a commercial launch planned for later

in 2015. In Greece, the steady recovery in revenue trends through

the year stalled in Q4 as a result of the worsening macroeconomic

conditions. The integration of Hellas Online is continuing in line

with expectations.

EBITDA declined 2.8%*, with a 0.1* percentage point increase in EBITDA

margin, as the impact of lower service revenue was largely offset

by strong cost control.