Vodafone 2016 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated statement of nancial position

The consolidated statement of nancial position is set out on page 88.

Details on the major movements of both our assets and liabilities in the

year are set out below:

Assets

Goodwill and other intangible assets

Goodwill and other intangible assets increased by £3.3 billion

to £46.8 billion. The increase primarily arose as a result of £7.3 billion

of additions, including £5.4 billion for spectrum purchased in India,

Germany, Turkey, Spain, Italy and the UK, plus £2.3 billion of favourable

movements in foreign exchange rates which were partly offset

by £4.3 billion of amortisation, £1.7 billion transferred to assets held

forresale and £0.5 billion of goodwill impairment.

Property, plant and equipment

Property, plant and equipment increased by £1.5 billion to £28.1 billion,

principally due to £6.7 billion of additions driven by investment

in the Group’s networks as a result of Project Spring plus £1.0 billion

of favourable foreign exchange movements, partly offset by £5.2 billion

of depreciation charges and £0.9 billion transferred to assets held

for resale.

Other non-current assets

Other non-current assets decreased by £2.0 billion to £30.7 billion,

mainly due to decrease in deferred tax assets primarily due to the

reduction of tax losses in Luxembourg (see note 6 for further details).

Current assets

Current assets increased by £8.3 billion to £28.1 billion, mainly due

to a £3.3 billion increase in cash and cash equivalents, £2.9 billion

of assets held for resale and a £1.1 billion increase in trade receivables.

Total equity and liabilities

Total equity

Total equity decreased by £0.4 billion to £67.3 billion as the £2.8 billion

of proceeds from the convertible bonds was offset by £3.2 billion

of dividends paid to equity shareholders and non-controlling interests

and the total comprehensive loss for the year of £0.1 billion.

Non-current liabilities

Non-current liabilities increased by £7.1 billion to £33.0 billion, primarily

due to a £6.9 billion increase in long-term borrowings.

Current liabilities

Current liabilities decreased by £4.5 billion to £33.4 billion, mainly due

to £3.4 billion of additional short-term borrowings and a £0.8 billion

increase in trade and other payables. Trade payables at 31 March 2016

were equivalent to 45 days (2015: 43days) outstanding, calculated

by reference to the amount owed to suppliers as a proportion of the

amounts invoiced by suppliers during the year. It is our policy to agree

terms of transactions, including payment terms, with suppliers and

it is our normal practice that payment is made accordingly.

Contractual obligations and commitments

A summary of our principal contractual nancial obligations and

commitments is shown below.

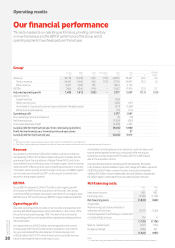

Payments due by period

£m

Contractual obligations and

commitments1Total < 1 year 1–3 years 3–5 years >5 years

Borrowings2 53,816 16 ,18 8 9,999 7, 215 20,414

Operating lease

commitments3 7, 8 62 1,527 2,084 1,429 2,822

Capital

commitments3,4 2,051 1,839 178 32 2

Purchase

commitments5 6,952 3,857 2,697 2 74 124

Total 70,681 2 3 , 411 14,958 8,950 23,362

Notes:

1 This table includes commitments in respect of options over interests in Group businesses

held by non-controlling shareholders (see “Potential cash outows from option agreements

and similar arrangements” on page 133) and obligations to pay dividends to non-controlling

shareholders (see “Dividends from associates and to non-controlling shareholders”

on page 133). The table excludes current and deferred tax liabilities and obligations under

post employment benet schemes, details of which are provided in notes 6 “Taxation”

and 26 “Post employment benets” respectively. The table also excludes the contractual

obligations of associates and joint ventures.

2 See note 21 “Borrowings”.

3 See note 29 “Commitments”.

4 Primarily related to spectrum and network infrastructure.

5 Primarily related to device purchase obligations.

Dividends

We provide returns to shareholders through equity dividends and

historically have generally paid dividends in February and August

in each year. The Directors expect that we will continue to pay dividends

semi-annually.

The £3.0 billion equity dividend in the current year comprises

£2.0 billion in relation to the nal dividend for the year ended 31 March

2015 and £1.0 billion for the interim dividend for the year ended

31 March 2016.

The interim dividend of 3.68 pence per share announced by the

Directors in November 2015 represented a 2.2% increase over last

year’s interim dividend. The Directors are proposing a nal dividend

of 7.77 pence per share. Total dividends for the year increased by 2.0%

to 11.45 pence per share.

Liquidity and capital resources

Our liquidity and working capital may be affected by a material decrease

in cash ow due to a number of factors as outlined in “Principal

risk factors and uncertainties” on pages 22 to 28. We do not use

non-consolidated special purpose entities as a source of liquidity

or forother nancing purposes.

Vodafone Group Plc

Annual Report 2016

36

Financial position and resources