Vodafone 2016 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

125

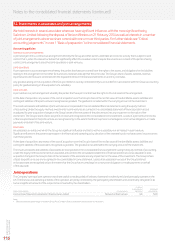

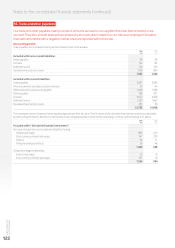

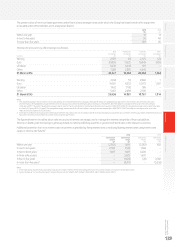

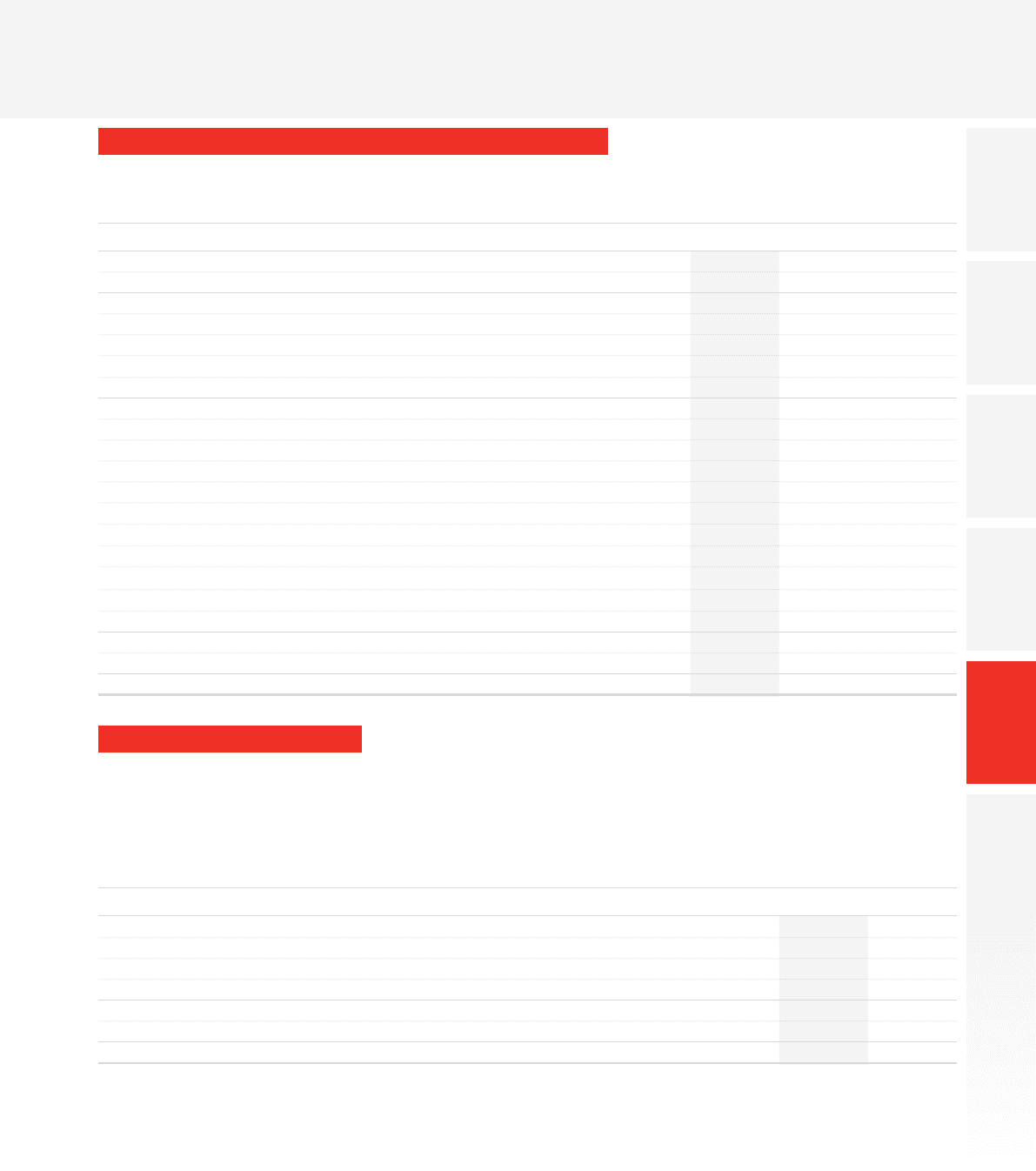

19. Reconciliation of net cash ow from operating activities

The table below shows how our prot for the year from continuing operations translates into cash ows generated

from our operating activities.

2016 2015 2014

Notes £m £m £m

(Loss)/prot for the nancial year (3,818) 5,917 59,420

Prot for the nancial year from discontinued operations 7–(57) (48,108)

(Loss)/prot for the nancial year from continuing operations (3,818) 5,860 11, 312

Non-operating income and expense 219 149

Investment income (300) (883) (346)

Financing costs 2,124 1,736 1,554

Income tax expense /(credit) 63,369 (4,765) (16,582)

Operating prot/(loss) 1,377 1,967 (3,913)

Adjustments for:

Share-based payments 27 117 88 92

Depreciation and amortisation 10, 11 9,498 9,565 7,560

Loss on disposal of property, plant and equipment and intangible assets 320 49 85

Share of result of equity accounted associates and joint ventures 12 (44) 63 (278)

Impairment losses 4450 –6,600

Other income and expense 75 114 620

(Increase)/decrease in inventory 14 (98) (73) 4

(Increase)/decrease in trade and other receivables 15 (547) (230) 526

Increase/(decrease) in trade and other payables 16 372 (1,146) 851

Cash generated by operations 11,220 10,397 12,147

Net tax paid (739) (682) (5,920)

Net cash ow from operating activities 10,481 9,715 6,227

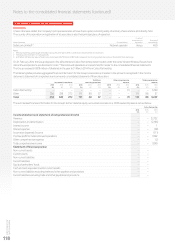

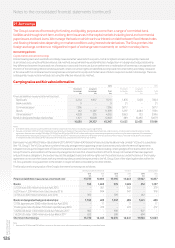

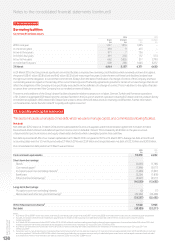

20. Cash and cash equivalents

The majority of the Group’s cash is held in bank deposits, money market funds or in repurchase agreements which

have a maturity of three months or less to enable us to meet our short-term liquidity requirements.

Accounting policies

Cash and cash equivalents comprise cash in hand and call deposits, and other short-term highly liquid investments that are readily convertible

to a known amount of cash and are subject to an insignicant risk of changes in value.

2016 2015

£m £m

Cash at bank and in hand 1,737 2,379

Money market funds 5,781 2,402

Repurchase agreements 2,700 2,000

Commercial paper – 101

Cash and cash equivalents as presented in the statement of nancial position 10,218 6,882

Bank overdrafts (9) (21)

Cash and cash equivalents as presented in the statement of cash ows 10,209 6,861

Cash and cash equivalents are held by the Group on a short-term basis with all having an original maturity of three months or less. The carrying

amount approximates their fair value.

Cash and cash equivalents of £1,284 million (2015: £1,722 million) are held in countries with restrictions on remittances but where the balances

could be used to repay subsidiaries’ third party liabilities. Of the balance at 31 March 2015, INR 57,863 million (£623 million) was used to settle India

spectrum licence obligations on 8 April 2015.