Vodafone 2016 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

93

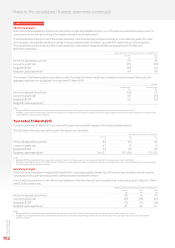

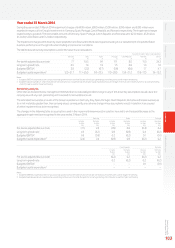

Post employment benets

Management judgement is exercised when determining the Group’s liabilities and expenses arising for dened benet pension schemes.

Management is required to make assumptions regarding future rates of ination, salary increases, discount rates and longevity of members, each

of which may have a material impact on the dened benet obligations that are recorded. Further details, including a sensitivity analysis, are included

in note 26 “Post employment benets” to the consolidated nancial statements.

Provisions and contingent liabilities

The Group exercises judgement in measuring and recognising provisions and the exposures to contingent liabilities related to pending litigation

or other outstanding claims subject to negotiated settlement, mediation, arbitration or government regulation, as well as other contingent liabilities

(see note 30 “Contingent liabilities and legal proceedings” to the consolidated nancial statements). Judgement is necessary to assess the likelihood

that a pending claim will succeed, or a liability will arise, and to quantify the possible range of any nancial settlement. The inherent uncertainty

of such matters means that actual losses may materially differ from estimates.

Impairment reviews

IFRS requires management to perform impairment tests annually for indenite lived assets and, for nite lived assets, if events or changes

in circumstances indicate that their carrying amounts may not be recoverable.

Impairment testing requires management to judge whether the carrying value of assets can be supported by the net present value of future cash

ows that they generate. Calculating the net present value of the future cash ows requires assumptions to be made in respect of highly uncertain

matters including management’s expectations of:

a growth in EBITDA, calculated as adjusted operating prot before depreciation and amortisation;

a timing and amount of future capital expenditure, licence and spectrum payments;

a long-term growth rates; and

a appropriate discount rates to reect the risks involved.

Management prepares formal ve year forecasts for the Group’s operations, which are used to estimate their value in use. In certain developing

markets ten year forecasts are used if it is considered that the fth year of a forecast is not indicative of expected long-term future performance

as operations may not have reached maturity.

For operations where ve year forecasts are used for the Group’s value in use calculations, a long-term growth rate into perpetuity has been

determined as the lower of:

a the nominal GDP growth rates for the country of operation; and

a the long-term compound annual growth rate in EBITDA in years six to ten estimated by management.

For operations where ten year forecasts are used for the Group’s value in use calculations, a long-term growth rate into perpetuity has been

determined as the lower of:

a the nominal GDP growth rates for the country of operation; and

a the compound annual growth rate in EBITDA in years nine to ten of the management plan.

Changing the assumptions selected by management, in particular the discount rate and growth rate assumptions used in the cash ow projections,

could signicantly affect the Group’s impairment evaluation and hence reported assets and prots or losses. Further details, including a sensitivity

analysis, are included in note 4 “Impairment losses” to the consolidated nancial statements.