Vodafone 2016 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

133

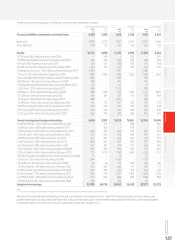

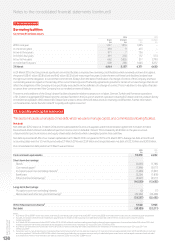

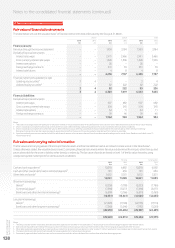

Committed bank facilities Amounts drawn Terms and conditions

2 December 2014

US$0.85 billion loan facility,

maturing 2 June 2018.

US$ 0.8 billion was drawn from the

facility on 8 June 2015. The remaining

US$ 0.05 billion was cancelled on the

same date.

As per the syndicated revolving credit facilities with the addition that

the expenditure should be spent on projects involving Canadian

domiciledentities.

17 December 2014

€0.35 billion loan facility,

maturing on the seven year

anniversary of the rst drawing.

This facility is undrawn and has an

availability period of 18 months.

The facility is available to nance a

project to upgrade and expand the

mobile network in Germany.

As per the syndicated revolving credit facilities with the addition that,

should our German operating company spend less than the equivalent

of €0.7billion on capital expenditure, we will be required to repay the

drawn amount of the facility that exceeds 50% of the capital expenditure.

9 September 2015

US$1.0 billion loan facility,

maturing 8 September 2016.

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

As per the syndicated revolving credit facilities.

9 November 2015

US$1.0 billion loan facility,

maturing 8 November 2016.

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

As per the syndicated revolving credit facilities.

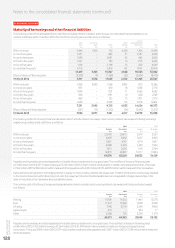

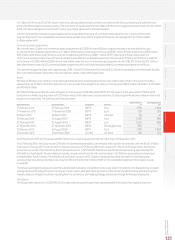

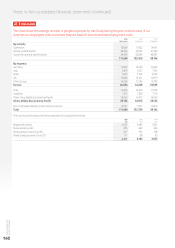

Furthermore, certain of our subsidiaries are funded by external facilities which are non-recourse to any member of the Group other than the

borrower. These facilities may only be used to fund their operations. At 31 March 2016, Vodafone India had facilities of INR242 billion (£2.5 billion)

of which INR236 billion (£2.5 billion) was drawn. Vodafone Egypt had undrawn revolving credit facilities of US$120 million (£83 million)

and EGP4 billion (£313 million). Vodacom had a fully drawn facility of US$184 million (£128 million) and a facility of ZAR3.5 billion (£166 million)

of which ZAR2.2 billion (£102 million) was drawn. Ghana had fully drawn facilities of US$192 million (£134 million) and GHS60 million (£11 million).

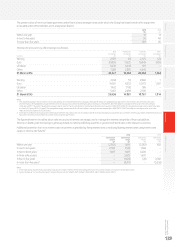

Dividends from associates and to non-controlling shareholders

Dividends from our associates are generally paid at the discretion of the Board of Directors or shareholders of the individual operating and holding

companies, and we have no rights to receive dividends except where specied within certain of the Group’s shareholders’ agreements. Similarly,

other than ongoing dividend obligations to the KDG minority shareholders should they continue to hold their minority stake, we do not have existing

obligations under shareholders’ agreements to pay dividends to non-controlling interest partners of our subsidiaries or joint ventures.

The amount of dividends received and paid in the year are disclosed in the consolidated statement of cash ows.

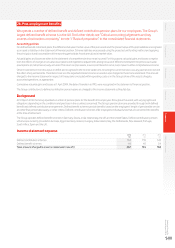

Potential cash outows from option agreements and similar arrangements

Under the terms of the sale and purchase agreement governing the disposal of the US Group, including the 45% interest in Verizon Wireless,

the Group retains the responsibility for any tax liabilities of the US Group, excluding those relating to the Verizon Wireless partnership, for periods

up to the completion of the transaction on 21 February 2014.

Put options issued as part of the hedging strategy for the mandatory convertible bonds permit the holders to exercise against the Group if there

is decrease in our share price. Under the terms of the options, settlement must be made in cash which will equate to the reduced value of shares

from the initial conversion price on 1,325 million shares.

Off-balance sheet arrangements

We do not have any material off-balance sheet arrangements as dened in item 5.E.2. of the SEC’s Form 20-F. Please refer to notes 29 and 30 for

a discussion of our commitments and contingent liabilities.