Vodafone 2016 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2016

148

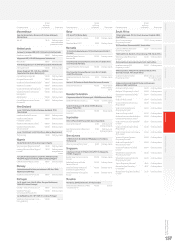

Notes to the consolidated nancial statements (continued)

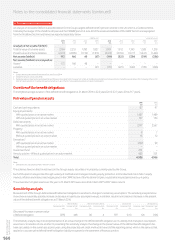

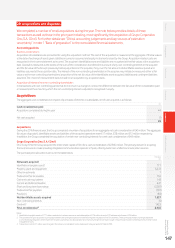

28. Acquisitions and disposals (continued)

Vodafone Omnitel B.V. (‘Vodafone Italy’)

On 21 February 2014 the Group acquired a 100% interest in Vodafone Italy, having previously held a 76.9% stake which was accounted for as a joint

venture. The Group acquired the additional 23.1% equity as part of the consideration received for the disposal of the Group’s interests in Verizon

Wireless (see “Disposals” below). There was no observable market for Verizon shares and so the fair value of consideration paid by the Group for the

acquisition was considered to be more reliably determined based on the acquisition-date fair value of Group’s existing equity interest in Vodafone

Italy. Using a value in use basis, the consideration paid for the acquisition was determined to be £7,121 million, comprising £5,473 million for the

Group’s existing 76.9% equity interest and £1,648 million for the additional 23.1% equity interest.

Disposals

Verizon Wireless (‘VZW’)

On 21 February 2014 the Group sold its US sub-group which included its entire 45% shareholding in VZW to Verizon Communications Inc.

for a total consideration of £76.7 billion before tax and transaction costs, comprising cash of £35.2 billion, shares in Verizon Communications

Inc. of £36.7 billion, loan notes issued by Verizon Communications Inc. of £3.1 billion and a 21.3% interest in Vodafone Italy valued at £1.7 billion.

The Group recognised a net gain on disposal of £44,996 million, reported in prot for the nancial year from discontinued operations.

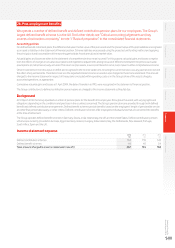

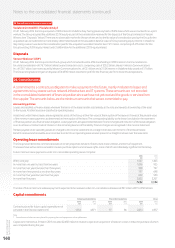

29. Commitments

A commitment is a contractual obligation to make a payment in the future, mainly in relation to leases and

agreements to buy assets such as network infrastructure and IT systems. These amounts are not recorded

in the consolidated statement of nancial position since we have not yet received the goods or services from

thesupplier. The amounts below are the minimum amounts that we are committed to pay.

Accounting policies

Leases are classied as nance leases whenever the terms of the lease transfer substantially all the risks and rewards of ownership of the asset

to thelessee. All other leases are classied as operating leases.

Assets held under nance leases are recognised as assets of the Group at their fair value at the inception of the lease or, if lower, at the present value

of the minimum lease payments as determined at the inception of the lease. The corresponding liability to the lessor is included in the statement

of nancial position as a nance lease obligation. Lease payments are apportioned between nance charges and reduction of the lease obligation

so as to achieve a constant rate of interest on the remaining balance of the liability. Finance charges are recognised in the income statement.

Rentals payable under operating leases are charged to the income statement on a straight-line basis over the term of the relevant lease.

Benetsreceived and receivable as an incentive to enter into an operating lease are also spread on a straight-line basis over the lease term.

Operating lease commitments

The Group has entered into commercial leases on certain properties, network infrastructure, motor vehicles and items of equipment.

The leaseshave various terms, escalation clauses, purchase options and renewal rights, none of which are individually signicant to the Group.

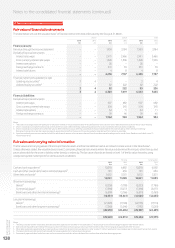

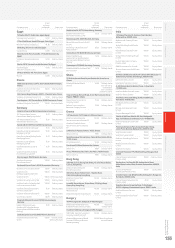

Future minimum lease payments under non-cancellable operating leases comprise:

2016 2015

£m £m

Within one year 1,527 1,403

In more than one year but less than two years 1,096 925

In more than two years but less than three years 988 797

In more than three years but less than four years 797 698

In more than four years but less than ve years 632 550

In more than ve years 2,822 2,207

7,862 6,580

The total of future minimum sublease payments expected to be received under non-cancellable subleases is £397 million (2015: £358 million).

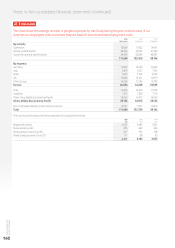

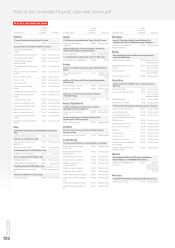

Capital commitments

Company and subsidiaries Share of joint operations Group

2016

£m

2015

£m

2016

£m

2015

£m

2016

£m

2015

£m

Contracts placed for future capital expenditure not

provided in the nancial statements11,954 4,871 97 86 2,051 4,957

Note:

1 Commitment includes contracts placed for property, plant and equipment and intangible assets.

Capital commitments at 31 March 2015 included £2,682 million in relation to spectrum acquired in 12 telecom circles in India, the purchase of which

was completed during the year.