Vodafone 2016 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

107

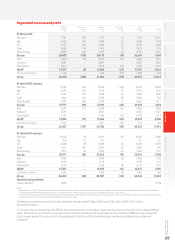

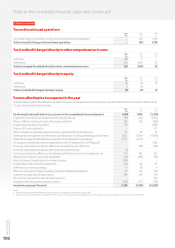

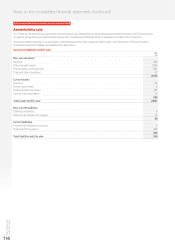

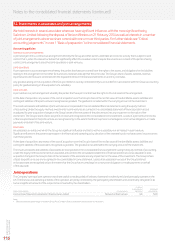

Deferred tax

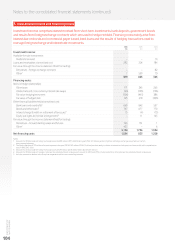

Analysis of movements in the net deferred tax balance during the year:

£m

1 April 2015 23,250

Exchange movements 2,043

Charged to the income statement (continuing operations) (3,134)

Charged directly to OCI (218)

Charged directly to equity (2)

Reclassications 8

Arising on acquisition and disposals (11)

31 March 2016 21,936

Deferred tax assets and liabilities, before offset of balances within countries, are as follows:

Amount

(charged)/

credited

in income

statement

£m

Gross

deferred

tax asset

£m

Gross

deferred tax

liability

£m

Less

amounts

unrecognised1

£m

Net

recognised

deferred tax

(liability)/

asset

£m

Accelerated tax depreciation 243 1,264 (1,309) (37) (82)

Intangible assets 27 67 (1,610) 12 (1,531)

Tax losses (3,588) 26,929 –(4,828) 22,101

Deferred tax on overseas earnings (14) –(53) –(53)

Other temporary differences 198 1,818 (98) (219) 1,501

31 March 2016 (3,134) 30,078 (3,070) (5,072) 21,936

Note:

1 Other unrecognised temporary differences include £141 million relating to Minimum Alternative Tax credits in India, of which £47 million expire within 0–5 years and £94 million expire within

6–10 years.

Deferred tax assets and liabilities are analysed in the statement of nancial position, after offset of balances within countries, as follows:

£m

Deferred tax asset 22,382

Deferred tax liability (446)

31 March 2016 21,936

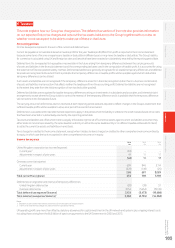

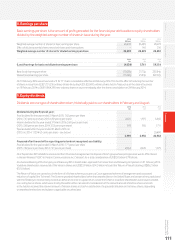

At 31 March 2015, deferred tax assets and liabilities, before offset of balances within countries, were as follows:

Amount Net

credited/ recognised

(charged) Gross Gross Less deferred tax

in income deferred deferred tax amounts (liability)/

statement tax asset liability unrecognised asset

£m £m £m £m £m

Accelerated tax depreciation 382 1,183 (1,355) (61) (233)

Intangible assets 195 107 (1,704) 13 (1,584)

Tax losses 4,866 28,080 –(4,430) 23,650

Deferred tax on overseas earnings (38) –(40) –(40)

Other temporary differences 68 1,695 (94) (144) 1,457

31 March 2015 5,473 31,065 (3,193) (4,622) 23,250

At 31 March 2015 deferred tax assets and liabilities were analysed in the statement of nancial position, after offset of balances within countries,

as follows:

£m

Deferred tax asset 23,845

Deferred tax liability (595)

31 March 2015 23,250

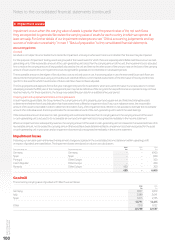

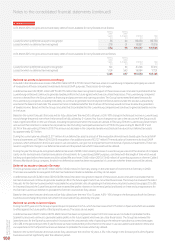

Factors affecting the tax charge in future years

The Group’s future tax charge, and effective tax rate, could be affected by several factors including; tax reform in countries around the world,

including any arising from the implementation of the OECD’s BEPS actions and European Commission initiatives such as the proposed anti-tax

avoidance directive, tax and nancial reporting directive or as a consequence of state aid investigations, future corporate acquisitions and disposals,

any restructuring of our businesses and the resolution of open tax issues (see below).

The Group is routinely subject to audit by tax authorities in the territories in which it operates and, specically, in India these are usually resolved

through the Indian legal system. We consider each issue on its merits and, where appropriate, hold provisions in respect of the potential tax liability

that may arise. However, the amount ultimately paid may differ materially from the amount accrued and could therefore affect the Group’s overall

protability and cash ows in future periods. See note 30 “Contingent liabilities and legal proceedings” to the consolidated nancial statements.