Vodafone 2016 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

139

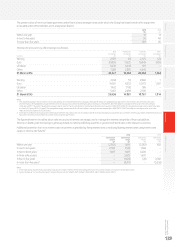

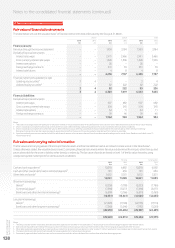

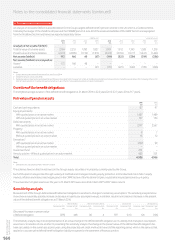

Net nancial instruments

The table below shows the Group’s nancial assets and liabilities that are subject to offset in the balance sheet and the impact of enforceable master

netting or similar agreements.

At 31 March 2016

Related amounts not set off in the balance sheet

Gross amount Amount set off

Amounts

presented in

balance sheet

Right of set off

with derivative

counterparties Cash collateral Net amount

£m £m £m £m £m £m

Derivative nancial assets 4,304 –4,304 (1,216) (2,837) 251

Derivative nancial liabilities (1,564) –(1,564) 1,216 110 (238)

Total 2,740 –2,740 –(2,727) 13

At 31 March 2015

Related amounts not set off in the balance sheet

Gross amount Amount set off

Amounts

presented in

balance sheet

Right of set off

with derivative

counterparties Cash collateral Net amount

£m £m £m £m £m £m

Derivative nancial assets 4,005 – 4,005 (726) (2,542) 737

Derivative nancial liabilities (984) – (984) 726 30 (228)

Total 3,021 – 3,021 – (2,512) 509

Financial assets and liabilities are offset and the amount reported in the consolidated balance sheet when there is a legally enforceable right

to offset the recognised amounts and there is an intention to settle on a net basis or realise the asset and settle the liability simultaneously.

Derivative nancial instruments that do not meet the criteria for offset could be settled net in certain circumstances under ISDA (International Swaps

and Derivatives Association) agreements where each party has the option to settle amounts on a net basis in the event of default from the other.

Collateral may be offset and net settled against derivative nancial instruments in the event of default by either party. The aforementioned collateral

balances are recorded in “other short-term investments” or “short-term debt” respectively.

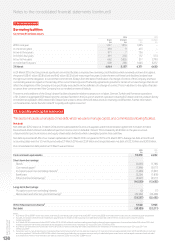

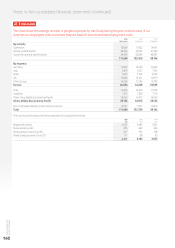

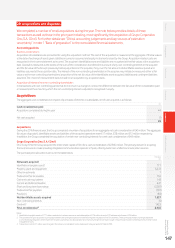

24. Directors and key management compensation

This note details the total amounts earned by the Company’s Directors and members of the Executive Committee.

Directors

Aggregate emoluments of the Directors of the Company were as follows:

2016 2015 2014

£m £m £m

Salaries and fees 4 4 4

Incentive schemes1232

Other benets21 1 1

787

Notes:

1 Excludes gains from long-term incentive plans.

2 Includes the value of the cash allowance taken by some individuals in lieu of pension contributions.

The aggregate gross pre-tax gain made on the exercise of share options in the year ended 31 March 2016 by one Director who served during the

year was £0.2 million (2015: one Director, <£0.1 million; 2014: three Directors, £4.0 million).

Key management compensation

Aggregate compensation for key management, being the Directors and members of the Executive Committee, was as follows:

2016 2015 2014

£m £m £m

Short-term employee benets 22 18 17

Share-based payments 20 18 21

42 36 38