Vodafone 2016 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Revenue decreased 1.3%, with strong organic growth offset

by a 7.7percentage point adverse impact from foreign exchange

movements, particularly with regards to the South African rand, Turkish lira

and Egyptian pound. On an organic basis, service revenue was up 6.9%*

driven by growth in the customer base, increased voice and data usage,

and continued good commercial execution. Overall growth was negatively

impacted by MTR cuts and other regulatory charges, mainly in India.

EBITDA decreased 1.1%, including a 7.9 percentage point adverse impact

from foreign exchange movements. On an organic basis, EBITDA grew

7.2%*, driven by growth in all major markets.

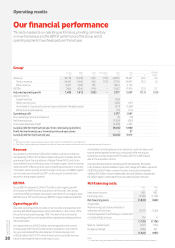

Organic

change

%

Other

activity1

pps

Foreign

exchange

pps

Reported

change

%

Revenue – AMAP 7. 0 (0.6) ( 7. 7 ) (1.3)

Service revenue

India 5.0 – (0.2) 4.8

Vodacom 5.4 – (12.7 ) ( 7. 3 )

Other AMAP 10 .1 (1.9) (9.3) (1.1)

AMAP 6.9 (0.7) ( 7. 0 ) (0.8)

EBITDA

India 4.1 – (0.3) 3.8

Vodacom 12.7 – (15. 5) (2.8)

Other AMAP 4.5 (1.3) ( 7.1) (3.9)

AMAP 7.2 (0.4) ( 7. 9) (1.1)

AMAP adjusted

operating prot 11.7 (1.1) (10.0) 0.6

Note:

1 “Other activity” includes the impact of M&A activity. Refer to “Organic growth” on page 191

for further detail.

India

Service revenue increased 5.0%* (Q3: 2.3%*; Q4: 5.3%*) as customer

base growth and strong demand for 3G data was partially offset

by a number of regulatory changes, including MTR cuts, roaming price

caps and an increase in service tax. Excluding these impacts, service

revenue growth was 10.0%*. Q4 growth recovered versus Q3 as voice

price competition moderated during the quarter and regulatory impacts

began to reduce in March.

We added 14.1 million customers during the year, taking the total

to 197.9 million. Growth in total minutes of use continued, but this was

offset by a decline in average revenue per minute as a result of ongoing

competition on voice business.

Data growth continues to be very strong, with data usage over the

network up 64% year-on-year, and the active data customer base

increasing by 3.8 million to 67.5 million. The 3G customer base grew

to 27.4 million, up 41.4% year-on-year, and smartphone penetration

in our four biggest urban areas is now 52.8%. In Q4, browsing revenue

represented 19.2% of local service revenue, up from 14.9% in the

equivalent quarter last year.

In the Netherlands, service revenue increased 0.3%*, with growth

moving into decline during H2 (Q3: 0.2%*; Q4: -1.3%*) as continued

gains in xed line (partly aided by a Q4 accounting reclassication)

were offset by a decline in mobile contract ARPU. In Portugal, xed

service revenue continues to grow strongly and mobile is recovering

as ARPU and churn pressure from the shift towards convergent pricing

begins to moderate. Our FTTH network now reaches 2.4 million

homes. Ireland returned to service revenue growth in Q2, with strong

momentum in xed line and an improving trend in mobile. The initial

4G roll-out is complete with 95% population coverage. In Greece

macroeconomic conditions remained a drag, however good cost

control led to improved margins. The integration of HOL is progressing

according to plan.

EBITDA declined 1.5%*, with a 1.0* percentage point decline in EBITDA

margin, mainly driven by lower margins in Portugal and Romania.

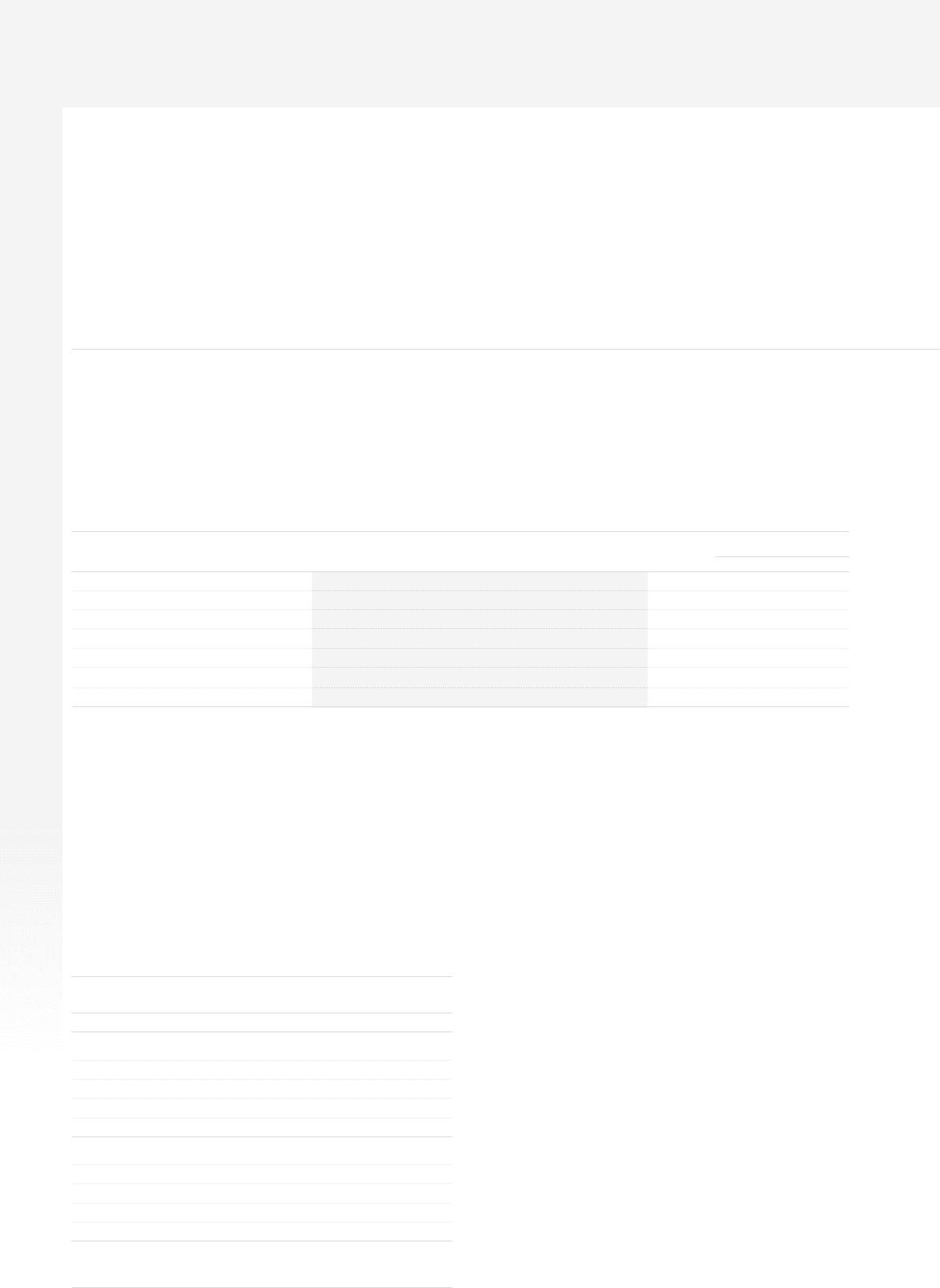

Africa, Middle East and Asia Pacic1

India

£m

Vodacom

£m

Other AMAP

£m

Eliminations

£m

AMAP

£m

Restated

2015

£m

% change

£Organic

Year ended 31 March 2016

Revenue 4, 516 3,887 4, 814 (9) 13, 208 13, 382 (1.3) 7. 0

Service revenue 4,497 3,233 4 ,122 (9) 11, 8 43 11, 93 5 (0.8) 6.9

Other revenue 19 654 692 – 1,365 1,447

EBITDA 1,331 1,484 1,227 –4,042 4,086 (1.1) 7. 2

Adjusted operating prot 469 992 352 –1,813 1,802 0.6 11.7

EBITDA margin 29.5% 38.2% 25.5% 30.6% 30.5%

Note:

1 The Group has amended its reporting to reect changes in the internal management of its Enterprise business. The primary change has been that on 1 April 2015 the Group redened its

segments to report international voice transit service revenue within Common Functions rather than within the service revenue amount disclosed for each country and region. The service

revenue amounts presented for the year ended 31 March 2015 have been restated onto a comparable basis together with all disclosed organic service revenue growth rates. There is no impact

on total Group service revenues or costs.

Vodafone Group Plc

Annual Report 2016

34

Operating results (continued)