Vodafone 2016 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

163

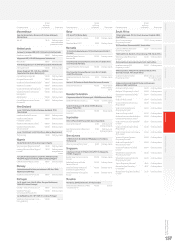

Other unaudited nancial information

Prior year operating results

This section presents our operating performance for the 2015 nancial year compared to the 2014 nancial

year, providing commentary on how the revenue and the EBITDA performance of the Group and its operating

segments have developed over those years.

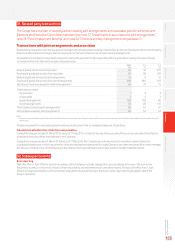

Group1,2

Restated2

Europe

£m

Restated2

AMAP

£m

Restated2

Other3

£m

Restated2

Eliminations

£m

2015

£m

2014

£m

% change

£Organic*

Revenue 27, 6 87 13,382 1,257 (99) 42,227 38,346 10 .1 (0.8)

Service revenue 25,588 11, 93 4 1,073 (98) 38,497 35 ,19 0 9.4 (1.6)

Other revenue 2,099 1,448 184 (1) 3,730 3,15 6

EBITDA 7, 8 94 4,086 (65) –11, 915 11 ,0 8 4 7. 5 (6.9)

Adjusted operating prot 1,733 1,802 (28) –3,507 4,310 (18.6) (24.1)

Adjustments for:

Impairment loss –(6,600)

Restructuring costs (157) (355)

Amortisation of acquired customer bases and brand intangible assets (1,269) (551)

Other income and expense (114) (717)

Operating loss 1,967 (3,913)

Notes:

1 2015 results reect average foreign exchange rates of £1:€1.28, £1:INR 98.51 and £1:ZAR 17.82. (2014: £1:€1.19 and £1:US$1.59).

2 The Group has amended its reporting to reect changes in the internal management of its Enterprise business. The primary change has been that on 1 April 2015, the Group redened its

segments to report international voice transit revenue and costs within Common Functions rather than within the results disclosed for each country and region. The results presented for the

year ended 31 March 2015 and 2014 have been restated onto a comparable basis. There is no impact on total Group revenue or cost.

3 The “Other” segment primarily represents the results of the partner markets and the net result of unallocated central Group costs.

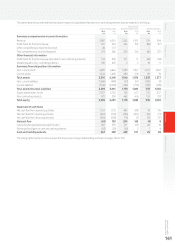

Revenue

Group revenue increased by 10.1% to £42.2 billion and service revenue

increased 9.4% to £38.5 billion. Reported growth rates reect the

acquisitions of KDG in October 2013 and of Ono in July 2014, as well

as the consolidation of Italy after we increased our ownership to 100%

in February 2014.

In Europe, organic service revenue declined by 5.0%* as growing

demand for 4G and data services continues to be offset by challenging

competitive and macroeconomic pressures and the impact of MTR cuts.

In AMAP, organic service revenue increased by 5.7%* driven

by continued growth in India, Turkey, Ghana, Qatar and Egypt, partially

offset by declines in Vodacom and New Zealand.

EBITDA

Group EBITDA rose 7.5% to £11.9 billion, with organic EBITDA down

6.9%*, mainly affected by revenue declines in Europe. The Group

EBITDA margin fell 0.7 percentage points to 28.2%, or 1.8* percentage

points on an organic basis.

This reects ongoing revenue declines in Europe and the growth

in operating expenses as a result of Project Spring, partially offset

by operating efciencies. H2 EBITDA fell 3.6%*, with the improved trend

supported by the better revenue performance and continued good

cost control.

Operating loss

Adjusted operating prot excludes certain income and expenses that

we have identied separately to allow their effect on the results of the

Group to be assessed (see page 190). The items that are included

in operating prot but are excluded from adjusted operating prot are

discussed below.

No impairment losses were recognised in the 2015 nancial year

(2014: £6,600 million). Further detail is provided in note 4 to the

Group’s consolidated nancial statements. Restructuring costs

of £157 million (2014: £355 million) were incurred to improve future

business performance and reduce costs.

Note:

* All amounts in the Operating Results section marked with an “*” represent organic growth

which presents performance on a comparable basis, both in terms of merger and acquisition

activity and movements in foreign exchange rates. Refer to “Organic growth” on page 191

for further detail.