Vodafone 2016 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other matters

The Committee also undertook a range of further activities in relation

to the Group’s accounting and external reporting in the year:

Adoption of recent accounting developments

The Committee received regular reporting from management

on the Group’s implementation of IFRS 15 “Revenue from contracts

with customers”, which will be adopted in the nancial year ending

31 March 2019, focusing on the key decision points relating to the

choice of IT system for generating the necessary accounting entries,

systems integration, the methodology in which the standard would

be adopted and programme resourcing. The Committee will also review

the Group’s implementation of IFRS 16 “Leases”, which will be adopted

in either the nancial years ending 31 March 2019 or 2020, once

management has more fully assessed the impact of the changes.

Fair, balanced and understandable

As part of the Committee’s assessment of whether the Annual

Report, taken as a whole, is fair, balanced and understandable and

provides the information necessary for shareholders to assess the

Company’s position and performance, business model and strategy,

it draws on the work of the Group’s Disclosure Committee and has

discussions with senior management. The processes and controls that

underpin our consideration include ensuring that:

a all contributors are fully briefed on the fair, balanced and

understandable requirement;

a a dedicated and experienced core team is responsible for the

coordination of content submissions, verication, detailed review

and challenge;

a senior management conrms that the content in respect

of their areas of responsibility is considered to be fair, balanced

and understandable;

a the Disclosure Committee reviews and assesses the Annual Report

as a whole; and

a the Committee receives an early draft of the Annual Report to enable

timely review and comment.

These processes allowed us to provide positive assurance to the

Board to assist them in making the statement required by the 2014

UK Corporate Governance Code.

Long-term viability statement

Following the adoption of the 2014 UK Corporate Governance Code

during the 2016 nancial year, the Committee’s terms of reference were

extended to include providing advice to the Board on the form and basis

underlying the long-term viability statement as set out on page 29.

The Committee reviewed the process and assessment of the

Group’s prospects made by management, including:

a the review period and alignment with the Group’s internal

long-term forecasts;

a the assessment of the capacity of the Group to remain viable

after consideration of future cash ows, expected debt service

requirements, undrawn facilities and access to capital markets; and

a the modelling of the nancial impact of certain of the Group’s

principal risks materialising using severe but plausible scenarios.

Management also sought independent external advice on best practice

to ensure appropriate compliance with the requirements of the 2014

UK Corporate Governance Code.

External audit

The Committee has primary responsibility for overseeing the

relationship with, and performance of, the external auditor. This includes

making the recommendation on the appointment, reappointment

and removal of the external auditor, assessing their independence

on an ongoing basis and for negotiating the audit fee.

Auditor appointment

PricewaterhouseCoopers LLP were appointed as the Group’s external

auditor in July 2014 following an audit tender and, in accordance with

the 2014 UK Corporate Governance Code, the Group will be required

to put the external audit contract out to tender by 2024. In addition,

PricewaterhouseCoopers LLP will be required to rotate the audit

partner responsible for the Group audit every ve years and, as a result,

the current lead audit partner will be required to change in 2019.

The Committee continues to review the auditor appointment and the

need to tender the audit, ensuring the Group’s compliance with the

2014 UK Corporate Governance Code and the reforms of the audit

market by the UK Competition and Markets Authority. Accordingly,

the Company conrms that it complied with the provisions of the

Competition and Markets Authority’s Order for the nancial year under

review. For the nancial year ending 31 March 2017, the Committee

hasrecommended to the Board that PricewaterhouseCoopers LLP be

reappointed under the current external audit contract and the Directors

will be proposing the reappointment of PricewaterhouseCoopers LLP

at the annual general meeting in July 2016.

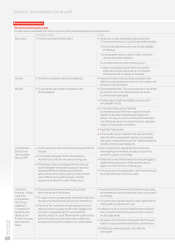

Audit risk

At the start of the audit cycle for the new nancial year we received

from PricewaterhouseCoopers LLP a detailed audit plan identifying

their audit scope, planning materiality and their assessment of key risks.

The audit risk identication process is considered a key factor in the

overall effectiveness of the external audit process, and the key risks for

the 2016 nancial year, which were unchanged from the previous year,

were as follows:

a Taxation matters, including a provisioning claim for withholding tax

in India and the recognition and recoverability of deferred tax assets

in Luxembourg and Germany.

a Carrying value of goodwill.

a Provisions and contingent liabilities.

a Revenue recognition.

a Accounting for signicant one-off transactions.

a Capitalisation and asset lives.

a Management override of internal controls.

These risks are regularly reviewed by the Committee to ensure the

external auditor’s areas of audit focus remain appropriate.

Working with the auditor

We hold private meetings with the external auditor at each Committee

meeting to provide additional opportunity for open dialogue and

feedback from the Committee and the auditor without management

being present. Matters typically discussed include the external

auditor’s assessment of business risks, the transparency and

openness of interactions with management, conrmation that there

has been no restriction in scope placed on them by management,

the independence of their audit and how they have exercised

professional scepticism. I also meet with the external lead audit partner

outside the formal Committee process throughout the year.

Board committees (continued)

Vodafone Group Plc

Annual Report 2016

50