Vodafone 2016 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

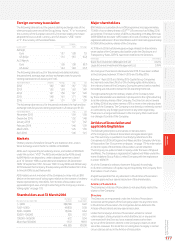

Investor calendar

Ex-dividend date for nal dividend 9 June 2016

Record date for nal dividend 10 June 2016

Trading update 22 July 2016

Annual general meeting 29 July 2016

Final dividend payment 3 August 2016

Half-year nancial results 15 November 2016

Ex-dividend date for interim dividend124 November 2016

Record date for interim dividend125 November 2016

Interim dividend payment12 February 2017

Note:

1 Provisional dates.

Dividends

See pages 36 and 111 for details on dividend amount per share.

Payment of dividends by direct credit

We pay cash dividends directly to shareholders’ bank or building society

accounts. This ensures secure delivery and means dividend payments

are credited toshareholders’ bank or building society accounts

on the same day as payment. A dividend conrmation covering

both the interim and nal dividends paid during the nancial year

is sent to shareholders at the time of the interim dividend in February.

ADS holders may alternatively have their cash dividends paid by cheque.

Overseas dividend payments

Holders of ordinary shares resident in the Eurozone (dened for

this purpose as a country that has adopted the euro as its national

currency) automatically receive their dividends in euros. The sterling/

euro exchange rate is determined by us in accordance with our Articles

of Association up to 13 business days before the payment date.

Holders resident outside the UK and Eurozone automatically receive

dividends in pounds sterling but may elect to receive dividends

in localcurrency directly into their bank account by registering

for ourregistrar’s (Computershare) Global Payments Service.

Visit investorcentre.co.uk for details and terms and conditions.

Cash dividends to ADS holders will be paid by the ADS depositary

in USdollars. The sterling/US dollar exchange rate for this purpose

is determined by us up to ten New York and London business days

beforethe payment date.

For the nancial year ending 31 March 2017 and beyond, dividends will

be declared in euros and paid in euros, pounds sterling and US dollars,

aligning the Group’s shareholder returns with the primary currency

in which we generate free cash ow. The foreign exchange rate at which

future dividends declared in euros will be converted into pounds sterling

and US dollars will be calculated based on the average exchange rate

of the ve business days during the week prior to the payment of the

dividend. The Board has determined that future dividend growth will

be calculated from the level of 14.48 eurocents per share in 2016, which

is equivalent to the 2016 total dividend payout of 11.45 pence at the

year-end £:€ exchange rate of 1.2647.

See vodafone.com/dividends for further information about dividend

payments or, alternatively, please contact our registrar or the ADS

depositary, as applicable. See page 176 for their contact information.

Dividend reinvestment plan

We offer a dividend reinvestment plan which allows holders of ordinary

shares who choose to participate to use their cash dividends to acquire

additional shares in the Company. These are purchased on their behalf

by the plan administrator through a low cost dealing arrangement.

For ADS holders, BNY Mellon maintains a Global BuyDIRECT Plan which

is a direct purchase and sale plan for depositary receipts with a dividend

reinvestment facility.

Dividend tax allowance

From April 2016 dividend tax credits will be replaced by an annual

£5,000 tax-free allowance on dividend income across an individual’s

entire share portfolio. Above this amount, individuals will pay tax in the

UK on their dividend income at a rate dependent on their income tax

bracket and personal circumstances. Vodafone will continue to provide

registered shareholders with a conrmation of the dividends paid

and this should be included with any other dividend income received

when calculating and reporting total dividend income received.

It is theshareholder’s responsibility to include all dividend income

whencalculating any tax liability.

This change was announced by the Chancellor, as part of the

UK Government Budget in July 2015. If you have any tax queries, please

contact a nancial adviser.

Managing your shares via Investor Centre

Computershare operates a portfolio service for investors in ordinary

shares, called Investor Centre. This provides our shareholders with

online access to information about their investments as well as a facility

to help manage their holdings online, such as being able to:

a update dividend mandate bank instructions and review dividend

payment history;

a update member details and address changes; and

a register to receive Company communications electronically.

Computershare also offers an internet and telephone share dealing

service to existing shareholders.

The service can be obtained at investorcentre.co.uk. Shareholders with

any queries regarding their holding should contact Computershare.

See page 176 for their contact details.

Shareholders may also nd the investors section of our corporate

website,vodafone.com/investor, useful for general queries and

information about the Company.

Shareholder communications

A growing number of our shareholders have opted to receive their

communications from us electronically using email and web-based

communications. The use of electronic communications, rather

than printed paper documents, means information about the

Company can be received as soon as it is available and has the

added benet of reducing costs and our impact on the environment.

Each timewe issue a shareholder communication, shareholders who

have positively elected for electronic communication (or are deemed

to have consented to receive electronic communication in accordance

with the Companies Act 2006) will be sent an email alert containing

a link to the relevant documents.

Overview Strategy review Performance Governance Financials

Additional

information

Vodafone Group Plc

Annual Report 2016

175

Shareholder information

Unaudited information