Vodafone 2016 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

135

Net investment hedges

Exchange differences arising from the translation of the net investment in foreign operations are recognised directly in equity. Gains and losses

on those hedging instruments (which include bonds, commercial paper, cross currency swaps and foreign exchange contracts) designated

as hedges of the net investments in foreign operations are recognised in equity to the extent that the hedging relationship is effective; these

amounts are included in exchange differences on translation of foreign operations as stated in the statement of comprehensive income. Gains and

losses relating to hedge ineffectiveness are recognised immediately in the income statement for the period. Gains and losses accumulated in the

translation reserve are included in the income statement when the foreign operation is disposed of.

Capital management

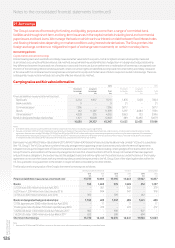

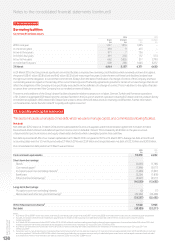

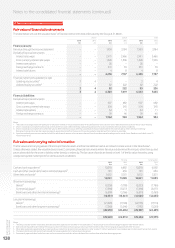

The following table summarises the capital of the Group at 31 March:

2016 2015

£m £m

Financial assets:

Cash and cash equivalents (10,218) (6,882)

Fair value through the income statement (held for trading) (4,160) (5,513)

Loans and receivables (1,570) –

Derivative instruments in designated hedge relationships (1,774) (1,376)

Financial liabilities:

Fair value through the income statements (held for trading) 1,355 958

Derivative instruments in designated hedge relationships 209 26

Financial liabilities held at amortised cost 45,347 35,058

Net debt 29,189 22,271

Equity 67,317 67,733

Capital 96,506 90,004

The Group’s policy is to borrow centrally using a mixture of long-term and short-term capital market issues and borrowing facilities to meet

anticipated funding requirements. These borrowings, together with cash generated from operations, are loaned internally or contributed as equity

to certain subsidiaries. The Board has approved three internal debt protection ratios being: net interest to operating cash ow (plus dividends from

associates); retained cash ow (operating cash ow plus dividends from associates less interest, tax, dividends to non-controlling shareholders and

equity dividends) to net debt; and operating cash ow (plus dividends from associates) to net debt. These internal ratios establish levels of debt that

the Group should not exceed other than for relatively short periods of time and are shared with the Group’s debt rating agencies being Moody’s,

FitchRatings and Standard & Poor’s.

Financial risk management

The Group’s treasury function provides a centralised service to the Group for funding, foreign exchange, interest rate management and counterparty

risk management.

Treasury operations are conducted within a framework of policies and guidelines authorised and reviewed by the Board, most recently

on 3 November 2015. A treasury risk committee comprising the Group’s Chief Financial Ofcer, Group General Counsel and Company Secretary,

Group Financial Controller, Group Treasury Director and Director of Financial Reporting meets three times a year to review treasury activities and

its members receive management information relating to treasury activities on a quarterly basis. The Group’s accounting function, which does not

report to the Group Treasury Director, provides regular update reports of treasury activity to the Board. The Group’s internal auditor reviews the

internal control environment regularly.

The Group uses a number of derivative instruments for currency and interest rate risk management purposes only that are transacted by specialist

treasury personnel. The Group mitigates banking sector credit risk by the use of collateral support agreements.

Credit risk

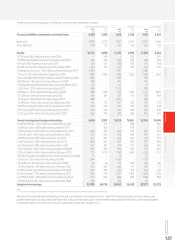

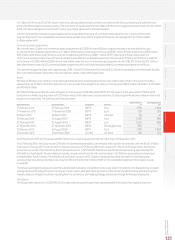

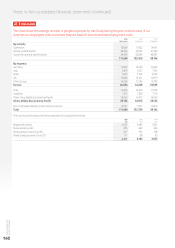

The Group considers its exposure to credit risk at 31 March to be as follows:

2016 2015

£m £m

Bank deposits 1,737 2,379

Repurchase agreements 2,700 2,000

Cash held in restricted deposits 791 650

UK government bonds 659 830

Money market fund investments 5,781 2,402

Derivative nancial instruments 4,304 4,005

Other investments – debt and bonds 6,347 5,906

Trade receivables 4,772 4,232

Other receivables and accrued income 3,206 2,959

30,297 25,363