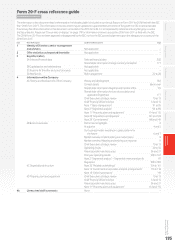

Vodafone 2016 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials

Additional

information

Vodafone Group Plc

Annual Report 2016

185

Albania

In March 2015 Vodafone M-Pesa was licensed as an e-money issuance

institution and has since been able to perform utility payments and

money transfer services for its customers.

Between April and June 2015 Vodafone Albania secured spectrum for

2x1.8MHz of 900MHz band, 2x14.4MHz of 1800MHz and 2x20+20MHz

of 2.6GHz band, allowing 4G services to be made available.

In September 2015 spectrum neutrality and reshufing in the 1800MHz

spectrum band was introduced.

Malta

In March 2014 the national regulatory authority (‘MCA’) set the MTR

at 0.40 eurocents per minute. Vodafone Malta has submitted an appeal

to the Administrative Review Tribunal on the basis that there was a lack

of transparency in the consultation process.

Africa, Middle East and Asia-Pacic region

India

In February 2012 Vodafone India challenged the Department

of Telecommunications (‘DoT’) at the Telecom Tribunal on the nancial

requirements for approving the transfer of Vodafone India telecom

licenses that were held under seven subsidiary companies to create two

telecom licensed companies – Vodafone India Limited and its subsidiary

Vodafone Mobile Services Limited. Pleadings were completed on 6 April

2016 and the next hearing is due on 19 May 2016.

In February 2015 the national regulatory authority (‘TRAI’) announced

its revised regulation on MTRs, reducing the rate from 20 paisa to 14

paisa per minute for mobile termination and nil termination for calls

originating from, or terminating on, a xed line. Vodafone India has

challenged TRAI’s decision in the Delhi High Court and the hearing

is due to commence in May 2016.

In April 2015 TRAI launched a consultation on the regulatory framework

for Over-The-Top (‘OTT’) services and Net Neutrality and the completion

of that consultation is awaited. In February 2016 TRAI issued a regulation

prohibiting the charging of discriminatory tariffs on the basis of content

or services accessed.

In March 2015 in the spectrum auction for 800MHz, 900MHz, 1800MHz

and 2.1GHz bands, Vodafone India won spectrum in all six circles

where the existing spectrum was due for expiry in December 2015,

thus ensuring continuity of business. It also won an additional 2.1GHz

spectrum in six service areas. The total auction spend by Vodafone India

was INR 258 billion.

In May 2015 the Supreme Court dismissed Vodafone India’s appeal

against the DoT’s refusal to extend its existing spectrum licences

in Delhi, Mumbai and Kolkata.

In September and October 2015 guidelines for Spectrum Sharing and

Spectrum Trading were issued respectively.

In January 2016 TRAI submitted its recommendations to the DoT on the

Valuation & Reserve price of Spectrum and DoT’s decision is expected

by the end of May 2016.

In February 2016 further to Prime Minister Narendra Modi’s allocation

of budget for the Government’s Digital India agenda, TRAI recommended

a public-private partnership (‘PPP’) “build own operate transfer” (‘BOOT’)

model as the preferred means of the implementation strategy for

BharatNet (the Government’s national optic bre network programme).

DoT’s decision on the TRAI recommendation is awaited.

In May 2016 further to a challenge by the telecom operators,

the Indian Supreme Court held that the order announced in October

2015 by TRAI, mandating MNOs to compensate customers for

any call drops, was “arbitrary, unreasonable and non-transparent”

and therefore cancelled.

For information on litigation in India, see note 30 “Contingent liabilities

and legal proceedings” to the consolidated nancial statements.

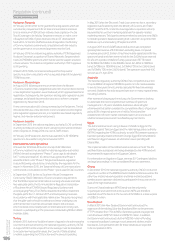

Vodacom: South Africa

In March 2014 the High Court ruled in favour of Vodacom and MTN

in their challenge to the national regulatory authority’s (‘ICASA’)

decision on Call Termination Regulations (‘CTR’). This led to ICASA

initiating another consultation process and in September 2014 they

published the nal CTR that reduces the rate to ZAR 0.13 cents per

minute by October 2016. In December 2014 Cell C served ICASA

(including other interested parties such as Vodacom and MTN) with

a notice of motion in terms of which it is seeking an order for the review

and setting aside by the High Court, of the September 2014 CTRs.

Vodacom had led a notice to oppose Cell C’s application. This matter

was due to be heard from 7 March 2016 however Cell C withdrew

its application.

In May 2014 the national competition authority (‘CompCom’)

conrmed its intention to proceed with the investigation into

an allegation by Cell C that Vodacom and MTN have abused their

market dominance in contravention of section 8 of the Competition Act.

Once the investigation is completed, the matter may be referred to the

Competition Tribunal where Vodacom will have a further opportunity

to make its case.

In May 2014 Vodacom entered into a sale and purchase agreement

under which it would acquire 100% of the issued share capital of Neotel

as well as Neotel’s shareholder loans and liabilities. The proposed

acquisition of the majority of Neotel’s assets has been abandoned due

to regulatory complexities and certain conditions not being fullled.

In September 2015 further to its International Mobile

Telecommunications (‘IMT’) Radio Frequency Spectrum Assignment

Plans (‘RFSAP’) published in March 2015 ICASA published

an Information Memorandum (‘IM’) on the prospective licensing

of the 700MHz, 800MHz and 2.6GHz High Demand Spectrum bands.

The IM is a precursor to an Invitation to Apply (‘ITA’). Vodacom has raised

its concerns that the IM does not provide sufcient detail on some of the

critical aspects of the auction design and process.

In February 2016 the Department of Trade and Industry (‘DTI’) published

the revised draft ICT Sector Code for consultation. This code follows the

May 2015 implementation of the revised generic DTI Codes on Black

Economic Empowerment (‘BEE’) which saw a complete overhaul

of the targets and requirements of the 2007 Codes, which included

the removal of the recognition of ZAR7.5 billion rule for ownership and

retention of 30% investing target that Vodacom must be compliant

with to be eligible to bid in future Spectrum auctions. The revised Codes

are expected to be nalised in June 2016 and will be applicable to the

nancial period of 1 April 2016 to 31 March 2017.

Vodacom: Democratic Republic of Congo

In December 2015 the Government ordered all operators to disconnect

any unregistered customers. In February 2016 all operators received

a non-compliance letter from the National Intelligence Agency, stating

sanctions would be applied. Vodacom DRC is suspending customers

with insufcient registration records and communicating to such

customers the requirement to register to avoid disconnection. To date,

no sanctions have been imposed.

In September 2015 the national regulatory authority (‘ARPTC’) retained

the current on-net voice price oor at 5.1 US cents per minute and

off net 8.5 US cents per minute set in March 2015 and extended the

price oor to cover international outgoing calls and promotions until

June 2016.

In December 2015 Vodacom Congo’s 2G licence was renewed with

a ten-year extension taking the expiry date to 1 January 2028, together

with securing additional spectrum 2x5.8 1800MHz and 1x15 1900MHz.

Collectively, the licence and spectrum fees paid was US$22.5 million.