Vodafone 2016 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

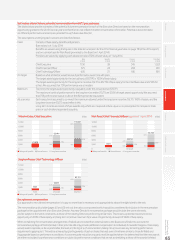

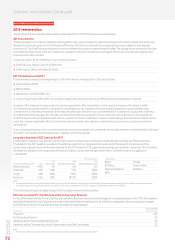

Estimates of total future potential remuneration from 2015 pay packages

The tables below provide estimates of the potential future remuneration for each of the Executive Directors based on the remuneration

opportunity granted in the 2015 nancial year and therefore do not reect the latest remuneration information. Potential outcomes based

on different performance scenarios are provided for each Executive Director.

The assumptions underlying each scenario are described below.

Fixed Consists of base salary, benets and pension.

Base salary is at 1 July 2014.

Benets are valued using the gures in the total remuneration for the 2014 nancial year table on page 78 (of the 2014 report)

and on a similar basis for Nick Read (promoted to the Board on 1 April 2014).

Pensions are valued by applying cash allowance rate of 30% of base salary at 1 July 2014.

Base

(£’000)

Benets

(£’000)

Pension

(£’000)

Total xed

(£’000)

Chief Executive 1,150 38 345 1,533

Chief Financial Ofcer 675 23 203 901

Chief Technology Ofcer 600 21 180 801

On target Based on what a Director would receive if performance was in line with plan.

The target award opportunity for the annual bonus (‘GSTIP’) is 100% of base salary.

The target award opportunity for the long-term incentive (‘GLTI’) is 237.5% of base salary for the Chief Executive and 210% for

others. Weassumed that TSR performance was at median.

Maximum Two times the target award opportunity is payable under the annual bonus (‘GSTIP’).

The maximum levels of performance for the long-term incentive (‘GLTI’) are 250% of target award opportunity. We assumed

that TSR performance was at or above the 80th percentile equivalent.

All scenarios Each executive is assumed to co-invest the maximum allowed under the long-term incentive (‘GLTI’), 100% of salary, and the

long-term incentive (‘GLTI’) award reects this.

Long-term incentives consist of share awards only which are measured at face value i.e. no assumption for increase in share

price or cash dividend equivalents payable.

Vittorio Colao, Chief Executive

10,000

12,000

8,000

6,000

4,000

2,000

0Fixed

£1,533

On target

£5,414

Maximum

£10,661

£’000

28%

21%

14%

22%

64%

51%

¢

Salary and benets ¢ Annual bonus ¢ Long-term incentive

Nick Read, Chief Financial Ofcer (appointed 1 April 2014)

10,000

12,000

8,000

6,000

4,000

2,000

0Fixed On target Maximum

£’000

¢

Salary and benets ¢ Annual bonus ¢ Long-term incentive

£901

£2,994

£5,795

30% 23%

47%

16%

23%

61%

Stephen Pusey, Chief Technology Ofcer

10,000

12,000

8,000

6,000

4,000

2,000

0Fixed On target Maximum

£’000

¢

Salary and benets ¢ Annual bonus ¢ Long-term incentive

£801

£2,661

30% 23% 16%

23%

61%

47%

£5,151

Recruitment remuneration

Our approach to recruitment remuneration is to pay no more than is necessary and appropriate to attract the right talent to the role.

The remuneration policy table (pages 60 and 61) sets out the various components which would be considered for inclusion in the remuneration

package for the appointment of an Executive Director. Any new Director’s remuneration package would include the same elements,

and be subject to the same constraints, as those of the existing Directors performing similar roles. This means a potential maximum bonus

opportunity of 200% of base salary and long-term incentive maximum face value of opportunity at award of 594% of base salary.

When considering the remuneration arrangements of individuals recruited from external roles to the Board, we will take into account the

remuneration package of that individual in their prior role. We only provide additional compensation to individuals for awards foregone. If necessary

we will seek to replicate, as far as practicable, the level and timing of such remuneration, taking into account also any remaining performance

requirements applying to it. This will be achieved by granting awards of cash or shares that vest over a timeframe similar to those forfeited and

if appropriate based on performance conditions. A commensurate reduction in quantum will be applied where it is determined that the new awards

are either not subject to performance conditions or subject to performance conditions that are not as stretching as those of the awards forfeited.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

63