Vodafone 2016 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208

|

|

Vodafone Group Plc

Annual Report 2016

124

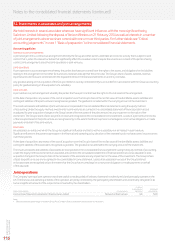

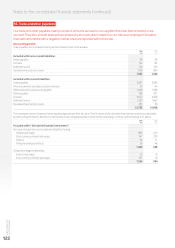

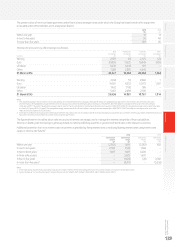

17. Provisions (continued)

Provisions have been analysed between current and non-current as follows:

31 March 2016

Asset

retirement Legal and

obligations regulatory Other Total

£m £m £m £m

Current liabilities 12 242 503 757

Non-current liabilities 439 719 122 1,280

451 961 625 2,037

31 March 2015

Asset

retirement Legal and

obligations regulatory Other Total

£m £m £m £m

Current liabilities 14 311 442 767

Non-current liabilities 452 523 107 1,082

466 834 549 1,849

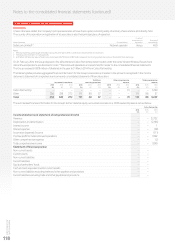

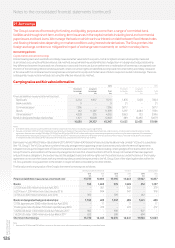

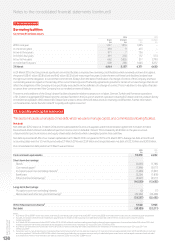

18. Called up share capital

Called up share capital is the number of shares in issue at their par value. A number of shares were allotted during

the year in relation to employee share schemes.

Accounting policies

Equity instruments issued by the Group are recorded at the amount of the proceeds received, net of direct issuance costs.

2016 2015

Number £m Number £m

Ordinary shares of 2020⁄21 US cents each allotted, issued and fully paid:1

1 April 28,812,787,098 3,792 28,811,923,128 3,792

Allotted during the year 608,910 –863,970 –

31 March 28,813,396,008 3,792 28,812,787,098 3,792

Note:

1 At 31 March 2016, the Group held 2,254,825,696 (2015: 2,300,749,013) treasury shares with a nominal value of £297 million (2015: £303 million). The market value of shares held was

£4,988 million (2015: £5,072 million). Duringthe year 45,923,317 (2015: 71,213,894) treasury shares were reissued under Group share schemes.

Allotted during the year

Nominal Net

value proceeds

Number £m £m

UK share awards – – –

US share awards 608,910 –1

Total share awards 608,910 –1

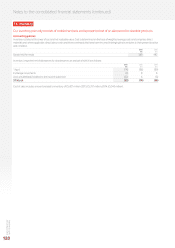

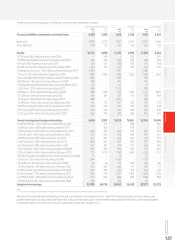

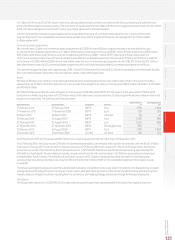

On 19 February 2016, we announced the placing of subordinated mandatory convertible bonds totalling £1.44 billion with an 18 months maturity

date due in 2017 and £1.44 billion with a 3 year maturity due in 2019. The bonds are convertible into a total of 1,325,356,650 ordinary shares with

a conversion price of £2.1730 per share. For further details see note 22 “Liquidity and capital resources”.

Notes to the consolidated nancial statements (continued)