Vodafone 2016 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating results (continued)

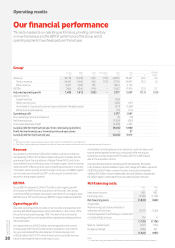

Europe1

Germany

£m

Italy

£m

UK

£m

Spain

£m

Other Europe

£m

Eliminations

£m

Europe

£m

Restated

2015

£m

% change

£Organic

Year ended 31 March 2016

Revenue 7, 78 7 4,405 6 ,17 3 3,633 4,835 (115) 26,718 27,687 (3.5) 0.4

Service revenue 7,19 7 3,758 5,849 3,2 74 4,494 (111) 24,461 25,588 (4.4) (0.6)

Other revenue 590 647 324 359 341 (4) 2,257 2,099

EBITDA 2,537 1,478 1,289 915 1,467 –7,686 7,894 (2.6) 1.7

Adjusted operating prot 378 590 (69) 53 457 –1,409 1,733 (18.7) (12.9)

EBITDA margin 32.6% 33.6% 20.9% 25.2% 30.3% 28.8% 28.5%

Note:

1 The Group has amended its reporting to reect changes in the internal management of its Enterprise business. The primary change has been that on 1 April 2015 the Group redened its

segments to report international voice transit service revenue within Common Functions rather than within the service revenue amount disclosed for each country and region. The service

revenue amounts presented for the year ended 31 March 2015 have been restated onto a comparable basis together with all disclosed organic service revenue growth rates. There is no impact

on total Group service revenue or costs.

Revenue decreased 3.5% for the year. M&A activity, including HOL and

Cobra, contributed a 1.3 percentage point positive impact, while foreign

exchange movements contributed a 5.2 percentage point negative

impact. On an organic basis, service revenue decreased by 0.6%*,

reecting continued competitive pressures in a number of markets.

EBITDA decreased 2.6%, including a 1.2 percentage point positive

impact from M&A activity and a 5.5 percentage point negative impact

from foreign exchange movements. On an organic basis EBITDA

increased 1.7%* driven by good cost control in a number of our markets,

as well as the benets of acquisition integrations.

Organic

change

%

Other

activity1

pps

Foreign

exchange

pps

Reported

change

%

Revenue – Europe 0.4 1.3 (5.2) (3.5)

Service revenue

Germany (0.4) – (6.7) (7.1)

Italy (0.8) – (6.7) (7.5)

UK (0.3) (0.4) (0.1) (0.8)

Spain (3.5) 8.7 (6.6) (1.4)

Other Europe 1.5 1.9 (6.8) (3.4)

Europe (0.6) 1.3 (5.1) (4.4)

EBITDA

Germany 2 .1 – (6.7) (4.6)

Italy 3.1 – (6.8) (3.7)

UK 1.2 (5.4) – (4.2)

Spain 4.2 19.6 (6.8) 17. 0

Other Europe (1.5) 1.3 (6.5) (6.7)

Europe 1.7 1.2 (5.5) (2.6)

Europe adjusted

operating prot (12.9) (0.2) (5.6) (18.7)

Note:

1 “Other activity” includes the impact of M&A activity. Refer to “Organic growth” on page 191

for further detail.

Germany

Service revenue declined 0.4%* for the year, but returned to growth

in Q4 (Q3: -0.4%*; Q4: 1.6%*) led by improvements in consumer mobile

and xed trends and aided by an accounting reclassication in xed line.

Mobile service revenue declined 1.6%*. Consumer contract revenue

stabilised in the year, supported by consistent growth in contract

net adds (+594,000 for the year). This performance has been driven

by an increased focus on direct channels and our ‘Otelo’ second brand;

during Q4, higher competition in indirect channels weighed on our

contract net additions. The Enterprise market became increasingly

competitive during the year, leading to a deteriorating revenue trend

as falling ARPU more than offset good contract wins. We have made

further strong progress on network investment, with 87% 4G coverage

and dropped call rates declining 25% year-on-year to an all-time low

of 0.44%. In November, the independent “Connect” test conrmed the

premium quality of our voice network in Germany and a strong second

and most improved data position.

Fixed service revenue growth was 1.5%*, with continued strong growth

in cable and a slowing decline in DSL-related revenue. Cable net adds

growth continued to be strong throughout the year, supplemented

by ongoing migrations from the DSL base; in the second half of the

year DSL net adds also turned positive, with growing customer demand

for VDSL. Broadband ARPU was down year-on-year in a promotional

market, with improvements in cable offset by DSL declines, although

the pace of decline began to moderate during H2. The integration

of KDG has been completed; we expect cost synergies to meet the initial

targets set out at the time of acquisition, and now expect further upside

potential longer-term. In November, we launched Vodafone Red One,

our fully integrated xed, mobile and TV service combining high speed

mobile and xed; as of 31 March 2016 we had 54,000 customers.

EBITDA grew 2.1%*, with EBITDA margin improving by 0.8* percentage

points. The impact of lower revenues and increased Project Spring

network opex was more than offset by opex efciencies (including KDG

synergies), savings in commercial costs (aided by our increased focus

on direct channels) and a change in commission processes.

Vodafone Group Plc

Annual Report 2016

32