Vodafone 2016 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

131

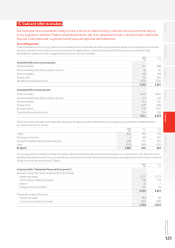

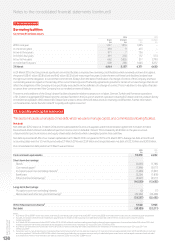

At 31 March 2016 we had £10,218 million of cash and cash equivalents which are held in accordance with the counterparty and settlement risk

limits of the Board approved treasurypolicy. The main forms of liquid investment at 31 March 2016 were managed investment funds, money market

funds, UK index linked government bonds, tri-party repurchase agreements and bankdeposits.

The cash received from collateral support agreements mainly reects the value of our interest rate swap and cross currency interest rate

swap portfolios which are substantially netpresent value positive. See note 23 “Capital and nancial risk management” for further details

on these agreements.

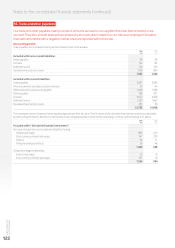

Commercial paper programmes

We currently have US and euro commercial paper programmes of US$15 billion and £8 billion respectively which are available to be used

to meet short-term liquidity requirements. At 31 March 2016 amounts external to the Group of €8,907 million (£7,043 million) and US$38 million

(£26 million) were drawn under the euro commercial paper programme and US$471 million (£327 million) were drawn down under the

US commercial paper programme, with such funds being provided by counterparties external to the Group. At 31 March 2015 amounts external

to the Group of €3,928 million (£2,839 million) were drawn under the euro commercial paper programme and US$3,321 million (£2,237 million)

were drawn down under the US commercial paper programme, with such funds being provided by counterparties external to the Group.

The commercial paper facilities were supported by US$4.1 billion (£2.8 billion) and €4.0 billion (£3.2 billion) of syndicated committed bank facilities

(see “Committed facilities” below). No amounts had been drawn under either bank facility.

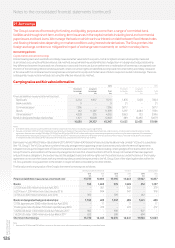

Bonds

We have a €30 billion euro medium-term note programme and a US shelf programme which are used to meet medium to long-term funding

requirements. At 31 March 2016 the total amounts in issue under these programmes split by currency were US$14.1 billion, £2.3 billion, €12.9 billion

and NOK 850 million.

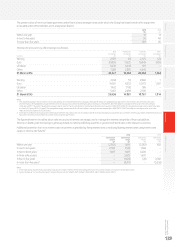

At 31 March 2016 we had bonds outstanding with a nominal value of £22,380 million (2015: £17,153 million). In the year ended 31 March 2016

bonds with a nominal value equivalent of £129 million and £5,450 million were issued under the US shelf programme and euro medium-term note

programme respectively. The bonds issued in the year were:

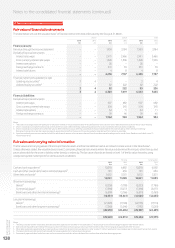

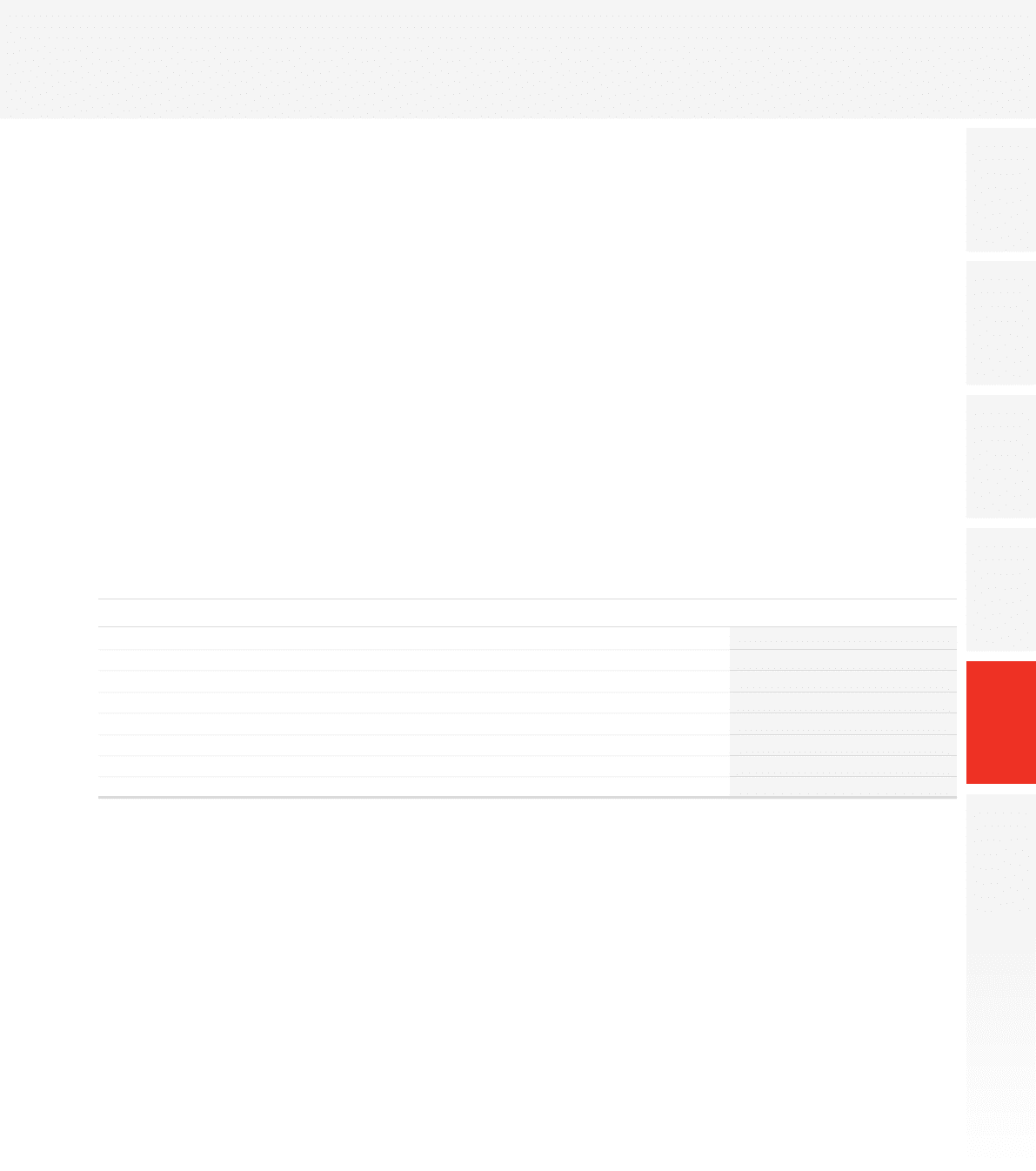

Nominal amount Sterling equivalent

Date of bond issue Maturity of bond Programme Currency m £m

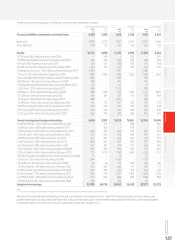

25 February 2016 25 February 2019 EMTN Euro 1,750 1,384

17 November 2015 17 November 2020 EMTN Euro 750 593

30 March 2016 30 March 2021 EMTN US dollar 60 42

25 February 2016 25 August 2021 EMTN Euro 1,250 988

25 February 2016 25 August 2023 EMTN Euro 1,250 988

27 November 2015 27 November 2025 EMTN Norwegian krona 850 71

25 February 2016 25 August 2026 EMTN Euro 1,750 1,384

3 December 2015 3 December 2045 US shelf US dollar 186 129

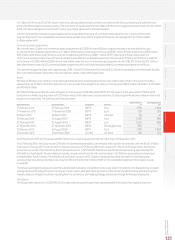

On 26 November 2015, the Group issued £600 million zero-coupon equity linked bonds maturing on 26 November 2020.

On 25 February 2016, the Group issued £2.9 billion of subordinated mandatory convertible bonds issued in two tranches, with the rst £1.4 billion

maturing on 25 August 2017 and a further £1.4 billion maturing on 25 February 2019 with coupons of 1.5% and 2.0% respectively. At the initial

conversion price of £2.1730, at maturity the bonds will convert to 1, 325,356,650 Vodafone Group Plc shares representing approximately 5%

of Vodafone’s share capital. The mandatory bonds are compound instruments with nominal values of £2.8 billion recognised as a component

of shareholders’ funds in equity. The initial fair value of future coupons of £0.1 billion is recognised as a nancial liability in borrowings and

subsequently measured at amortised cost using the effective interest rate method. Refer to the consolidated statement of changes in equity

on page 89.

The Group has hedged its exposure under the subordinated mandatory convertible bonds to any future movements in its share price by an option

strategy designed to hedge the economic impact of share price movements during the term of the bonds. Should the Group decide to buy back

ordinary shares to mitigate the dilution resulting from the conversion, the hedging strategy will provide a hedge for the repurchase price.

Own shares

The Group held a maximum of 2,300,749,013 of its own shares during the year which represented 8.0 % of issued share capital at that time.