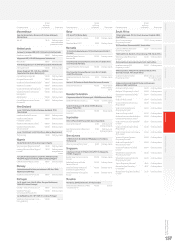

Vodafone 2016 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2016

164

Other unaudited nancial information (continued)

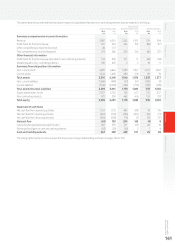

Prior year operating results (continued)

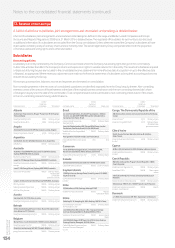

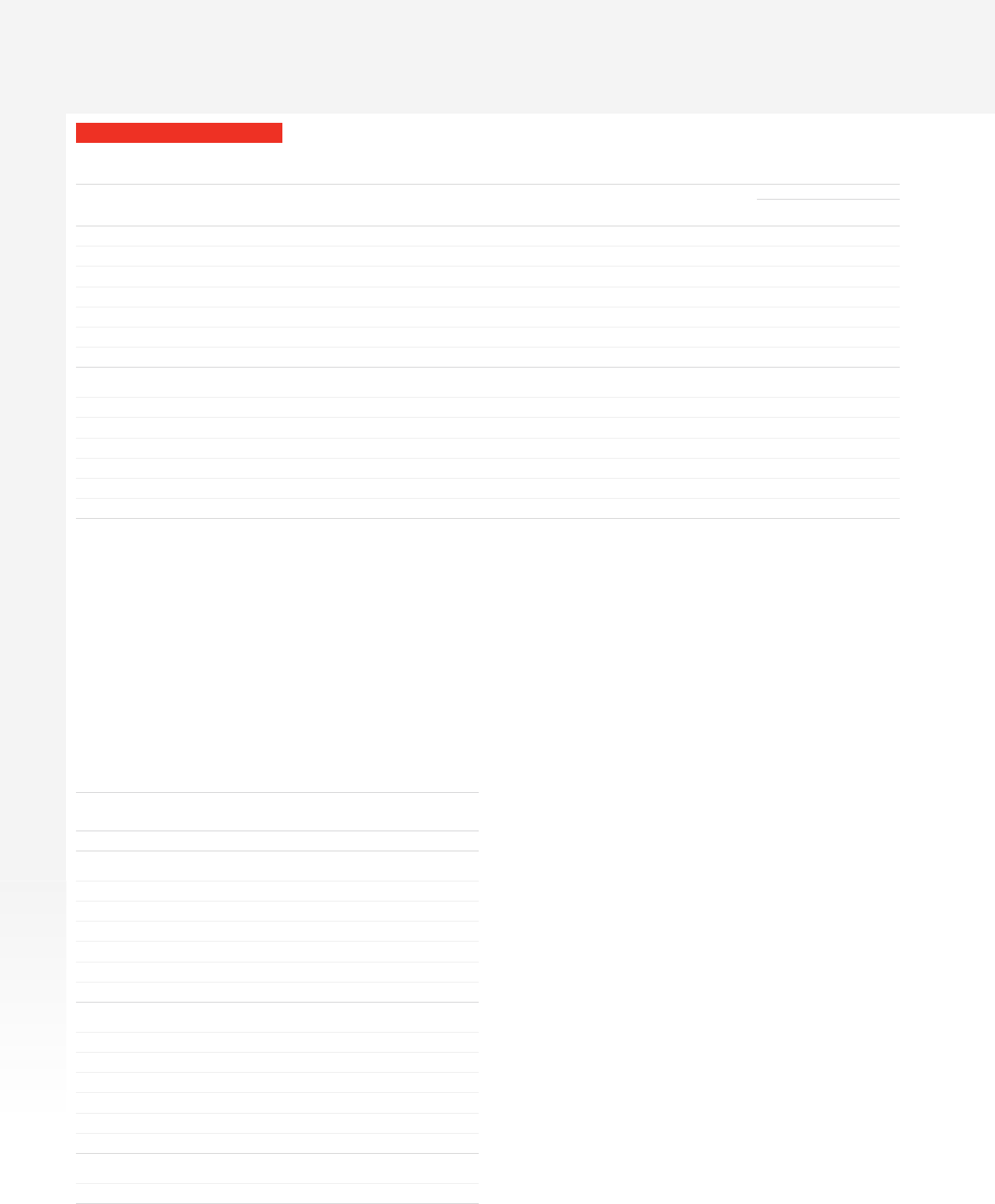

Europe1

% change

Germany

£m

Italy

£m

UK

£m

Spain

£m

Other Europe

£m

Eliminations

£m

Europe

£m £Organic*

Year ended 31 March 2015 restated

Revenue 8,384 4,587 6 ,19 9 3 , 614 4,993 (90) 2 7, 6 8 7 15.7 (4.5)

Service revenue 7, 74 6 4,062 5,893 3,320 4,652 (85) 25,588 14.7 (5.0)

Other revenue 638 525 306 294 341 (5) 2,099

EBITDA 2,659 1,535 1,345 782 1,573 –7,8 9 4 16 .3 (12.3)

Adjusted operating prot 530 644 26 2 531 –1,733 (24.7) (40.6)

EBITDA margin 31.7% 33.5% 21.7% 21.6% 31.5% 28.5%

Year ended 31 March 2014 restated

Revenue 8,220 518 6,249 3,470 5 ,515 (43) 23,929 0.2 (8.8)

Service revenue 7, 6 87 4 61 5,918 3,18 3 5,090 (40) 22,299 0.6 (8.2)

Other revenue 533 57 331 287 425 (3) 1,630

EBITDA 2,688 181 1,399 785 1,735 –6,788 (5.5) (17.1)

Adjusted operating prot 907 372 167 179 676 – 2,301 (38.5) (41.9)

EBITDA margin 32.7% 34.9% 22.4% 22.6% 31.5% 28.4%

Note:

1 The Group has amended its reporting to reect changes in the internal management of its Enterprise business. The primary change has been that on 1 April 2015, the Group redened its

segments to report international voice transit revenue and costs within Common Functions rather than within the results disclosed for each country and region. The results presented for the

year ended 31 March 2015 and 2014 have been restated onto a comparable basis. There is no impact on total Group revenue or cost.

Revenue increased 15.7%. M&A activity, including KDG, Ono and the

consolidation of Vodafone Italy, contributed a 26.7 percentage point

positive impact, while foreign exchange movements contributed a 6.5

percentage point negative impact. On an organic basis, service revenue

declined 5.0%*, driven primarily by price competition and the impact

of MTR cuts.

EBITDA increased 16.3%, including a 35.6 percentage point positive

impact from M&A activity and a 7.0 percentage point negative impact

from foreign exchange movements. On an organic basis EBITDA

declined 12.3%*, reecting the weak organic revenue trend.

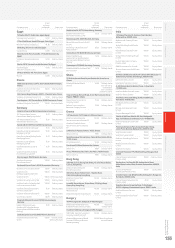

Organic

change*

%

Other

activity1

pps

Foreign

exchange

pps

Reported

change

%

Revenue – Europe (4.5) 26.7 (6.5) 15.7

Service revenue

Germany (3.7) 12.0 (7.5) 0.8

Italy1(10.2) 916.7 (125.4) 781.1

UK (1.8) 1.4 –(0.4)

Spain (10.9) 22.9 (7.7) 4.3

Other Europe (2.2) 0.8 (7.2) (8.6)

Europe (5.0) 26.2 (6.5) 14.7

EBITDA

Germany (11 . 0) 17.3 ( 7. 4 ) (1.1)

Italy1(15.3) 882.7 (119.3) 74 8.1

UK (12.4) 8.5 –(3.9)

Spain (29.5) 36.3 (7.2) (0.4)

Other Europe (2.8) 0.5 (7.0) (9.3)

Europe (12.3) 35.6 (7.0) 16.3

Adjusted operating prot

Europe (40.6) 20.6 (4.7) (24.7)

Note:

1 “Other activity” includes the impact of M&A activity. Refer to “Organic growth” on page 191

for further detail.

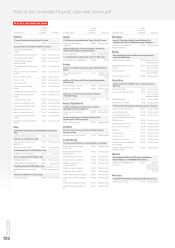

Germany

Service revenue decreased 3.7%* excluding KDG. Q4 service revenue

was down 3.5%*.

Mobile service revenue fell 3.5%*, mainly as a result of price reductions

in the prior year continuing to penetrate the consumer customer

base. The contract customer base grew, supported by a stronger

commercial performance as we look to increase our focus on direct,

branded channels, falling churn and the ongoing substantial investment

in network infrastructure. We increased our 4G coverage to 77% of the

population and signicantly improved voice coverage and reliability,

as evidenced in independent tests. At the end of the period we had

5.0 million 4G customers.

Fixed service revenue excluding KDG fell 4.4%*, reecting ongoing

declines in our Vodafone DSL customer base, in part from migrations

to KDG cable infrastructure. The rate of decline eased during the year

(H1 -5.0%*; H2 -3.8%*), with an improving rate of gross customer

additions and increasing demand for high speed broadband (‘VDSL’),

as well as stronger growth in carrier services. KDG maintained its

strong rate of growth, contributing £1,492 million to service revenue

and £676 million to EBITDA, and adding 0.4 million broadband

customers (excluding migrations from Vodafone DSL) during the

year. The integration of KDG has continued, including the launch

of a combined xed/mobile proposition in H2.

EBITDA declined 11.0%*, with a 3.0* percentage point decline in EBITDA

margin, driven by lower service revenue and a higher level of customer

investment year-on-year, partially compensated by a year-on-year

reduction in operating expenses.