Vodafone 2016 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

91

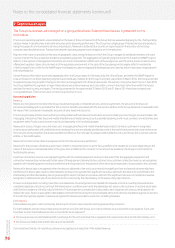

1. Basis of preparation

This section describes the critical accounting judgements that management has identied as having a potentially

material impact on the Group’s consolidated nancial statements and sets out our signicant accounting policies

that relate to the nancial statements as a whole. Where an accounting policy is generally applicable to a specic

note to the nancial statements, the policy is described within that note. We have also detailed below the new

accounting pronouncements that we will adopt in future years and our current view of the impact they will have

on our nancial reporting.

The consolidated nancial statements are prepared in accordance with International Financial Reporting Standards (‘IFRS’) as issued by the

International Accounting Standards Board (‘IASB’) and are also prepared in accordance with IFRS adopted by the European Union (‘EU’),

the Companies Act 2006 and Article 4 of the EU IAS Regulations. The consolidated nancial statements are prepared on a going concern basis.

The preparation of nancial statements in conformity with IFRS requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the nancial statements and the reported

amounts of revenue and expenses during the reporting period. A discussion on the Group’s critical accounting judgements and key sources

of estimation uncertainty is detailed below. Actual results could differ from those estimates. The estimates and underlying assumptions are reviewed

on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only that

period; they are recognised in the period of the revision and future periods if the revision affects both current and future periods.

Amounts in the consolidated nancial statements are stated in pounds sterling. With effect from 1 April 2016, the presentation currency of the

Group will change from sterling to the euro to better align with the geographic split of the Group’s operations.

Vodafone Group Plc is incorporated and domiciled in England and Wales (registration number 1833679). The registered address of the Company

is Vodafone House, The Connection, Newbury, Berkshire, RG14 2FN, England.

IFRS requires the Directors to adopt accounting policies that are the most appropriate to the Group’s circumstances. These have been applied

consistently to all the years presented, unless otherwise stated. In determining and applying accounting policies, Directors and management are

required to make judgements in respect of items where the choice of specic policy, accounting estimate or assumption to be followed could

materially affect the Group’s reported nancial position, results or cash ows; it may later be determined that a different choice may have been

more appropriate.

Management has identied accounting estimates and assumptions relating to revenue recognition, taxation, business combinations and goodwill,

joint arrangements, nite lived intangible assets, property, plant and equipment, post employment benets, provisions and contingent liabilities

and impairment that it considers to be critical due to their impact on the Group’s nancial statements. These critical accounting judgements,

assumptions and related disclosures have been discussed with the Company’s Audit and Risk Committee.

Critical accounting judgements and key sources of estimation uncertainty

Revenue recognition

Arrangements with multiple deliverables

In revenue arrangements where more than one good or service is provided to the customer, customer consideration is allocated between the goods

and services using relative fair value principles. The fair values determined for deliverables may impact the timing of the recognition of revenue.

Determining the fair value of each deliverable can require complex estimates. The Group generally determines the fair value of individual elements

based on prices at which the deliverable is regularly sold on a stand-alone basis after considering any appropriate volume discounts.

Gross versus net presentation

When the Group sells goods or services as a principal, income and payments to suppliers are reported on a gross basis in revenue and operating

costs. If the Group sells goods or services as an agent, revenue and payments to suppliers are recorded in revenue on a net basis, representing the

margin earned. Whether the Group is considered to be the principal or an agent in the transaction depends on analysis by management of both the

legal form and substance of the agreement between the Group and its business partners; such judgements impact the amount of reported revenue

and operating expenses but do not impact reported assets, liabilities or cash ows.

Taxation

The Group’s tax charge on ordinary activities is the sum of the total current and deferred tax charges. The calculation of the Group’s total tax charge

involves estimation and judgement in respect of certain matters where the tax impact is uncertain until a conclusion is reached with the relevant tax

authority or through a legal process. The nal resolution of some of these items may give rise to material prots, losses and/or cash ows.

Resolving tax issues can take many years as it is not always within the control of the Group and often depends on the efciency of legal processes

in the relevant tax jurisdiction.

Recognition of deferred tax assets

Signicant items on which the Group has exercised accounting estimation and judgement include the recognition of deferred tax assets in respect

of losses in Luxembourg, Germany, Spain and India and capital allowances in the United Kingdom.

The recognition of deferred tax assets, particularly in respect of tax losses, is based upon whether it is probable that there will be sufcient and

suitable taxable prots in the relevant legal entity or tax group against which to utilise the assets in the future.

Judgement is required when determining probable future taxable prots. The Group assesses the availability of future taxable prots using the same

undiscounted ve year forecasts for the Group’s operations as are used in the Group’s value in use calculations (see “Impairment reviews” below).

Where tax losses are forecast to be recovered beyond the ve year period, the availability of taxable prots is assessed using the cash ows and

long-term growth rates used for the value in use calculations.

Notes to the consolidated nancial statements