Vodafone 2016 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

77

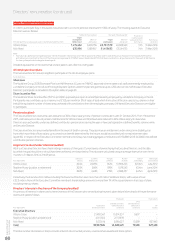

Cash ow and liquidity reviews

The business planning process provides outputs for detailed cash ow

and liquidity reviews, to ensure that the Group maintains adequate

liquidity throughout the forecast periods. The prime output is a one year

liquidity forecast which is prepared and updated on a daily basis which

highlights the extent of the Group’s liquidity based on controlled cash

ows and the headroom under the Group’s undrawn revolving credit

facility (‘RCF’).

The key inputs into this forecast are:

a free cash ow forecasts, with the rst three month’s inputs being

sourced directly from the operating companies (analysed on a

daily basis), with information beyond this taken from the latest

forecast/budget cycle;

a bond and other debt maturities; and

a expectations for shareholder returns, spectrum auctions and

M&A activity.

The liquidity forecast shows two scenarios assuming either maturing

commercial paper is renanced or no new commercial paper issuance.

The liquidity forecast is reviewed by the Group Chief Financial Ofcer

and included in each of his reports to the Board.

In addition, the Group continues to manage its foreign exchange and

interest rate risks within the framework of policies and guidelines

authorised and reviewed by the Board, with oversight provided

by theTreasury Risk Committee.

Conclusion

The Group has considerable nancial resources, and the Directors

believe that the Group is well placed to manage its business risks

successfully. Accordingly, the Directors continue to adopt the going

concern basis in preparing the Annual Report and accounts.

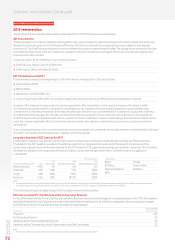

Management’s report on internal control

over nancial reporting

As required by section 404 of the US Sarbanes-Oxley Act, management

is responsible for establishing and maintaining adequate internal control

over nancial reporting for the Group. The Group’s internal control over

nancial reporting includes policies and procedures that:

a pertain to the maintenance of records that, in reasonable detail,

accurately and fairly reect transactions and dispositions of assets;

a are designed to provide reasonable assurance that transactions

arerecorded as necessary to permit the preparation of nancial

statements in accordance with IFRS, as adopted by the EU and IFRS

as issued by the IASB, and that receipts and expenditures are being

made only in accordance with authorisation of management and the

Directors of the Company; and

a provide reasonable assurance regarding prevention or timely

detection of unauthorised acquisition, use or disposition

of the Group’s assets that could have a material effect on the

nancial statements.

Any internal control framework, no matter how well designed,

has inherent limitations including the possibility of human error and

the circumvention or overriding of the controls and procedures,

and maynot prevent or detect misstatements. Also, projections

of any evaluationof effectiveness to future periods are subject to the

riskthatcontrols may become inadequate because of changes

in conditions or because the degree of compliance with the policies

orprocedures may deteriorate.

Management has assessed the effectiveness of the internal control

over nancial reporting at 31 March 2016 based on the updated

Internal Control – Integrated Framework, issued by the Committee

of Sponsoring Organizations of the Treadway Commission (‘COSO’)

in 2013. Based on management’s assessment, management has

concluded that internal control over nancial reporting was effective

at 31 March 2016.

During the period covered by this document, there were no changes

in the Group’s internal control over nancial reporting that have

materially affected or are reasonably likely to materially affect the

effectiveness of the internal controls over nancial reporting.

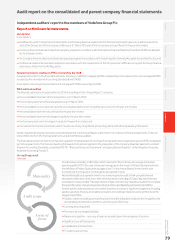

The Group’s internal control over nancial reporting at 31 March 2016

has been audited by PricewaterhouseCoopers LLP, an independent

registered public accounting rm who also audit the Group’s

consolidated nancial statements. Their audit report on internal

control over nancial reporting is on page 78.

By Order of the Board

Rosemary Martin

Group General Counsel and Company Secretary

17 May 2016