Vodafone 2016 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2016

150

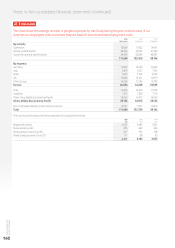

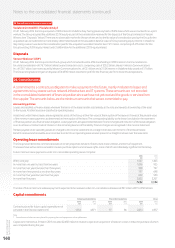

30. Contingent liabilities and legal proceedings (continued)

Indian tax case

In August 2007 and September 2007, Vodafone India Limited (‘VIL’) and VIHBV respectively received notices from the Indian tax authority

alleging potential liability in connection with an alleged failure by VIHBV to deduct withholding tax from consideration paid to the Hutchison

Telecommunications International Limited group (‘HTIL’) in respect of HTIL’s gain on its disposal to VIHBV of its interests in a wholly-owned subsidiary

that indirectly holds interests in VIL. In January 2012 the Indian Supreme Court handed down its judgement, holding that VIHBV’s interpretation

of the Income Tax Act 1961 was correct, that the HTIL transaction in 2007 was not taxable in India, and that consequently, VIHBV had no obligation

to withhold tax from consideration paid to HTIL in respect of the transaction. The Indian Supreme Court quashed the relevant notices and demands

issued to VIHBV in respect of withholding tax and interest. On 20 March 2012 the Indian Government returned VIHBV’s deposit of INR 25 billion and

released the guarantee for INR 85 billion, which was based on the demand for payment issued by the Indian tax authority in October 2010, for tax

of INR 79 billion plus interest.

On 28 May 2012 the Finance Act 2012 became law. The Finance Act 2012 contained provisions intended to tax any gain on transfer of shares

in a non-Indian company, which derives substantial value from underlying Indian assets, such as VIHBV’s transaction with HTIL in 2007.

Further it seeks to subject a purchaser, such as VIHBV, to a retrospective obligation to withhold tax. VIHBV received a letter on 3 January 2013

reminding it of the tax demand raised prior to the Indian Supreme Court’s judgement and purporting to update the interest element of that demand

to a total amount of INR 142 billion. On 17 January 2014, VIHBV served an amended trigger notice on the Indian Government under the Dutch-India

Bilateral Investment Treaty (‘Dutch BIT’), supplementing a trigger notice led on 17 April 2012, immediately prior to the Finance Act 2012 becoming

effective, to add claims relating to an attempt by the Indian Government to tax aspects of the transaction with HTIL under transfer pricing rules.

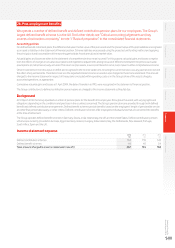

VIHBV arbitration proceedings

On 17 April 2014, VIHBV served its notice of arbitration under the Dutch BIT, formally commencing the Dutch BIT arbitration proceedings.

An arbitrator has been appointed by VIHBV. The Indian Government has also appointed its arbitrator. The two party-appointed arbitrators failed

to appoint a chairman. Consequently, the President of the International Court of Justice will now appoint the third arbitrator who will act as the

presiding arbitrator. On 15 June 2015, Vodafone Group Plc and Vodafone Consolidated Holdings Limited served a trigger notice on the Indian

Government under the United Kingdom-India Bilateral Investment Treaty (’UK BIT’) in respect of retrospective tax claims under the Finance Act 2012.

On 4 February 2016, VIHBV received a reminder of an outstanding tax demand of INR 221 billion. The latest reminder threatens enforcement action

if the demand is not satised.

Separate proceedings in the Bombay High Court taken against VIHBV to seek to treat it as an agent of HTIL in respect of its alleged tax on the

same transaction, as well as penalties of up to 100% of the assessed withholding tax for the alleged failure to have withheld such taxes, were listed

for hearing at the request of the Indian Government on 21 April 2016 despite the issue having been ruled upon by the Indian Supreme Court.

The hearing was adjourned to a date yet to be listed.

Should a further demand for taxation be received by VIHBV or any member of the Group as a result of the retrospective legislation, we believe

it is probable that we will be able to make a successful claim under the Dutch BIT and/or UK BIT. We did not carry a provision for this litigation

or in respect of the retrospective legislation at 31 March 2016, or at previous reporting dates.

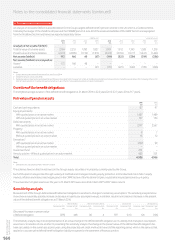

Other Indian tax cases

VIL and Vodafone India Services Private Limited (‘VISPL’) (formerly 3GSPL) are involved in a number of tax cases with total claims exceeding

£1.4 billion plus interest, and penalties of up to 300% of the principal.

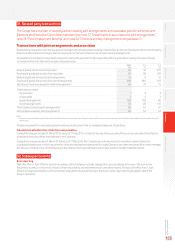

VISPL tax claims

VISPL has been assessed as owing tax of approximately £223 million (plus interest of £123 million) in respect of (i) a transfer pricing margin charged

for the international call centre of HTIL prior to the 2007 transaction with Vodafone for HTIL assets in India; (ii) the sale of the international call centre

by VISPL to HTIL; and (iii) the acquisition of and/or the alleged transfer of options held by VISPL for VIL. The rst two of the three heads of tax are

subject to an indemnity by HTIL. The larger part of the potential claim is not subject to any indemnity. VISPL unsuccessfully challenged the merits

of the tax demand in the statutory tax tribunal and the jurisdiction of the tax ofce to make the demand in the High Court. The Tax Appeal Tribunal

heard the appeal and ruled in the Tax Ofce’s favour. VISPL lodged an appeal (and stay application) in the Bombay High Court which was concluded

in early May 2015. On 13 July 2015 the tax authorities issued a revised tax assessment reducing the tax VISPL had previously been assessed as owing

in respect of (i) and (ii) above. In the meantime, (i) a stay of the tax demand on a deposit of £20 million and (ii) a corporate guarantee by VIHBV for the

balance of tax assessed remain in place. On 8 October 2015, the Bombay High Court ruled in favour of Vodafone in relation to the options and the

call centre sale. The Tax Ofce has recently appealed to the Supreme Court of India.

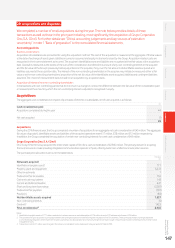

Indian regulatory cases

Litigation remains pending in the Telecommunications Dispute Settlement Appellate Tribunal (‘TDSAT’), High Courts and the Indian Supreme Court

in relation to a number of signicant regulatory issues including mobile termination rates (‘MTRs’), spectrum and licence fees, licence extension and

3G intra-circle roaming (‘ICR’).

Public interest litigation: Yakesh Anand v Union of India, Vodafone and others

The Petitioner brought a special leave petition in the Indian Supreme Court on 30 January 2012 against the Government of India and mobile

network operators, including VIL, seeking recovery of the alleged excess spectrum allocated to the operators, compensation for the alleged excess

spectrum held in the amount of approximately €4.7 billion and a criminal investigation of an alleged conspiracy between government ofcials and

the network operators. A claim with similar allegations was dismissed by the Indian Supreme Court in March 2012, with an order that the Petitioner

should pay a ne for abuse of process. The case is pending before the Indian Supreme Court and is expected to be called for hearing at some

uncertain future date.

Notes to the consolidated nancial statements (continued)