Vodafone 2016 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net nancing costs, excluding mark-to-market losses and foreign

exchange differences in relation to certain intercompany balances,

decreased by 3% primarily due to the impact of foreign exchange losses

on nancing costs.

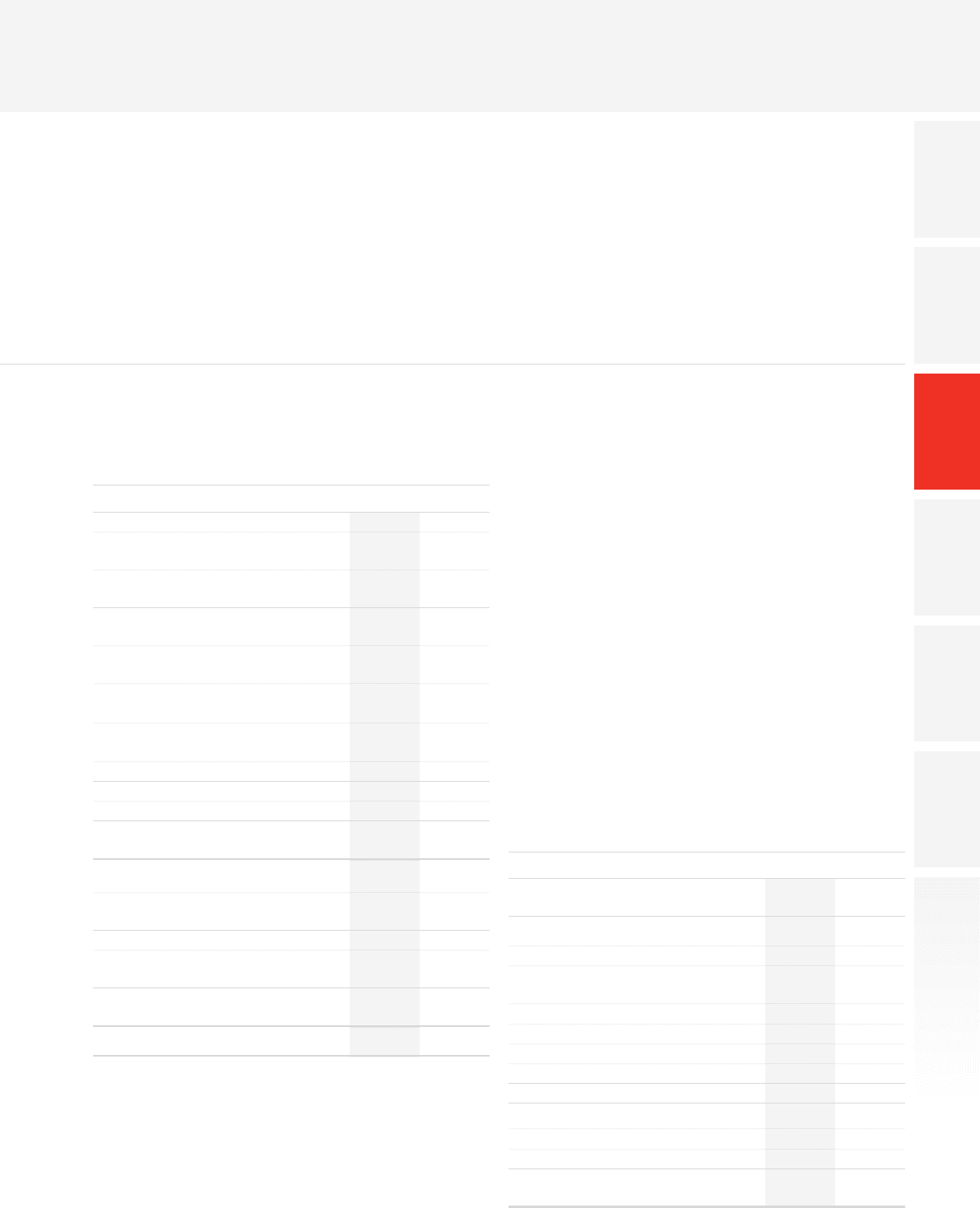

Taxation

2016

£m

2015

£m

Income tax

Continuing operations before deferred tax on

revaluation of investments in Luxembourg (162) (703)

Deferred tax on revaluation of investments

inLuxembourg (3,207) 5,468

Total income tax (expense)/credit –

continuing operations (3,369) 4,765

Tax on adjustments to derive adjusted

prot before tax (436) (305)

Recognition of deferred tax asset for losses

inLuxembourg – (3,341)

Deferred tax following revaluation

ofinvestments in Luxembourg 3,207 (2,127)

Deferred tax on use of Luxembourg losses 423 439

Adjusted income tax expense (175) (569)

Share of associates’ and joint ventures’ tax (104) (117)

Adjusted income tax expense for

calculating adjusted tax rate (279) (686)

(Loss)/prot before tax (449) 1,095

Adjustments to derive adjusted

prot beforetax (see earnings per share) 2 ,191 1,12 2

Adjusted prot before tax 1,74 2 2,217

Share of associates’ and joint ventures’ tax

andnon-controlling interest 104 117

Adjusted prot before tax for calculating

adjusted effective tax rate 1,846 2,334

Adjusted effective tax rate 15.1% 29.4%

The Group’s underlying tax rate for the year ended 31 March 2016

was 28.8%. Certain non-recurring items had a signicant effect on the

adjusted effective tax rate in the year, which was 15.1%. These include

a benet of 18.4% following the restructuring and simplication of our

Indian business, partially offset by a tax cost of 4.6% due to the reduction

in the UK corporation tax rate (which resulted in a decrease in the value

of our UK capital allowances).

The Group’s adjusted effective tax rate is expected to be in the

mid-twenties over the medium term reecting the ongoing impact

fromthe re-organisation of our Indian business.

The Group’s adjusted effective tax rate for both years does not

include the use of Luxembourg losses in the year of £423 million

(2015: £439 million) and a reduction in the deferred tax asset in the

period of £3,207 million (2015: recognition of an additional asset

of £2,127 million) arising from the tax treatment of the revaluation

of investments based upon the local GAAP nancial statements.

These items reduce the amount of losses we have available for future

use against our prots in Luxembourg and do not affect the amount

of tax we pay in other countries.

Additionally, the adjusted effective tax rate in the year ended 31 March

2015 did not include the impact of the recognition of an additional

£3,341 million deferred tax asset in respect of the Group’s historic tax

losses in Luxembourg. The losses were recognised as a consequence

of the acquisition of Ono.

Earnings per share

Adjusted earnings per share, which excludes the reduction in the tax

losses in Luxembourg following the revaluation of investments in the

local statutory accounts in the current period and the recognition

of deferred tax assets in respect of tax losses in Luxembourg in the prior

year, was 5.04 pence, a decrease of 9.2% year-on-year, reecting the

Group’s lower adjusted operating prot for the year.

Basic earnings per share was a loss of 15.08 pence primarily due to the

reduction in deferred tax on losses, as described above, which has been

excluded from adjusted earnings per share.

2016

£m

2015

£m

(Loss)/prot attributable to owners

ofthe parent (4,024) 5,761

Adjustments:

Impairment loss 450 –

Amortisation of acquired customer base

and brand intangible assets 979 1,269

Restructuring costs 236 157

Other income and expense 75 114

Non-operating income and expense 2 19

Investment income and nancing costs 449 (437)

2 ,191 1,122

Taxation 3 ,19 4 (5,334)

Discontinued operations – (57)

Non-controlling interests (17) (21)

Adjusted prot attributable to owners

ofthe parent 1,344 1,471

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

31