Vodafone 2016 Annual Report Download

Download and view the complete annual report

Please find the complete 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Con dence

in the future

Vodafone Group Plc

Annual Report 2016

Vodafone Group Plc

Table of contents

-

Page 1

Confidence in the future Vodafone Group Plc Annual Report 2016 -

Page 2

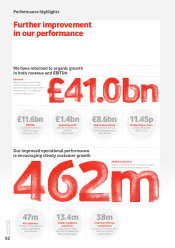

...Governance Financials Performing across all our markets...Pages 30-37 Creating and maintaining the right culture...Pages 38-74 Delivering results for shareholders...Pages 75-162 Vodafone today We confidently connect more and more people each year. Today we have 462 million mobile customers, 13... -

Page 3

..., induction and training Shareholder engagement Board committees Compliance with the 2014 UK Corporate Governance Code Our US listing requirements Directors' remuneration Directors' report Financials The statutory financial statements of the Group and the Company and associated audit reports. 75 76... -

Page 4

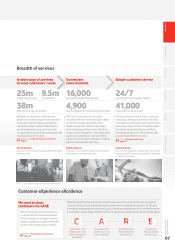

... 4G during the year. 4G customers 13.4m rose by over one million, supported by the expansion of our broadband reach. Fixed broadband customers are up by 37% over the year, driven by our global scale and reach. Internet of Things connections 38m 02 Vodafone Group Plc Annual Report 2016 -

Page 5

... sets out in more detail our plans for continued growth, supported by increasing efficiency, on pages 14 and 15. The Board continues to view the dividend as the key element of shareholder returns and consistent with this policy we have raised the dividend per share by 2% to 11.45 pence for the year... -

Page 6

... a range of services including voice, broadband and TV services to consumers and a wider range of services to our enterprise customers, including cloud & hosting and IP-VPN (Virtual Private Networks). 04 Vodafone Group Plc Annual Report 2016 Other services Includes Partner Markets and Common... -

Page 7

...: Europe, and Africa, Middle East and Asia Pacific ('AMAP'), which includes our emerging markets. Overview Strategy review Our reach and scale Performance Governance Germany Vodacom 19% 9% India 12% 32% AMAP 11% UK 16% Split of service revenue Other AMAP Financials 66% Europe Italy... -

Page 8

...Europe. Investment and returns to shareholders £47bn Vodafone Group Plc Annual Report 2016 re-investing in our business We've invested £47 billion in capital expenditure, new acquisitions and spectrum and licences in the last three years. This has enhanced our networks, and competitive position... -

Page 9

...call centres in all European markets 1 retail customer service staff Financials Additional information We have a broad customer base comprising individuals, domestic businesses of all sizes, multinationals and public sector departments, with a wide range of communications needs. Our highly-trained... -

Page 10

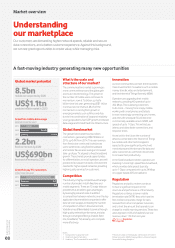

...applications have enabled companies to offer data services via apps, increasing the number of competitors further. In this environment, Vodafone has differentiated its service through high-quality network performance, and also through converged offerings (mobile, fixed line, broadband, TV), allowing... -

Page 11

... for pre-integrated fixed, mobile and cloud services with simple, predictable and transparent pricing. We have invested in building these service offerings at scale helping us achieve a commercial advantage across our footprint. More on Enterprise: Page 13 Vodafone Group Plc Annual Report 2016 09 -

Page 12

...scale and efficiency benefits of our global presence, we aim to generate attractive returns, enabling us to sustain our investment levels, further increase our network differentiation and meet our customers' high expectations. Data Convergence Enterprise 10 Vodafone Group Plc Annual Report 2016 -

Page 13

...Governance Financials Additional information Vodafone Group Plc Annual Report 2016 197m of our customers use data, representing 43% of all customers, up from 40% last year Enhancing customer services M-Pesa, our money transfer service, now has more than 25 million active customers, an increase of... -

Page 14

... or cable. We already reach 72 million households in Europe, up from 41 million last year a We're aiming to expand our TV services, to support the take up of broadband. We already have TV services in seven markets Fixed broadband customers million 2014 2015 2016 Vodafone Group Plc Annual Report 2016... -

Page 15

... trusted brand, global footprint and service quality a We aim to increase our market share in fixed enterprise services, by building on Project Spring investments a We intend to continue to invest in the growth areas of converged communications, cloud & hosting services, and the Internet of Things... -

Page 16

... the Group is to gain competitive fixed networks to meet the growing demand for converged services. Part of the execution of this strategy is to acquire companies where we can see a clear return on that investment. KDG and Ono, two leading cable companies, were acquired in 2013 and 2014 respectively... -

Page 17

... accelerate our growth and improve our long-term strategic positioning. The Board intends to grow dividends per share annually. For the 2017 financial year and beyond, dividends will be declared in euros and paid in euros, pounds sterling and US dollars, aligning the Group's shareholder returns with... -

Page 18

... Generation Network providing high-speed broadband over 30 Mbps. 3 Before the impact of M&A, spectrum purchases and restructuring costs. 2014 2015 2016 9.2 12.0 13.4 Vodafone Group Plc Annual Report 2016 Fixed services have become more important as businesses increasingly look to procure fixed and... -

Page 19

... Net Promoter Scores ('NPS') to measure the extent to which our customers would recommend us to friends and family. This year we increased the number of markets where we are ranked number one, but have more work to do in the UK and Germany. Achieved Performance Governance Financials 2014 2015 2016... -

Page 20

... treats people fairly. Last year we launched a new global maternity policy, providing mandatory minimum maternity benefits, including 16 weeks of full pay followed by full pay for a 30-hour week for the first six months after employees return to work. Vodafone Group Plc Annual Report 2016 This year... -

Page 21

... to manage risks, and if incidents occur we work hard to identify and address the root causes. For more on Health & Safety read our sustainability report at www.vodafone.com/sustainability India 20% UK 15% 1 Recognising performance number Financials Monthly average employees 2014 2015 2016 92... -

Page 22

...'s health and wellbeing SMS service which sends twice-weekly texts offering information and advice about prenatal, antenatal and infant care and women's health. An interactive app with information about child development has also been downloaded 160,000 times. Vodafone Group Plc Annual Report 2016 -

Page 23

... 2014 2015 2016 2018 Target 1.19 1.41 1.74 2.00 Note: 2014 figures have been extrapolated from actuals for 2013 and 2015. Emissions savings for customers have been calculated based on GeSI's ICT Enablement Methodology. Vodafone Group Plc Annual Report 2016 Our Sustainable Business Report 2016... -

Page 24

... to risk management To support the implementation of this framework, the following actions have been put in place during the 2016 financial year. a Created a Group Risk function reporting to the Group Risk & Compliance Director a Brought together a global risk community from local markets and... -

Page 25

... reviews and reviews of third parties that hold data on our behalf. Vodafone holds internationally recognised certifications for its information security processes a We regularly provide mandatory security and privacy awareness training to Vodafone employees Vodafone Group Plc Annual Report 2016... -

Page 26

... plans ensure that cost synergies and revenue benefits are delivered and acquired businesses are successfully integrated through the alignment of policies, processes and systems Adverse political measures Movement from 2015: Stable What is the risk? Vodafone operates under licence in most markets... -

Page 27

... Enterprise that ensures alignment, visibility and control across the entire customer experience, from sales governance and commercial risk through to service delivery, billing and in-life operations. This is supported by global standardised "ways of working" frameworks a We have an investment plan... -

Page 28

... substitution. The loss of voice and messaging revenue is partially offset by the increase in data revenue a We monitor the competitor landscape in all markets, and react appropriately, working to make sure each market has a fair and competitive environment 26 Vodafone Group Plc Annual Report 2016 -

Page 29

... as a result of an internal project or transformation. Failure to successfully implement key IT transformation projects would also increase the risk of IT systems being unable to support our strategic objectives. Governance Financials Changes from 2015 During 2016 a number of major projects to... -

Page 30

... our network and IT systems. Changes from 2015 We have now completed one year of our Customer eXperience eXcellence programme. In the 2016 financial year we achieved improvements in our consumer Net Promoter Score ('NPS') position in 15 out of 20 of our Local Markets. Vodafone is now ranked number... -

Page 31

Overview Strategy review Long-Term Viability Statement In accordance with the revised UK Corporate Governance Code, the Directors have assessed the prospects of the Group over a period significantly longer than 12 months from the approval of the financial statements. The Board has concluded that ... -

Page 32

... of outstanding tax issues Mark-to-market losses Foreign exchange1 300 (2,124) (1,824) 883 (1.736) (853) (1,107) (15) (1,122) (247) (455) (1,824) (1,160) 4 (1,156) (134) 437 (853) 30 Vodafone Group Plc Annual Report 2016 Note: 1 Comprises foreign exchange rate differences in relation to... -

Page 33

Overview Strategy review Net financing costs, excluding mark-to-market losses and foreign exchange differences in relation to certain intercompany balances, decreased by 3% primarily due to the impact of foreign exchange losses on financing costs. Taxation 2016 £m 2015 £m Income tax Continuing ... -

Page 34

...in commercial costs (aided by our increased focus on direct channels) and a change in commission processes. Revenue - Europe Service revenue Germany Italy UK Spain Other Europe Europe EBITDA Germany Italy UK Spain Other Europe Europe Europe adjusted operating profit Vodafone Group Plc Annual Report... -

Page 35

... with our network sharing partner is now accelerating. We achieved significant growth in 4G customers, with 7.0 million at the period end (September 2015: 5.3 million). Vodafone Group Plc Annual Report 2016 Other Europe Service revenue rose 1.5%* (Q3: 1.6%*; Q4: 2.1%*), with all markets except... -

Page 36

..., EBITDA grew 7.2%*, driven by growth in all major markets. Organic change % Other activity1 pps Foreign exchange pps Reported change % Note: 1 "Other activity" includes the impact of M&A activity. Refer to "Organic growth" on page 191 for further detail. India Service revenue increased 5.0%* (Q3... -

Page 37

... benefiting from sustained network investment. Vodacom Group EBITDA increased 12.7%*, significantly faster than revenues, with a 3.6* percentage point improvement in EBITDA margin. This strong performance partly reflected a change in accounting for certain transactions in the indirect channel, which... -

Page 38

... statement of financial position The consolidated statement of financial position is set out on page 88. Details on the major movements of both our assets and liabilities in the year are set out below: Assets Goodwill and other intangible assets Goodwill and other intangible assets increased... -

Page 39

...analysis of our performance and position, a review of the business during the year, and outlines the principal risks and uncertainties we face. The strategic report was approved by the Board and signed on its behalf by the Chief Executive and Chief Financial Officer. Vodafone Group Plc Annual Report... -

Page 40

... 45 Vodafone Group Plc Annual Report 2016 Chairman's introduction Our governance framework Board of Directors Executive Committee Board activities Board evaluation, induction and training Shareholder engagement 47 54 56 57 74 Board committees Compliance with the 2014 UK Corporate Governance Code... -

Page 41

... system of corporate governance; and a is accountable to shareholders for the proper conduct of the business. More on: Page 44 Board Executive Committee a Focuses on strategy implementation, financial and competitive performance, commercial and technological developments, succession planning and... -

Page 42

... of international capital markets, regulation, services industries and business transformation developed from her previous roles as chief executive of the London Stock Exchange Group plc and Credit Lyonnais Rouse Ltd. Her financial proficiency is highly valued as a member of the Audit and Risk... -

Page 43

...Life plc and chief financial officer of Scottish Power plc. Other current appointments: a HSBC Holdings Plc, non-executive director a London Stock Exchange Group Plc, non-executive director a Zurich Insurance Group, board member a UK Green Investment Bank Plc, non-executive director a Council of the... -

Page 44

... Chief Executive Officer, Southern Europe (2012-2013) a Vodafone Italy, Chief Executive Officer (2008-2013) a Vodacom Group, Board Director (2010-2012) Warren Finegold Group Business Development Director Tenure: 10 years Nationality: British Responsibilities: Warren has responsibility for managing... -

Page 45

...2013) a McKinsey & Company, senior partner (2007-2008) a RCS Quotidiani, managing director (2004-2006) Financials Additional information Johan Wibergh Group Technology Officer Tenure: 1 year Nationality: Swedish Responsibilities: Johan has responsibility for defining and leading Vodafone's global... -

Page 46

...year the Board received and discussed: a reports from the Chief Executive on performance of operations in Europe, 10 to 13 AMAP and Enterprise; a information on the financial performance 10 to 15, 30 to 37 of the Group; a network and customer satisfaction updates 16 and 17 and quarterly market share... -

Page 47

..., a Vodafone UK store and Vodafone's call centre in Stoke-on-Trent (UK); a meetings with various Group senior managers to discuss Group strategy, people strategy and remuneration, technology and marketing, external affairs, finance, investor relations and risk; a training on his duties as a director... -

Page 48

.... All shareholders present can question the Board during the meeting. a fixed broadband and TV strategy; a spectrum renewal costs; Our investor calendar Set out below is a calendar of our investor events throughout the year. May 2015 a Preliminary results published a London, New York, Boston... -

Page 49

... to assess the Company's position and performance, business model and strategy. This assessment forms the basis of the advice given to the Board to assist them in making the statement required by the 2014 UK Corporate Governance Code. Additional information Vodafone Group Plc Annual Report 2016 47 -

Page 50

... of Vodafone India Limited in 2007, further details of which are included in note 30 "Contingent liabilities and legal proceedings". Further, the Group has extensive accumulated tax losses as detailed in note 6 "Taxation", and a key management judgement is whether a deferred tax asset should... -

Page 51

...the development of key business and related IT controls to ensure a robust system of internal control. During the year, this focused on ongoing work programmes over general ledger account controls and user access to the Group's core Enterprise Resource Planning ('ERP') system as well as new activity... -

Page 52

...accounting developments The Committee received regular reporting from management on the Group's implementation of IFRS 15 "Revenue from contracts with customers", which will be adopted in the financial year ending 31 March 2019, focusing on the key decision points relating to the choice of IT system... -

Page 53

... to Vodafone compliance standards; a changes to the Group's Enterprise operations to improve service and delivery to customers; a the risk and control framework associated with implementation of a new billing system in the Netherlands; a the Group's cyber security strategy, covering network, IT... -

Page 54

...the effectiveness of the Group's system of internal control, including risk management, during the year and up to the date of this Annual Report, in accordance with the requirements of the Guidance on Risk Management, Internal Control and related Financial and Business Reporting published by the FRC... -

Page 55

... of the evaluation is set out on page 45. Succession planning The Committee received several presentations throughout the year from the Chief Executive and Group Human Resources Director. The presentations provided details of the changes to the Vodafone organisational structure in order to deliver... -

Page 56

... and challenge performance and risk management across the Group's business; and a assess the risk and integrity of the financial information and controls. The Chairman met with just the Non-Executive Directors at every Board meeting this year. Vodafone Group Plc Annual Report 2016 B. Effectiveness... -

Page 57

... mistreatment or loss. The long-term viability statement can be found on page 29. The Board has implemented in full the FRC "Guidance on Risk Management Internal Control and related Financial and Business Reporting" for the year and to the date of this Annual Report. The resulting procedures, which... -

Page 58

... whether shareholder approval is required for a transaction depends on, among other things, whether the size of a transaction exceeds a certain percentage of the size of the listed company undertaking the transaction. Committees Related party transactions 56 Vodafone Group Plc Annual Report 2016 -

Page 59

... long-term strategic goals and that remuneration levels fairly reflect ongoing performance in the context of wider market conditions and shareholder views. Overview Strategy review Letter from the Remuneration Committee Chairman Dear shareholder On behalf of the Board, I present our 2016 Directors... -

Page 60

... that the Policy Report put forward for shareholder approval is appropriately positioned to support our executive remuneration programme over the next three years. Conclusion The success of Project Spring was always going to require more than financial investment. Indeed, our latest results show how... -

Page 61

... conditions of employees in Vodafone Group as a whole, with particular reference to the market in which the executive is based. Further information on our remuneration policy for other employees is given on page 62. Performance measures and targets Our Company strategy and business objectives... -

Page 62

... vesting are reviewed annually to ensure they continue to support our strategy. a Long-term incentive base awards consist of performance shares which are granted each year. a Individuals must co-invest in Vodafone shares and hold them in trust for at least three years in order to receive the full... -

Page 63

... 50%. Strategic measures may include (but are not limited to) competitive performance metrics such as net promoter score and market share. a The basic target award level is 137.5% of base salary for the Chief Executive (110% for other Executive Directors). a The target award level may increase up... -

Page 64

... are applied to the target number of shares granted. 0% 50% 100% 125% 0% 75% 150% 187.5% 0% 100% 200% 250% Outstanding awards For the awards made in the 2013 and 2014 financial years (vesting in July 2015 and June 2016 respectively) the award structure is as set out above, except that the... -

Page 65

... fixed (£'000) Overview Strategy review Performance On target Maximum All scenarios Chief Executive 1,150 38 345 1,533 Chief Financial Officer 675 23 203 901 Chief Technology Officer 600 21 180 801 Based on what a Director would receive if performance was in line with plan. The target award... -

Page 66

... non-competition, non-solicitation of customers and employees etc. Additionally, all of the Company's share plans contain provisions relating to a change of control. Outstanding awards and options would normally vest and become exercisable on a change of control to the extent that any performance... -

Page 67

... market data on executive reward; reward consultancy; and performance analysis. £102 Reward and benefits consultancy; provision of benchmark data; pension administration; and insurance consultancy services. Additional information 2015 annual general meeting - Remuneration Report voting results... -

Page 68

... including customer churn rates and revenue market share. Group performance for the year was slightly above target reflecting our position as Consumer NPS leader in 13 out of 21 markets - an increase from our previous position as leader in 11 markets. 66 Vodafone Group Plc Annual Report 2016 -

Page 69

... BT Group Telecom Italia Deutsche Telekom Telefónica Emerging markets composite Performance The adjusted free cash flow for the three year period ended on 31 March 2016, having removed the impact of the investment made under Project Spring as set out in our 2014 Annual Remuneration Report, was... -

Page 70

... closing share price for the day prior to each grant). Dividend equivalents on the shares that vest are paid in cash after the vesting date. All-employee share plans The Executive Directors are also eligible to participate in the UK all-employee plans. Summary of plans Sharesave The Vodafone Group... -

Page 71

...the Vodafone Group 2008 Sharesave Plan were granted at a discount of 20% to the market value of the shares at the time of the grant. No other options may be granted at a discount. At 1 April 2015 or date of appointment Grant date Number of shares Options granted during the 2016 financial year Number... -

Page 72

...plan is based on the TSR performance shown in the chart on page 67 and not this chart. Seven-year historical TSR performance (growth in the value of a hypothetical â,¬100 holding over seven years) 325 267 275 215 225 175 125 75 100 03/09 Vodafone Group Financial year remuneration for Chief Executive... -

Page 73

... change from 2015 to 2016 Item Chief Executive: Vittorio Colao Other Vodafone Group employees employed in the UK Overview Strategy review Base salary Taxable benefits Annual bonus 0.9% -20.0% 4.3% 5.1% 0.4% 15.4% Relative spend on pay The chart below shows both the dividends distributed... -

Page 74

... for the 2017 financial year are set out below. 2017 base salaries The Remuneration Committee considered business performance, salary increases for other UK employees and external market information and decided to increase the salary of the Chief Financial Officer by 2.0% which is in line with the... -

Page 75

... terminated. This report on remuneration has been approved by the Board of Directors and signed on its behalf by: Strategy review Performance Governance Valerie Gooding Chairman of the Remuneration Committee 17 May 2016 Financials Additional information Vodafone Group Plc Annual Report 2016 73 -

Page 76

... 2016. Details of Directors' interests in the Company's ordinary shares, options held over ordinary shares, interests in share options and long-term incentive plans are set out on pages 66 to 72. Code of Conduct All of the key Group policies have been consolidated into the Vodafone Code of Conduct... -

Page 77

... preparation Income statement 2. Segmental analysis 3. Operating profit/(loss) 4. Impairment losses 5. Investment income and financing costs 6. Taxation 7. Discontinued operations and assets held for sale 8. Earnings per share 9. Equity dividends Financial position 10. Intangible assets 11. Property... -

Page 78

...the assets, liabilities, financial position and profit of the Company; and a the strategic report includes a fair review of the development and performance of the business and the position of the Group together with a description of the principal risks and uncertainties that it faces. Vodafone Group... -

Page 79

...report on internal control over financial reporting is on page 78. By Order of the Board Overview Strategy review Performance Governance Financials Rosemary Martin Group General Counsel and Company Secretary 17 May 2016 Additional information Management's report on internal control over financial... -

Page 80

... statement of changes in equity and consolidated statement of cash flows present fairly, in all material respects, the financial position Vodafone Group Plc and its subsidiaries ("the Company") at 31 March 2016 and 31 March 2015, and the results of their operations and their cash flows for the years... -

Page 81

...; a the Company statement of changes in equity for the year then ended; and a the notes to the financial statements, which include a summary of significant accounting policies and other explanatory information. Certain required disclosures have been presented elsewhere in the Annual Report, rather... -

Page 82

...matters relating to the legal claim in respect of withholding tax on the acquisition of Hutchison Essar Limited and the recognition and recoverability of deferred tax assets in Luxembourg and Germany. How our audit addressed the area of focus We evaluated the design and implementation of controls in... -

Page 83

... revenue and margin trends, capital expenditure on network assets and of recoverable amount, being the higher of fair value spectrum, market share and customer churn, foreign exchange rates and discount less costs to sell and value-in-use, requires judgement rates, against external data where... -

Page 84

... note 22 - Liquidity and capital resources. Based on our procedures, we noted no issues and were satisfied with the associated accounting for these matters. We validated the appropriateness of the related disclosures in note 22 of the financial statements. 82 Vodafone Group Plc Annual Report 2016 -

Page 85

... data last year. migration processes; The Group has continued to devote considerable a tested the enhanced user access management controls; resources to the development of key business and related IT controls to ensure a robust system of internal a following issues with the implementation of a new... -

Page 86

... reasons. Going concern Under the Listing Rules we are required to review the Directors' statement, set out on pages 76 and 77, in relation to going concern. We have nothing to report having performed our review. Under ISAs (UK & Ireland) we are required to report to you if we have anything... -

Page 87

... the financial statements; and a the information given in the corporate governance statement set out on pages 76 and 77 with respect to internal control and risk management systems and about share capital structures is consistent with the financial statements. ISAs (UK and Ireland) reporting Under... -

Page 88

... Listing Rules we are required to review the part of the corporate governance statement relating to 10 further provisions of the Code. We have nothing to report having performed our review. Responsibilities for the financial statements and the audit Our responsibilities and those of the Directors... -

Page 89

Consolidated income statement for the years ended 31 March Note 2016 £m 2015 £m 2014 £m Overview Revenue Cost of sales Gross profit Selling and distribution expenses Administrative expenses Share of results of equity accounted associates and joint ventures Impairment losses Other income ... -

Page 90

Consolidated statement of financial position at 31 March 31 March 2016 £m 31 March 2015 £m Note Non-current assets Goodwill Other intangible assets Property, plant and equipment Investments in associates and joint ventures Other investments Deferred tax assets Post employment benefits Trade... -

Page 91

... million net loss) recycled to the income statement. 7 Includes £3 million tax credit (2015: £7 million tax credit; 2014: £12 million charge). 8 Includes the equity component of mandatory convertible bonds which are compound instruments issued in the year. Vodafone Group Plc Annual Report 2016... -

Page 92

... for the years ended 31 March Note 2016 £m 2015 £m 2014 £m Inflow from operating activities Cash flows from investing activities Purchase of interests in subsidiaries, net of cash acquired Purchase of interests in associates and joint ventures Purchase of intangible assets Purchase of... -

Page 93

...The registered address of the Company is Vodafone House, The Connection, Newbury, Berkshire, RG14 2FN, England. IFRS requires the Directors to adopt accounting policies that are the most appropriate to the Group's circumstances. These have been applied consistently to all the years presented, unless... -

Page 94

... costs of purchasing and developing computer software. Where intangible assets are acquired through business combinations and no active market for the assets exists, the fair value of these assets is determined by discounting estimated future net cash flows generated by the asset. Estimates relating... -

Page 95

...Overview Strategy review Performance Governance a long-term growth rates; and a appropriate discount rates to reflect the risks involved. Management prepares formal five year forecasts for the Group's operations, which are used to estimate their value in use. In certain developing markets ten year... -

Page 96

... on non-monetary financial assets, such as investments in equity securities classified as available-for-sale, are reported as part of the fair value gain or loss and are included in equity. For the purpose of presenting consolidated financial statements, the assets and liabilities of entities... -

Page 97

...: 2012-2014 cycle". The Group's financial reporting will be presented in accordance with the new standards above, which are not expected to have a material impact on the consolidated results, financial position or cash flows of the Group, from 1 April 2016. Overview Strategy review New accounting... -

Page 98

... fair value of the consideration receivable, exclusive of sales taxes and discounts. The Group principally obtains revenue from providing mobile and fixed telecommunication services including: access charges, voice and video calls, messaging, interconnect fees, fixed and mobile broadband and related... -

Page 99

... sale of goods for the year ended 31 March 2016 was £3,269 million (2015: £3,211 million, 2014: £2,660 million). The Group's measure of segment profit, EBITDA, excludes depreciation, amortisation, impairment loss, restructuring costs, loss on disposal of fixed assets, the Group's share of results... -

Page 100

... analysis (continued) 2016 £m 2015 £m 2014 £m EBITDA Depreciation, amortisation and loss on disposal of fixed assets Share of results in associates and joint ventures Adjusted operating profit Impairment loss Restructuring costs Amortisation of acquired customer based and brand intangible... -

Page 101

...information Vodafone Group Plc Annual Report 2016 Notes: 1 Relates to fees for statutory and regulatory filings. 2 Amount for 2014 primarily arose from regulatory filings and shareholder documentation requirements in respect of the disposal of Verizon Wireless and the acquisition of the outstanding... -

Page 102

... our annual impairment review, the impairment charges recognised in the consolidated income statement within operating profit in respect of goodwill are stated below. The impairment losses were based on value in use calculations. Cash-generating unit Reportable segment 2016 £m 2015 £m 2014... -

Page 103

... future business performance in the light of the current trading environment. The table below shows key assumptions used in the value in use calculations. Assumptions used in value in use calculation Romania % Germany % Spain % Pre-tax risk adjusted discount rate Long-term growth rate Budgeted... -

Page 104

... 2015, no impairment charges were recorded in respect of the Group's goodwill balances. The table below shows key assumptions used in the value in use calculations. Assumptions used in value in use calculation Germany % Italy % Spain % Pre-tax risk adjusted discount rate Long-term growth rate... -

Page 105

... conditions. The table below shows key assumptions used in the value in use calculations. Assumptions used in value in use calculation Germany % Italy % Spain % Portugal % Czech Republic % Romania % Greece % Overview Strategy review Pre-tax risk adjusted discount rate Long-term growth rate... -

Page 106

... and commercial paper issued, bank loans and the results of hedging transactions used to manage foreign exchange and interest rate movements. 2016 £m 2015 £m 2014 £m Investment income: Available-for-sale investments: Dividends received Loans and receivables at amortised cost Fair value... -

Page 107

...) UK operating profits are more than offset by statutory allowances for capital investment in the UK network and systems plus ongoing interest costs including those arising from the £6.8 billion of spectrum payments to the UK Government in 2000 and 2013. Vodafone Group Plc Annual Report 2016 105 -

Page 108

... deferred tax asset recognition in Luxembourg and Germany on page 108. 2 Amounts for 2014 include the US tax charge of £2,210 million on the rationalisation and reorganisation of non-US assets prior to the disposal of our interest in Verizon Wireless. 106 Vodafone Group Plc Annual Report 2016 -

Page 109

...analysed in the statement of financial position, after offset of balances within countries, as follows: £m Deferred tax asset Deferred tax liability 31 March 2015 23,845 (595) 23,250 Factors affecting the tax charge in future years The Group's future tax charge, and effective tax rate, could be... -

Page 110

..., combined with the length of time which would be likely to elapse before these losses would be utilised. We also have £7,642 million (2015: £7,642 million) of Luxembourg losses in a former Cable & Wireless Worldwide Group company, for which no deferred tax asset has been recognised as it is... -

Page 111

... after the balance sheet date (see table above). No deferred tax liability has been recognised in respect of a further £14,106 million (2015: £14,925 million) of unremitted earnings of subsidiaries, associates and joint ventures because the Group is in a position to control the timing of the... -

Page 112

... been classed as held for sale on the Statement of Financial Position. The relevant assets and liabilities are detailed in the table below. Assets and liabilities held for sale 2016 £m Non-current assets Goodwill Other intangible assets Plant, property and equipment Trade and other receivables... -

Page 113

... new ordinary shares in issue immediately after the share consolidation on 24 February 2014. Governance 9. Equity dividends Dividends are one type of shareholder return, historically paid to our shareholders in February and August. 2016 £m 2015 £m 2014 £m Declared during the financial year... -

Page 114

...on a straight-line basis, with the exception of customer relationships which are amortised on a sum of digits basis. The amortisation basis adopted for each class of intangible asset reflects the Group's consumption of the economic benefit from that asset. 112 Vodafone Group Plc Annual Report 2016 -

Page 115

...: 1 April 2014 Exchange movements Amortisation charge for the year Disposals Other 31 March 2015 Exchange movements Amortisation charge for the year Impairment losses (note 4) Disposals Transfer of assets held for resale Other 31 March 2016 Net book value: 31 March 2015 31 March 2016 77,121... -

Page 116

.... Accounting policies Land and buildings held for use are stated in the statement of financial position at their cost, less any subsequent accumulated depreciation and any accumulated impairment losses. Amounts for equipment, fixtures and fittings, which includes network infrastructure assets and... -

Page 117

... 26,603 28,082 Strategy review Performance Governance Financials Additional information The net book value of land and buildings and equipment, fixtures and fittings includes £27 million and £592 million respectively (2015: £24 million and £468 million) in relation to assets held under finance... -

Page 118

... are carried in the consolidated statement of financial position at cost as adjusted for post-acquisition changes in the Group's share of the net assets of the joint venture, less any impairment in the value of the investment. The Group's share of post-tax profits or losses are recognised in the... -

Page 119

... Report 2016 Note: 1 Prior to 21 February 2014 the other participating shareholder held substantive veto rights such that the Group did not unilaterally control the financial and operating policies of Vodafone Omnitel B.V. The Group did not receive a dividend in the year to 31 March 2016 (2015... -

Page 120

... Partnership which traded under the name Verizon Wireless. Results from discontinued operations are disclosed in note 7 "Discontinued operations and assets held for resale" to the consolidated financial statements. The Group received £4,828 million of dividends in the year to 31 March 2014 from... -

Page 121

... net profit or loss for the period. Other investments classified as loans and receivables are stated at amortised cost using the effective interest method, less any impairment. 2016 £m 2015 £m Overview Strategy review Performance Included within non-current assets: Equity securities: Listed... -

Page 122

... the inventories to their present location and condition. 2016 £m 2015 £m Goods held for resale Inventory is reported net of allowances for obsolescence, an analysis of which is as follows: 2016 £m 565 482 2015 £m 2014 £m 1 April Exchange movements Amounts (debited)/credited... -

Page 123

... 269 8,053 Performance Governance Financials The Group's trade receivables are stated after allowances for bad and doubtful debts based on management's assessment of creditworthiness, an analysis of which is as follows: 2016 £m 2015 £m 2014 £m 1 April Exchange movements Amounts charged to... -

Page 124

... also include taxes and social security amounts due in relation to our role as an employer. Derivative financial instruments with a negative market value are reported within this note. Accounting policies Trade payables are not interest bearing and are stated at their nominal value. 2016 £m 2015... -

Page 125

... one year. The timing of the cash flows associated with property is dependent upon the remaining term of the associated lease. Asset retirement obligations £m Legal and regulatory £m Overview Strategy review Performance Governance Financials Other £m Total £m 1 April 2014 Exchange... -

Page 126

...up share capital Called up share capital is the number of shares in issue at their par value. A number of shares were allotted during the year in relation to employee share schemes. Accounting policies Equity instruments issued by the Group are recorded at the amount of the proceeds received, net of... -

Page 127

... and are subject to an insignificant risk of changes in value. 2016 £m 2015 £m Additional information Cash at bank and in hand Money market funds Repurchase agreements Commercial paper Cash and cash equivalents as presented in the statement of financial position Bank overdrafts Cash and cash... -

Page 128

...-term and long-term issuances in the capital markets including bond and commercial paper issues and bank loans. We manage the basis on which we incur interest on debt between fixed interest rates and floating interest rates depending on market conditions using interest rate derivatives. The Group... -

Page 129

... respectively, using quoted market prices or discounted cash flows with a discount rate based upon forward interest rates available to the Group at the reporting date. Further information can be found in note 23 "Capital and financial risk management". Vodafone Group Plc Annual Report 2016 127 -

Page 130

... derivatives (which includes cross currency interest rate swaps and foreign exchange swaps) is as follows: 2016 Payable £m Receivable £m Payable £m 2015 Receivable £m Sterling Euro US dollar Japanese yen Other Vodafone Group Plc Annual Report 2016 17,890 11,672 7,748 673 5,388... -

Page 131

...as positive indicate an increase in fixed interest debt and figures shown in brackets indicate a reduction in fixed interest debt. 2 Figures shown as "in more than five years" relate to the periods from March 2021 to March 2022 (2015: March 2020 to March 2021). Vodafone Group Plc Annual Report 2016... -

Page 132

... domination agreement in relation to Kabel Deutschland AG (£1.4 billion) and deferred spectrum licence costs in India (£4.1 billion). This increased by £6.9 billion in the year as a result of payments for spectrum licences and equity shareholder dividends which outweighed positive free cash flow... -

Page 133

... risk limits of the Board approved treasury policy. The main forms of liquid investment at 31 March 2016 were managed investment funds, money market funds, UK index linked government bonds, tri-party repurchase agreements and bank deposits. The cash received from collateral support agreements... -

Page 134

..., maturing 4 December 2020. This facility is fully drawn down and is amortising. This facility was drawn down in full on 5 June 2013. This facility was drawn down in full on 18 September 2012. This facility was drawn down in full on 4 December 2013. 132 Vodafone Group Plc Annual Report 2016 -

Page 135

...associates and to non-controlling shareholders Dividends from our associates are generally paid at the discretion of the Board of Directors or shareholders of the individual operating and holding companies, and we have no rights to receive dividends except where specified within certain of the Group... -

Page 136

... the Group's policies approved by the Board of Directors, which provide written principles on the use of financial derivatives consistent with the Group's risk management strategy. Changes in values of all derivatives of a financing nature are included within investment income and financing costs in... -

Page 137

... comprising the Group's Chief Financial Officer, Group General Counsel and Company Secretary, Group Financial Controller, Group Treasury Director and Director of Financial Reporting meets three times a year to review treasury activities and its members receive management information relating to... -

Page 138

...holder at that point. Detailed below is the value of the cash collateral, which is reported within short-term borrowings, held by the Group at 31 March: 2016 £m 2015 £m Cash collateral 2,837 2,542 The majority of the Group's trade receivables are due for maturity within 90 days and largely... -

Page 139

...2016 £m 2015 £m Overview Strategy review Performance Governance Financials Additional information Euro 8% (2015: 5%) change - Operating profit1 Note: 1 Operating profit before impairment losses and other income and expense. 109 81 At 31 March 2016 the Group's sensitivity to foreign exchange... -

Page 140

... market sourced data. 4 Listed and unlisted securities are classified as held for sale financial assets and fair values are derived from observable quoted market prices for similar items. Details are included in note 13 "Other investments". Fair value and carrying value information The fair values... -

Page 141

... Key management compensation Aggregate compensation for key management, being the Directors and members of the Executive Committee, was as follows: 2016 £m 2015 £m 2014 £m Short-term employee benefits Share-based payments 22 20 42 18 18 36 17 21 38 Vodafone Group Plc Annual Report 2016... -

Page 142

...the consolidated financial statements (continued) 25. Employees This note shows the average number of people employed by the Group during the year, in which areas of our business our employees work and where they are based. It also shows total employment costs. 2016 Employees 2015 Employees 2014... -

Page 143

...Africa, Spain and the UK. Financials Income statement expense 2016 £m 2015 £m 2014 £m Additional information Defined contribution schemes Defined benefit schemes Total amount charged to income statement (note 25) 163 44 207 155 40 195 124 34 158 Vodafone Group Plc Annual Report 2016... -

Page 144

... benefit pension schemes expose the Group to actuarial risks such as longer than expected longevity of members, lower than expected return on investments and higher than expected inflation, which may increase the liabilities or reduce the value of assets of the plans. The UK pensions environment... -

Page 145

...) Governance Financials Additional information 2015 £m 2014 £m 2013 £m 2012 £m Analysis of net deficit: Total fair value of scheme assets Present value of funded scheme liabilities Net deficit for funded schemes Present value of unfunded scheme liabilities Net deficit Net deficit is... -

Page 146

... rate hedging and, in the CWW Section of the Vodafone UK plan, a substantial insured pensioner buy-in policy. The actual return on plan assets over the year to 31 March 2016 was a loss of £2 million (2015: £897 million return). Sensitivity analysis Measurement of the Group's defined benefit... -

Page 147

... and usually at a discount of 20% to the then prevailing market price of the Company's shares. Financials Additional information Share plans Vodafone Group executive plans Under the Vodafone Global Incentive Plan awards of shares are granted to Directors and certain employees. The release of these... -

Page 148

...information The total fair value of shares vested during the year ended 31 March 2016 was £58 million (2015: £84 million; 2014: £90 million). The compensation cost included in the consolidated income statement in respect of share options and share plans was £117 million (2015: £88 million; 2014... -

Page 149

... customers unified communication services. The purchase price allocation is set out in the table below: Fair value £m Net assets acquired: Identifiable intangible assets1 Property, plant and equipment Other investments Trade and other receivables Cash and cash equivalents Current and deferred... -

Page 150

... contracts placed for property, plant and equipment and intangible assets. Vodafone Group Plc Annual Report 2016 Capital commitments at 31 March 2015 included £2,682 million in relation to spectrum acquired in 12 telecom circles in India, the purchase of which was completed during the year. 148 -

Page 151

... 2016 Vodafone agreed to acquire You Broadband (India) Private Limited and You System Integration Private Limited in India for £35 million. The transaction, which is expected to close later this year, is subject to regulatory approval by the Foreign Investment Promotion Board. Overview Strategy... -

Page 152

... 2015, Vodafone Group Plc and Vodafone Consolidated Holdings Limited served a trigger notice on the Indian Government under the United Kingdom-India Bilateral Investment Treaty ('UK BIT') in respect of retrospective tax claims under the Finance Act 2012. On 4 February 2016, VIHBV received a reminder... -

Page 153

... claim in its entirety. FASTWEB appealed the decision and the first appeal hearing took place in September 2015. The Court has scheduled a final hearing for September 2016. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2016 151 -

Page 154

... settlement. Greece: Papistas Holdings SA, Mobile Trade Stores (formerly Papistas SA) and Athanasios and Loukia Papistas v Vodafone Greece, Vodafone Group Plc and certain Directors and Officers of Vodafone. In December 2013, Mr and Mrs Papistas, and companies owned or controlled by them, brought... -

Page 155

...line with market rates. Dividends received from associates and joint ventures are disclosed in the consolidated statement of cash flows. Transactions with Directors other than compensation During the three years ended 31 March 2016, and as of 17 May 2016, no Director nor any other executive officer... -

Page 156

... and Reports) Regulations 2008) as at 31 March 2016 is detailed below. The registered office address for each entity is also disclosed as additional information. No subsidiaries are excluded from the Group consolidation. Unless otherwise stated the Company's subsidiaries all have share capital... -

Page 157

... Vodafone Enterprise Global Network HK Ltd Vodafone Enterprise Hong Kong Ltd 100.00 100.00 Ordinary shares Ordinary shares Vodafone House, Corporate Road, Prahladnagar, Off S. G. Highway, Ahmedabad, Gujarat, 380051, India Vodafone Business Services Limited Vodafone India Services Private Limited... -

Page 158

... class Company name Share class Company name Share class Ireland 27 Lower Fitzwilliam Street, Dublin 2, Ireland Siro Limited Vodafone Ireland Marketing Limited Cable & Wireless (Ireland) Limited Cable & Wireless GN Limited Vodafone Ireland Property Holdings Limited Cable & Wireless Services... -

Page 159

... Networks B.V. Vodafone Enterprise Netherlands BV Vodafone Europe B.V. Vodafone International Holdings B.V. Vodafone Panafon International Holdings B.V. XM Mobile B.V. Cable & Wireless Internet Service Provider B.V. 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 Ordinary shares Ordinary... -

Page 160

... Limited Cable & Wireless Capital Limited Cable & Wireless CIS Services Limited Cable & Wireless Communications Data Network Services Limited Cable & Wireless Communications Starclass Limited Cable & Wireless Europe Holdings Limited Cable & Wireless Global Business Services Limited Share class... -

Page 161

... shares Company name Vodafone Panafon UK Vodafone Partner Services Limited Vodafone Property Investments Limited Vodafone Retail (Holdings) Limited Vodafone Retail Limited Vodafone Sales & Services Limited Vodafone Satellite Services Limited Vodafone Specialist Communications Limited Vodafone UK... -

Page 162

... on the closing quoted share price on the Nairobi Stock Exchange. 7 Shareholding is indirect through Vodafone Kabel Deutschland GmbH. 8 The entity was merged with its parent company Cable & Wireless Ireland Holdings Limited now re-named Vodafone Ireland Property Holdings Limited on 31 March 2016 by... -

Page 163

... are material to the Group. Vodacom Group Limited 2016 £m 2015 £m Vodafone Egypt Telecommunications S.A.E. 2016 £m 2015 £m Vodafone Qatar Q.S.C. 2016 £m 2015 £m Overview Summary comprehensive income information Revenue Profit/(loss) for the financial year Other comprehensive expense/(income... -

Page 164

... of the Companies Act 2006 for the year ended 31 March 2016. Name Registration number Name Registration number AAA (MCR) Ltd AAA (UK) Ltd Cable & Wireless Capital Limited Cable & Wireless CIS Services Limited Cable & Wireless Europe Holdings Limited Cable & Wireless Global Holding Limited Cable and... -

Page 165

... £m % change 2015 £m 2014 £m £ Organic* Overview Strategy review Revenue 27,687 13,382 Service revenue 25,588 11,934 Other revenue 2,099 1,448 EBITDA 7,894 4,086 Adjusted operating profit 1,733 1,802 Adjustments for: Impairment loss Restructuring costs Amortisation of acquired customer bases... -

Page 166

... results presented for the year ended 31 March 2015 and 2014 have been restated onto a comparable basis. There is no impact on total Group revenue or cost. Revenue increased 15.7%. M&A activity, including KDG, Ono and the consolidation of Vodafone Italy, contributed a 26.7 percentage point positive... -

Page 167

...expectations. EBITDA declined 2.8%*, with a 0.1* percentage point increase in EBITDA margin, as the impact of lower service revenue was largely offset by strong cost control. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2016 165 -

Page 168

... point improvement in EBITDA margin as economies of scale from growing service revenue were partly offset by the increase in operating costs related to the Project Spring network build and higher acquisition costs. Revenue - AMAP Service revenue India Vodacom Other AMAP AMAP EBITDA India Vodacom... -

Page 169

... by growth in customers, voice bundles and data. Total revenue growth in Qatar was 13.2%*, but slowed in H2 due to significantly increased price competition. EBITDA grew 7.0%* with a 0.3* percentage point decline in EBITDA margin. Additional information Vodafone Group Plc Annual Report 2016 167 -

Page 170

...own Profit and loss shareholders' 2 3 shares account funds £m £m £m 1 April 2014 Issue or reissue of shares Loss for the financial year Dividends Capital contribution given relating to share-based payments Contribution received relating to share-based payments Other movements 31 March 2015 Issue... -

Page 171

... 46 to 52 of IFRS 2, "Shared-based payment" (details of the number and weighted-average exercise prices of share options, and how the fair value of goods or services received was determined); a IFRS 7 "Financial Instruments: Disclosures"; Performance Overview Strategy review a Paragraph 91 to 99 of... -

Page 172

... accounting The Company's activities expose it to the financial risks of changes in foreign exchange rates and interest rates which it manages using derivative financial instruments. The use of derivative financial instruments is governed by the Group's policies approved by the Board of Directors... -

Page 173

... Financials Percentage shareholding Vodafone European Investments Holding company England 100 Details of direct and indirect related undertakings are set out in note 33 "Related undertakings" to the consolidated financial statements. 3. Debtors Additional information 2016 £m 2015... -

Page 174

... are set out in note 22 "Liquidity and capital resources" on pages 131 to 133 in the consolidated financial statements. 6. Share capital Accounting policies Equity instruments issued by the Company are recorded as the proceeds received, net of direct issuance costs. 2016 Number £m Number 2015... -

Page 175

... £m Overview US share awards and option scheme awards 608,910 - 1 Strategy review 7. Share-based payments Accounting policies The Group operates a number of equity-settled share-based payment plans for the employees of subsidiaries using the Company's equity instruments. The fair value of... -

Page 176

... of its joint venture, Vodafone Hutchison Australia Pty Limited. The Company will guarantee the debts and liabilities of certain of its UK subsidiaries at the balance sheet date in accordance with section 479C of the Companies Act 2006. The Company has assessed the probability of loss under these... -

Page 177

....co.uk for details and terms and conditions. Cash dividends to ADS holders will be paid by the ADS depositary in US dollars. The sterling/US dollar exchange rate for this purpose is determined by us up to ten New York and London business days before the payment date. For the financial year ending... -

Page 178

... market quotations of ordinary shares on the London Stock Exchange, and (ii) the reported high and low sales prices of ADSs on NASDAQ. London Stock Exchange Pounds per ordinary share Year ended 31 March High Low High NASDAQ Dollars per ADS Low Quarter High Low High Low 2012 2013 2014 2015 2016... -

Page 179

... the Director's interest in the Company's shares or other securities. However, this restriction on voting does not apply in certain circumstances set out in the Articles of Association. Additional information Markets Ordinary shares of Vodafone Group Plc are traded on the London Stock Exchange and... -

Page 180

... of the Company's ADSs are entitled to receive notices of shareholders' meetings under the terms of the deposit agreement relating to the ADSs. Employees are able to vote any shares held under the Vodafone Group Share Incentive Plan and "My ShareBank" (a vested nominee share account) through the... -

Page 181

... income tax purposes; investors holding shares or ADSs in connection with a trade or business conducted outside of the US; or investors whose functional currency is not the US dollar. Vodafone Group Plc Annual Report 2016 Limitations on transfer, voting and shareholding As far as the Company is... -

Page 182

...day they are received, the US holder generally will not be required to recognise any foreign currency gain or loss in respect of the dividend income. Where UK tax is payable on any dividends received, a foreign tax credit may be claimable under the treaty. 180 Vodafone Group Plc Annual Report 2016 -

Page 183

... other reporting obligations that may apply to the ownership or disposition of shares or ADSs, including requirements related to the holding of certain foreign financial assets. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2016... -

Page 184

... â,¬920 million (£784 million) before tax and transaction costs. a On 27 July 2012 we acquired the entire share capital of Cable & Wireless Worldwide plc for a cash consideration of £1,050 million. a On 31 October 2012 we acquired TelstraClear Limited in New Zealand for a cash consideration of NZ... -

Page 185

...single market. The strategy has three pillars: (i) maximising the growth potential of the European digital economy; (ii) creating the right conditions for digital networks and services to flourish; and (iii) better access for consumers and businesses to online e-goods and services across Europe. The... -

Page 186

... August 2016 expiration date of Vodafone Greece's 2x15MHz spectrum at 1800MHz. Czech Republic In June 2015 the former fixed incumbent (O2 Czech Republic) was split into two legally separate entities (network and service company) but both entities are still controlled by the private investment fund... -

Page 187

... and off net 8.5 US cents per minute set in March 2015 and extended the price floor to cover international outgoing calls and promotions until June 2016. In December 2015 Vodacom Congo's 2G licence was renewed with a ten-year extension taking the expiry date to 1 January 2028, together with securing... -

Page 188

... and legal proceedings" to the consolidated financial statements. Ghana In December 2015 the national regulatory authority ('NCA') conducted a spectrum auction in the 800MHz band. Vodafone Ghana as well as the other four mobile network operators and three mobile broadband wireless access operators... -

Page 189

...') is ready to issue the full Commercial Licence. The CA is also conducting a stakeholders' consultation on the allocation of LTE spectrum in the 800MHz band to all mobile operators. In August 2015 CA issued new subscriber regulations to be implemented by February 2016. Safaricom is working with the... -

Page 190

... for asymmetric data (non-voice) use; block quantity has been rounded to the nearest whole number. 2 Blocks within the same spectrum band but with different licence expiry dates are separately identified. 3 UK - 900MHz, 1800MHz and 2.1GHz - indefinite licence with a five-year notice of revocation... -

Page 191

... rate or where a glide-path or a final decision has been determined by the national regulatory authority. 3 MTR under review by ECJ and decision due after June 2016. 4 MTR under appeal and due to be heard 18 May 2016. 5 Please see Vodacom: South Africa on page 185. Vodafone Group Plc Annual Report... -

Page 192

... of associates, impairment losses, restructuring costs, amortisation of customer bases and brand intangible assets, other operating income and expense and other significant one-off items. Adjusted earnings per share also excludes certain foreign exchange rate differences, together with related tax... -

Page 193

.... For the year ended 31 March 2016, the Group has amended its reporting to reflect changes in the internal management of its Enterprise business. The primary change has been that, on 1 April 2015, the Group redefined its segments to report international voice transit service revenue and costs within... -

Page 194

... pps Reported change % 31 March 2016 Group Revenue Service revenue Service revenue excluding the impact of MTR cuts Enterprise service revenue Enterprise fixed service revenue Vodafone Global Enterprise service revenue Machine-to-machine revenue EBITDA Percentage point change in EBITDA margin... -

Page 195

... exchange pps Reported change % Overview AMAP India - Service revenue excluding the impact of MTR cuts and other South Africa - Service revenue Vodacom's international operations - Service revenue Turkey - Service revenue Egypt - Service revenue India - Percentage point change in EBITDA margin... -

Page 196

... - Service revenue New Zealand - Service revenue Ghana - Service revenue Qatar - Total revenue Vodacom - Percentage point change in EBITDA margin Other AMAP - Percentage point change in EBITDA margin 31 March 2014 restated Group Revenue Service revenue EBITDA Adjusted operating profit Europe Revenue... -

Page 197

... applicable Not applicable Risk management History and development Contact details Shareholder information: Registrar and transfer office Shareholder information: Articles of association and applicable English law Chief Executive's strategic review Chief Financial Officer's review Note 1 "Basis of... -

Page 198

... 24 "Directors and key management compensation" Compliance with the 2014 UK Corporate Governance Code Shareholder information: Articles of association and applicable English law Directors' remuneration Board of Directors Board Committees Our people Note 25 "Employees" Directors' remuneration Note 27... -

Page 199

... Governance Directors' statement of responsibility: Management's report on internal control over financial reporting Report of independent registered public accounting firm Board Committees Our US listing requirements Note 3 "Operating profit/(loss)" Board Committees: Audit and Risk Committee... -

Page 200

... political conditions in the jurisdictions in which the Group operates and changes to the associated legal, regulatory and tax environments; a increased competition; a levels of investment in network capacity and the Group's ability to deploy new technologies, products and services; a rapid changes... -

Page 201

...; a developments in the Group's financial condition, earnings and distributable funds and other factors that the Board takes into account in determining the level of dividends; a the Group's ability to satisfy working capital requirements; a changes in foreign exchange rates; Governance Financials... -

Page 202

... Information and communications technology. IFRS International Financial Reporting Standards. Impairment A downward revaluation of an asset. Interconnect costs A charge paid by Vodafone to other fixed line or mobile operators when a Vodafone customer calls a customer connected to a different network... -

Page 203

... in digital form via discrete packets rather than by using the traditional public switched telephone network. Verizon Wireless, the Group's former associate in the United States. Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2016... -

Page 204

...March 2016 2015 2014 2013 2012 Consolidated income statement data (£m) Revenue Operating profit/(loss) (Loss)/profit before taxation (Loss)/profit for financial year from continuing operations (Loss)/profit for the financial year Consolidated statement of financial position data (£m) Total assets... -

Page 205

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc Annual Report 2016 Notes 203 -

Page 206

Notes 204 Vodafone Group Plc Annual Report 2016 -

Page 207

... design of the Vodafone Group. Other product and company names mentioned herein may be the trade marks of their respective owners. The content of our website (vodafone.com) should not be considered to form part of this annual report or our annual report on Form 20-F. © Vodafone Group 2016 Text... -

Page 208

Vodafone Group Plc Annual Report 2016 Vodafone Group Plc Registered Office: Vodafone House The Connection Newbury Berkshire RG14 2FN England Registered in England No. 1833679 Telephone: +44 (0)1635 33251 Fax: +44 (0)1635 238080 Contact details: Shareholder helpline Telephone: +44 (0)370 702 0198 (...