Vodafone 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 97

Financials

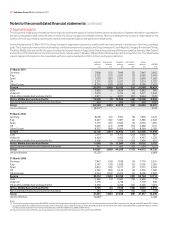

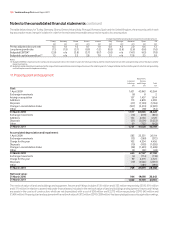

9. Intangible assets

Licences and Computer

Goodwill spectrum software Other Total

£m £m £m £m £m

Cost:

1 April 2009 106,664 26,138 7,359 1,471 141,632

Exchange movements (2,751) 62 (72) 326 (2,435)

Arising on acquisition 1,185 1,454 153 1,604 4,396

Change in consolidation status (102) (413) (281) (175) (971)

Additions – 306 1,199 19 1,524

Disposals – – (114) – (114)

31 March 2010 104,996 27,547 8,244 3,245 144,032

Exchange movements (1,120) (545) (16) 8 (1,673)

Arising on acquisition 24 – 17 – 41

Additions – 3,157 1,493 9 4,659

Disposals – – (424) (1) (425)

Other – – 635 8 643

31 March 2011 103,900 30,159 9,949 3,269 147,277

Accumulated impairment losses and amortisation:

1 April 2009 52,706 7,552 5,223 1,213 66,694

Exchange movements (1,848) (29) (104) 64 (1,917)

Amortisation charge for the year – 1,730 1,046 678 3,454

Change in consolidation status – (135) (154) (181) (470)

Impairment losses 2,300 (200) – – 2,100

Disposals – – (87) – (87)

31 March 2010 53,158 8,918 5,924 1,774 69,774

Exchange movements (644) (104) (14) (6) (768)

Amortisation charge for the year – 1,809 1,166 529 3,504

Impairment losses 6,150 – – – 6,150

Disposals – – (426) – (426)

Other – – 485 – 485

31 March 2011 58,664 10,623 7,135 2,297 78,719

Net book value:

31 March 2010 51,838 18,629 2,320 1,471 74,258

31 March 2011 45,236 19,536 2,814 972 68,558

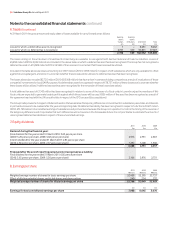

For licences and spectrum and other intangible assets, amortisation is included within the cost of sales line within the consolidated income statement.

Licences and spectrum with a net book value of £3,845 million (2010: £2,570 million) have been pledged as security against borrowings.

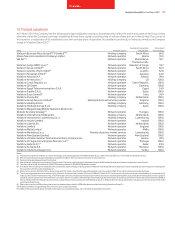

The net book value at 31 March 2011 and expiry dates of the most significant licences are as follows:

2011 2010

Expiry date £m £m

Germany December 2020/2025 5,540 4,802

UK December 2021 3,581 3,914

India September 2030 1,746 –

Qatar June 2028 1,187 1,328

Italy December 2021 1,002 1,097

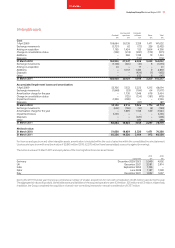

During the 2011 financial year the Group completed a number of smaller acquisitions for net cash consideration of £46 million paid during the year.

The aggregate fair values of goodwill, identifiable assets and liabilities of the acquired operations were £24 million, £25 million and £3 million, respectively.

In addition, the Group completed the acquisition of certain non-controlling interests for net cash consideration of £137 million.