Vodafone 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Vodafone Group Plc Annual Report 2011

Financial position and resources continued

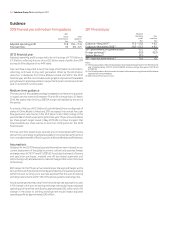

We provide returns to shareholders through dividends and have historically

paid dividends semi-annually, with a regular interim dividend in respect of

the first six months of the financial year payable in February and a final

dividend payable in August. The directors expect that we will continue to pay

dividends semi-annually.

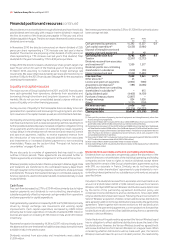

In November 2010 the directors announced an interim dividend of 2.85

pence per share representing a 7.1% increase over last year’s interim

dividend. The directors are proposing a final dividend of 6.05 pence per

share representing a 7.1% increase over last year’s final dividend. Total

dividends for the year increased by 7.1% to 8.90 pence per share.

In May 2010 the directors issued a dividend per share growth target of at

least 7% per annum for each of the financial years in the period ending

31 March 2013, assuming no material adverse foreign exchange rate

movements. We expect that total dividends per share will therefore be no

less than 10.18p for the 2013 financial year. See page 44 for the assumptions

underlying this expectation.

Liquidity and capital resources

The major sources of Group liquidity for the 2011 and 2010 financial years

were cash generated from operations, dividends from associates and

borrowings through short-term and long-term issuances in the capital

markets. We do not use non-consolidated special purpose entities as a

source of liquidity or for other financing purposes.

Our key sources of liquidity for the foreseeable future are likely to be cash

generated from operations and borrowings through long-term and short-

term issuances in the capital markets as well as committed bank facilities.

Our liquidity and working capital may be affected by a material decrease in

cash flow due to factors such as reduced operating cash flow resulting from

further possible business disposals, increased competition, litigation, timing

of tax payments and the resolution of outstanding tax issues, regulatory

rulings, delays in the development of new services and networks, licence

and spectrum payments, inability to receive expected revenue from

the introduction of new services, reduced dividends from associates

and investments or increased dividend payments to non-controlling

shareholders. Please see the section titled “Principal risk factors and

uncertainties” on pages 45 and 46.

We are also party to a number of agreements that may result in a cash

outflow in future periods. These agreements are discussed further in

“Option agreements and similar arrangements” at the end of this section.

Wherever possible, surplus funds in the Group (except in Albania, Egypt, India

and Vodacom) are transferred to the centralised treasury department

through repayment of borrowings, deposits, investments, share purchases

and dividends. These are then loaned internally or contributed as equity to

fund our operations, used to retire external debt, invested externally or used

to pay dividends.

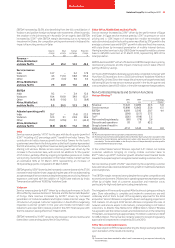

Cash ows

Free cash flow decreased by 2.7% to £7,049 million primarily due to higher

taxation payments and dividends to non-controlling shareholders in

subsidiaries partially offset by improved cash generated from operations

and lower payments for capital expenditure.

Cash generated by operations increased by 0.4% to £15,392 million primarily

driven by foreign exchange rate movements and working capital

improvements. Cash capital expenditure decreased by £328 million

primarily due to lower expenditure in India. We invested £2,982 million in

licences and spectrum including £1,725 million in India and £1,210 million

in Germany.

Payments for taxation increased by 14.3% to £2,597 million primarily due to

the absence of the one-time benefit of additional tax deductions which were

available in Italy in the previous year.

Dividends received from associates and investments were stable at

£1,509 million.

Net interest payments decreased by 5.5% to £1,328 million primarily due to

lower average net debt.

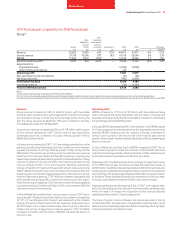

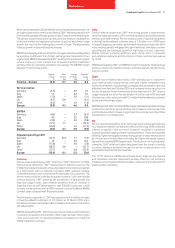

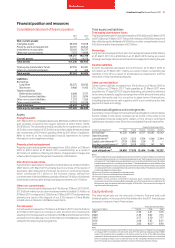

2011 2010

£m £m %

Cash generated by operations 15,392 15,337 0.4

Cash capital expenditure(1) (5,658) (5,986)

Disposal of intangible assets and

property, plant and equipment 51 48

Operating free cash flow 9,785 9,399 4.1

Taxation (2,597) (2,273)

Dividends received from associates

and investments(2) 1,509 1,577

Dividends paid to non-controlling

shareholders in subsidiaries (320) (56)

Interest received and paid (1,328) (1,406)

Free cash flow 7,049 7,241 (2.7)

Other amounts(3) 45 –

Licence and spectrum payments (2,982) (989)

Acquisitions and disposals(4) (183) (2,683)

Contributions from non-controlling

shareholders in subsidiaries(5) – 613

Equity dividends paid (4,468) (4,139)

Purchase of treasury shares (2,087) –

Foreign exchange 834 1,038

Other(6) 5,250 (174)

Net debt decrease 3,458 907

Opening net debt (33,316) (34,223)

Closing net debt (29,858) (33,316) (10.4)

Notes:

(1) Cash paid for purchase of property, plant and equipment and intangible assets, other than

licence and spectrum payments.

(2) Year ended 31 March 2011 includes £373 million (2010:£389 million) from our interest in SFR

and £1,024 million (2010: £1,034 million) from our interest in Verizon Wireless.

(3) Comprises items in respect of: the UK CFC settlement (£800 million), tax relating to the disposal

of China Mobile Limited (£208 million), the SoftBank disposal (£1,409 million) and the court

deposit made in respect of the India tax case (£356 million). The latter is included within the line

item “Purchase of interests in subsidiaries and joint ventures, net of cash acquired” in the

consolidated statement of cash flows.

(4) Year ended 31 March 2011 includes net cash and cash equivalents paid of £183 million (2010:

£1,777 million) and assumed debt of £nil (2010: £906 million).

(5) Year ended 31 March 2010 includes £613 million in relation to Qatar.

(6) Year ended 31 March 2011 includes £4,264 million in relation to the disposal of our 3.2% interest

in China Mobile Limited.

Dividends from associates and to non-controlling shareholders

Dividends from our associates are generally paid at the discretion of the

board of directors or shareholders of the individual operating and holding

companies and we have no rights to receive dividends except where

specified within certain of the Group’s shareholders’ agreements such as

with SFR, our associate in France. Similarly, we do not have existing

obligations under shareholders’ agreements to pay dividends to non-

controlling interest partners of our subsidiaries or joint ventures, except as

specified below.

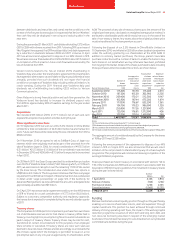

Included in the dividends received from associates and investments is an

amount of £1,024 million (2010: £1,034 million) received from Verizon

Wireless. Until April 2005 Verizon Wireless’ distributions were determined

by the terms of the partnership agreement distribution policy and

comprised income distributions and tax distributions. Since April 2005

only tax distributions have been issued. Following the announcement of

Verizon Wireless’ acquisition of Alltel, certain additional tax distributions

were agreed in addition to the tax distributions required by the partnership

agreement. Taken together with recent revisions to the tax distribution

provisions in the partnership agreement, current projections forecast that

tax distributions will cover the US tax liabilities arising from our partnership

interest in Verizon Wireless.

Under the terms of the partnership agreement the Verizon Wireless board

has no obligation to effect additional distributions above the level of the

tax distributions. However, the Verizon Wireless board has agreed that it

will review distributions from Verizon Wireless on a regular basis. When

considering whether distributions will be made each year, the Verizon

Wireless board will take into account its debt position, the relationship