Vodafone 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Vodafone Group Plc Annual Report 2011

Notes to the consolidated nancial statements continued

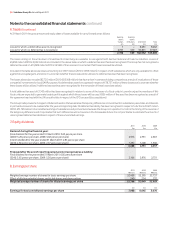

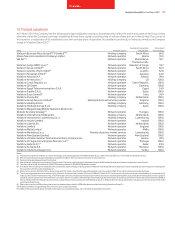

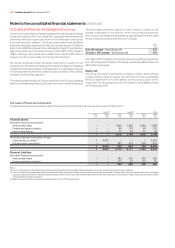

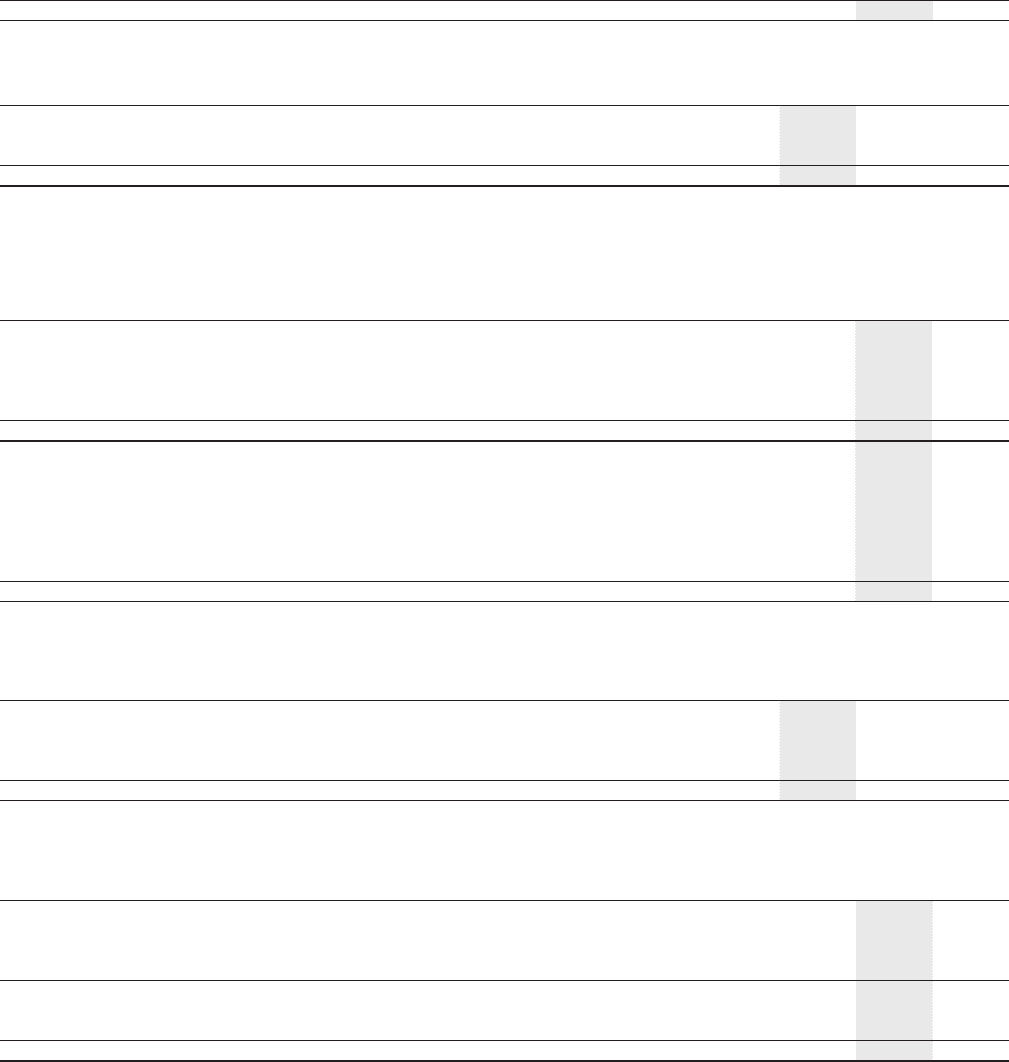

16. Inventory

2011 2010

£m £m

Goods held for resale 537 433

Inventory is reported net of allowances for obsolescence, an analysis of which is as follows:

2011 2010 2009

£m £m £m

1 April 120 111 118

Exchange movements (1) 5 13

Amounts (credited)/charged to the income statement (2) 4 (20)

31 March 117 120 111

Cost of sales includes amounts related to inventory amounting to £5,878 million (2010: £5,268 million; 2009: £4,853 million).

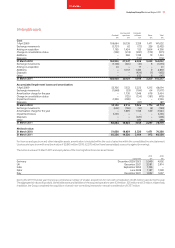

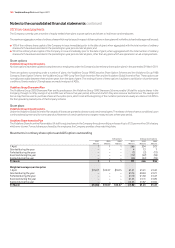

17. Trade and other receivables

2011 2010

£m £m

Included within non-current assets:

Trade receivables 92 59

Other receivables 1,719 678

Prepayments and accrued income 137 148

Derivative financial instruments 1,929 1,946

3,877 2,831

Included within current assets:

Trade receivables 4,185 4,008

Amounts owed by associates 53 24

Other receivables 1,606 1,122

Prepayments and accrued income 3,299 3,448

Derivative financial instruments 116 182

9,259 8,784

The Group’s trade receivables are stated after allowances for bad and doubtful debts based on management’s assessment of creditworthiness, an analysis

of which is as follows:

2011 2010 2009

£m £m £m

1 April 929 874 664

Exchange movements (30) (27) 101

Amounts charged to administrative expenses 460 465 423

Trade receivables written off (353) (383) (314)

31 March 1,006 929 874

The carrying amounts of trade and other receivables approximate their fair value. Trade and other receivables are predominantly non-interest bearing.

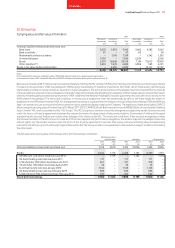

2011 2010

£m £m

Included within “Derivative financial instruments”:

Fair value through the income statement (held for trading):

Interest rate swaps 1,292 1,031

Foreign exchange swaps 99 132

1,391 1,163

Fair value hedges:

Interest rate swaps 654 965

2,045 2,128

The fair values of these financial instruments are calculated by discounting the future cash flows to net present values using appropriate market interest

and foreign currency rates prevailing at 31 March.