Vodafone 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 Vodafone Group Plc Annual Report 2011

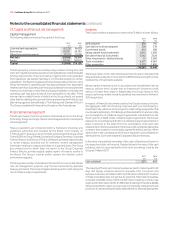

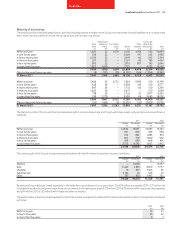

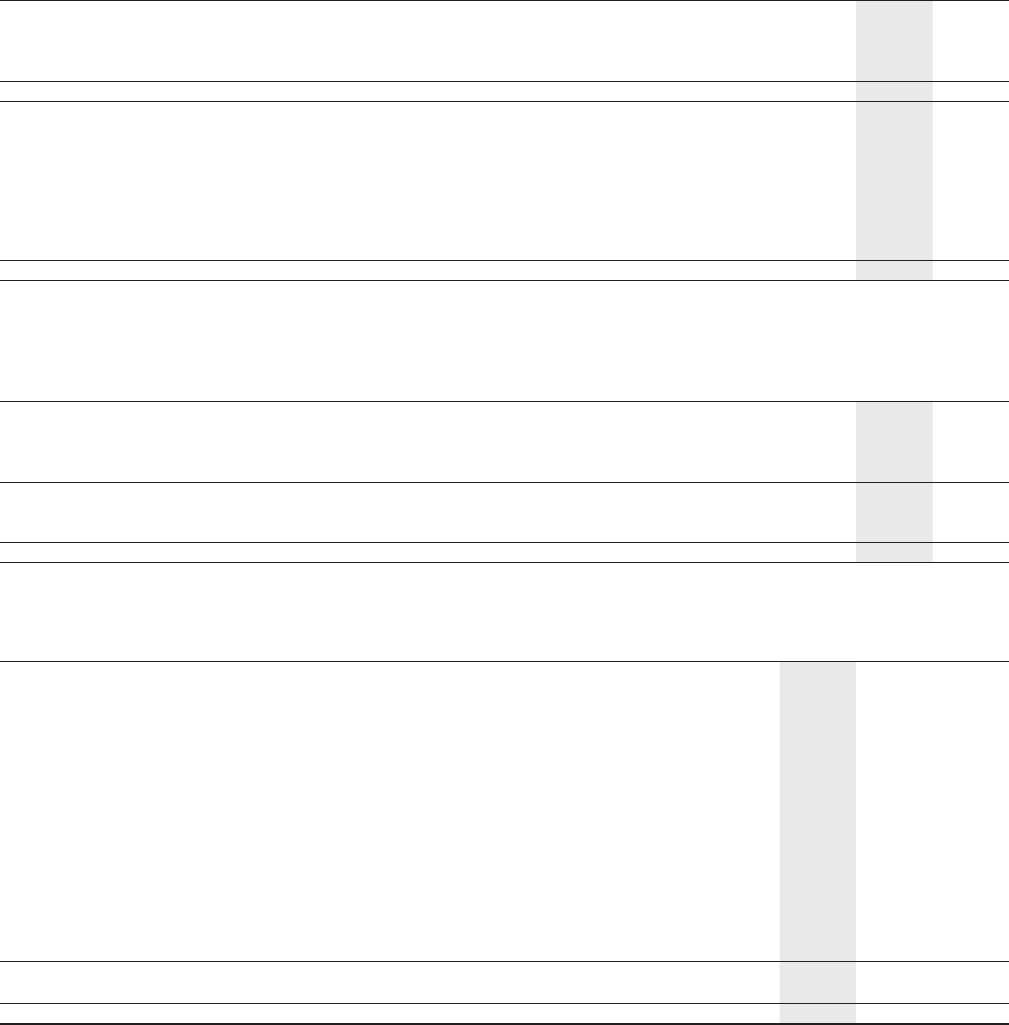

25. Trade and other payables

2011 2010

£m £m

Included within non-current liabilities:

Other payables 80 76

Accruals and deferred income 329 379

Derivative financial instruments 395 361

804 816

Included within current liabilities:

Trade payables 4,453 3,254

Amounts owed to associates 23 17

Other taxes and social security payable 1,140 998

Other payables 520 650

Accruals and deferred income 8,409 9,064

Derivative financial instruments 153 99

14,698 14,082

The carrying amounts of trade and other payables approximate their fair value. The fair values of the derivative financial instruments are calculated by

discounting the future cash flows to net present values using appropriate market interest and foreign currency rates prevailing at 31 March.

2011 2010

£m £m

Included within “Derivative financial instruments”:

Fair value through the income statement (held for trading):

Interest rate swaps 342 330

Foreign exchange swaps 153 95

495 425

Fair value hedges:

Interest rate swaps 53 35

548 460

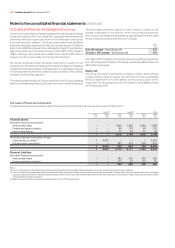

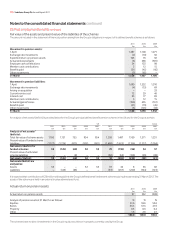

26. Reconciliation of net cash ow from operating activities

2011 2010 2009

£m £m £m

Profit for the financial year 7,870 8,618 3,080

Adjustments for:

Share-based payments 156 150 128

Depreciation and amortisation 7,876 7,910 6,814

Loss on disposal of property, plant and equipment 91 101 10

Share of result in associates (5,059) (4,742) (4,091)

Impairment losses 6,150 2,100 5,900

Other income and expense 16 (114) –

Non-operating income and expense (3,022) 10 44

Investment income (1,309) (716) (795)

Financing costs 429 1,512 2,419

Income tax expense 1,628 56 1,109

(Increase)/decrease in inventory (107) 2 81

(Increase)/decrease in trade and other receivables (387) (714) 80

Increase/(decrease) in trade and other payables 1,060 1,164 (145)

Cash generated by operations 15,392 15,337 14,634

Tax paid (3,397) (2,273) (2,421)

Net cash flow from operating activities 11,995 13,064 12,213

Notes to the consolidated nancial statements continued