Vodafone 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.122 Vodafone Group Plc Annual Report 2011

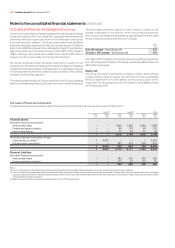

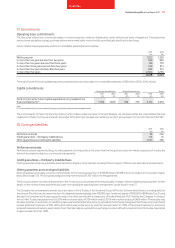

28. Contingent liabilities continued

Legal proceedings

The Company and its subsidiaries are currently, and may be from time to

time, involved in a number of legal proceedings, including inquiries from, or

discussions with, governmental authorities that are incidental to their

operations. However, save as disclosed below, the Company and its

subsidiaries are not currently involved in any legal or arbitration proceedings

(including any governmental proceedings which are pending or known to

be contemplated) which may have, or have had in the 12 months preceding

the date of this report, a significant effect on the financial position or

profitability of the Company and its subsidiaries. With the exception of the

Vodafone 2 enquiry, due to inherent uncertainties, no accurate

quantification of any cost, or timing of such cost, which may arise from any

of the legal proceedings outlined below can be made.

The Company was one of a number of co-defendants in four actions filed in

2001 and 2002 in the Superior Court of the District of Columbia in the

United States alleging personal injury, including brain cancer, from mobile

phone use. The Company is not aware that the health risks alleged in such

personal injury claims have been substantiated and vigorously defends such

claims. In August 2007 the trial court dismissed all four actions against the

Company on the basis of the federal pre-emption doctrine. On 29 October

2009 the District of Columbia Court of Appeals ruled on the plaintiffs’ appeal

of the trial court’s dismissal of all claims in the action on the basis of the

federal pre-emption doctrine. The Court of Appeals has upheld the dismissal

of most claims. However, the decision permits the plaintiffs to continue any

claims alleging i) injuries in respect of mobile phones purchased before 1

August 1996 (the date of the Federal Communication Commission’s Specific

Absorption Rate standard (‘FCC standard’)); ii) injuries in respect of mobile

phones alleged not to have complied with the FCC standard; and iii) fraud

and misrepresentation in respect of the sale or marketing of mobile phones

in question. The cases were returned to the trial court to be adjudicated in

accordance with the Court of Appeals’ decision and on 3 May 2010 plaintiffs

in the four actions filed amended complaints with the Superior Court.

The defendants filed a motion to dismiss the amended complaints on

30 July 2010. The plaintiffs in these four actions have agreed to dismiss

the Company from the actions on jurisdiction grounds. However, the

plaintiffs have reserved the right to re-commence the actions against the

Company if evidence supporting an assertion of jurisdiction were to emerge.

On 30 September 2010 the plaintiffs filed a stipulation for the voluntary

dismissal of the Company and the order granting the stipulation dismissing

the Company without prejudice was entered on the court record on

5 October 2010.

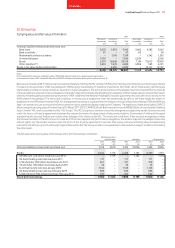

On 22 July 2010 the Company settled the Vodafone 2 CFC case with HMRC

by agreeing to pay £1.25 billion (comprising £800 million in the 2011

financial year, with the balance to be paid in instalments over the following

five years) in respect of all outstanding CFC issues from 2001 to date. It was

also agreed that no further UK CFC tax liabilities will arise in the near future

under current legislation. Longer term, no CFC liabilities are expected to

arise as a consequence of the likely reforms of the CFC regime due to the

facts established in this agreement.

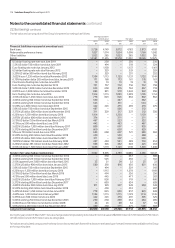

Vodafone Essar Limited (‘VEL’) and Vodafone International Holdings B.V.

(‘VIHBV’) each received notices in August 2007 and September 2007

respectively, from the Indian tax authority alleging potential liability in

connection with alleged failure by VIHBV to deduct withholding tax from

consideration paid to the Hutchison Telecommunications International

Limited group (‘HTIL’) in respect of HTIL’s gain on its disposal to VIHBV of its

interests in a wholly-owned subsidiary that indirectly holds interests in VEL.

Following the receipt of such notices, VEL and VIHBV each filed writs

seeking orders that their respective notices be quashed and that the tax

authority take no further steps under the notices. Initial hearings were held

before the Bombay High Court and in the case of VIHBV the High Court

admitted the writ for final hearing in June 2008. In December 2008 the

High Court dismissed VIHBV’s writ. VIHBV subsequently filed a special leave

petition to the Supreme Court to appeal the High Court’s dismissal of the

writ. On 23 January 2009 the Supreme Court referred the question of the

tax authority’s jurisdiction to seek to pursue tax back to the tax authority for

Notes to the consolidated nancial statements continued

adjudication on the facts with permission granted to VIHBV to appeal that

decision back to the High Court should VIHBV disagree with the tax

authority’s findings. On 30 October 2009 VIHBV received a notice from the

tax authority requiring VIHBV to show cause as to why it believed that the

tax authority did not have competent jurisdiction to proceed against VIHBV

for the default of non-deduction of withholding tax from consideration paid

to HTIL. VIHBV provided a response on 29 January 2010. On 31 May 2010

VIHBV received an order from the Indian tax authority confirming their view

that they did have jurisdiction to proceed against VIHBV as well as a further

notice alleging that VIHBV should be treated as the agent of HTIL for the

purpose of recovering tax on the transaction. VIHBV appealed this ruling to

the Bombay High Court. On 8 September 2010 the Bombay High Court

ruled that the tax authority had jurisdiction to decide whether the

transaction or some part of the transaction could be taxable in India. VIHBV

appealed this decision to the Supreme Court on 14 September 2010. A

hearing before the Supreme Court took place on 27 September 2010 at

which the Supreme Court noted the appeal and asked the tax authority to

quantify any liability. On 22 October 2010 the Indian tax authority

quantified the alleged tax liability and issued a demand for payment of INR

112.2 billion (£1.6 billion) of tax and interest. VIHBV has contested the

amount of such demand both on the basis of the calculation and on the

basis that no tax was due in any event. On 15 November 2010 VIHBV was

asked to make a deposit with the Supreme Court of INR 25 billion (£356

million) and provide a guarantee for INR 85 billion (£1,188 million) pending

final adjudication of the case, which request it duly complied with. The

Supreme Court will now hear the appeal on the issue of jurisdiction as well

as on the challenge to quantification on 19 July 2011. On 23 March 2011

VIHBV received a notice requesting it to explain why it should not be liable

for penalties of up to 100% of any tax found due for alleged failure to

withhold. On 15 April 2011 the Supreme Court, in response to an application

made by VIHBV, allowed the Indian tax authority to continue its

investigations into the application of penalties but stayed the Indian tax

authorities from enforcing any liability until after the outcome of the

Supreme Court hearing scheduled for 19 July 2011. After investigations, on

29 April 2011, the Indian tax authority raised an order alleging penalties

were due but noting that these will not be enforced in line with the Supreme

Court stay. In addition, the separate proceedings taken against VIHBV to

seek to treat it as an agent of HTIL in respect of its alleged tax on the same

transaction have been deferred until the outcome in the first matter is

known. VEL’s case also continues to be stayed pending the outcome of the

VIHBV Supreme Court hearing. VIHBV believes that neither it nor any other

member of the Group is liable for such withholding tax, or is liable to be

made an agent of HTIL; however, the outcome of the proceedings remains

uncertain and such proceedings may or may not dispose of the matter in

its entirety and there can be no assurance that any outcome will be

favourable to VIHBV or the Group.

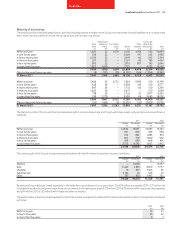

In light of the uncertainty created by the Indian tax authority’s actions as set

out above, VIHBV, through its indirect wholly owned subsidiary Euro Pacific

Securities Ltd, has sought confirmation from the Authority for Advanced

Rulings (‘AAR’) in India on whether tax should be withheld in respect of

consideration payable on the acquisition of Essar Group’s (‘Essar’) offshore

holding in VEL. A ruling from the AAR is expected by the end of May 2011 at

the latest. The Group does not believe that there is any legal requirement to

withhold tax in respect of these transactions but if, contrary to expectations,

the AAR directs tax to be withheld, this amount is anticipated to be

approximately an additional US$1 billion.