Vodafone 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 Vodafone Group Plc Annual Report 2011

Notes to the consolidated nancial statements continued

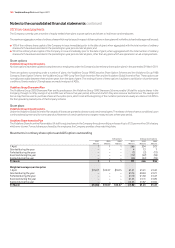

22. Borrowings continued

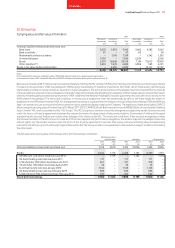

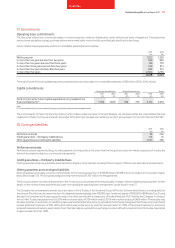

Interest rate and currency of borrowings

Total Floating rate Fixed rate Other

borrowings borrowings borrowings(1) borrowings(2)

Currency £m £m £m £m

Sterling 2,831 906 1,925 –

Euro 12,361 4,198 8,163 –

US dollar 16,030 9,488 3,352 3,190

Japanese yen 807 807 – –

Other 6,252 2,920 3,332 –

31 March 2011 38,281 18,319 16,772 3,190

Sterling 3,022 3,022 – –

Euro 14,244 9,429 4,815 –

US dollar 15,195 7,329 4,461 3,405

Japanese yen 2,605 2,605 – –

Other 4,729 4,105 624 –

31 March 2010 39,795 26,490 9,900 3,405

Notes:

(1) The weighted average interest rate for the Group’s sterling denominated fixed rate borrowings

is 5.7% (2010: n/a). The weighted average time for which these rates are fixed is 5.4 years (2010:

n/a). The weighted average interest rate for the Group’s euro denominated fixed rate borrowings

is 4.3% (2010: 5.3%). The weighted average time for which the rates are fixed is 3.8 years (2010:

3.4 years). The weighted average interest rate for the Group’s US dollar denominated fixed rate

borrowings is 5.4% (2010: 5.5%). The weighted average time for which the rates are fixed is 9.7

years (2010: 12.3 years). The weighted average interest rate for the Group’s other currency fixed

rate borrowings is 9.2% (2010: 10.1%). The weighted average time for which the rates are fixed is

2.0 years (2010: 1.5 years).

(2) Other borrowings of £3,190 million (2010: £3,405 million) are the liabilities arising under options

over direct and indirect interests in Vodafone Essar.

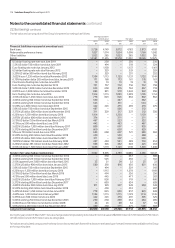

The figures shown in the tables above take into account interest rate swaps

used to manage the interest rate profile of financial liabilities. Interest on

floating rate borrowings is generally based on national LIBOR equivalents or

government bond rates in the relevant currencies.

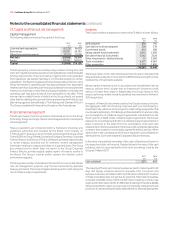

At 31 March 2011 the Group had entered into foreign exchange contracts to

decrease its sterling, US dollar and other currency borrowings above by

£10,198 million and amounts equal to £374 million and £105 million

respectively, and to increase its euro and Japanese yen currency borrowings

above by amounts equal to £8,590 million and £2,141 million respectively.

At 31 March 2010 the Group had entered into foreign exchange contracts to

decrease its sterling currency borrowings above by £8,257 million and to

increase its euro, US dollar, Japanese yen and other currency borrowings

above by amounts equal to £5,473 million, £1,490 million, £527 million and

£730 million respectively.

Further protection from euro and US dollar interest rate movements is

provided by interest rate swaps. At 31 March 2011 the Group had euro

denominated interest rate swaps covering the period March 2011 to

September 2015 for an amount equal to £883 million and US dollar

denominated interest swaps covering the period March 2011 to September

2015 for an amount equal to £641 million. The average effective rate which

has been fixed is 1.23% for euro denominated interest rate swaps and 1.73%

in relation to US dollar denominated interest rate swaps.

The Group has entered into euro and US dollar denominated interest rate

futures. The euro denominated interest rate futures cover the periods

September 2011 to December 2011, December 2011 to March 2012, March

2012 to June 2012 and June 2012 to September 2012 for amounts equal to

£2,083 million, £833 million, £7,185 million and £6,811 million respectively.

Additional cover is provided for the period March 2013 to March 2014 and

March 2015 to March 2016 for average amounts for each period equal to

£2,006 million and £2,331 million respectively. The US dollar denominated

interest rate futures cover the periods June 2011 to September 2011, June

2013 to September 2013 and September 2013 to December 2013 for

amounts equal to £3,601 million, £1,923 million and £833 million

respectively. The average effective rate which has been fixed is 2.87% for

euro denominated interest rate futures and 1.33% for US dollar denominated

interest rate futures.

The Group has entered into interest rate futures to alter the level of

protection against interest rate movements during some futures periods.

During the period June 2016 to December 2016 euro denominated interest

rate swaps will reduce the level of fixed rate debt in the Group by an amount

equal to £833 million. US dollar denominated futures will reduce the level

of fixed rate debt during the period March 2016 to March 2019 for an amount

equal to £321 million. US dollar denominated interest rate futures will

reduce the level of fixed rate debt during the periods September 2012 to

December 2012 and December 2013 to March 2014 for amounts equal to

£4,487 million and £1,282 million respectively.

At 31 March 2010 the Group had entered into euro and US dollar

denominated interest rate futures. The euro denominated interest rate

futures cover the period June 2010 to September 2010, September 2010 to

December 2010 and December 2010 to March 2011 for amounts equal to

£7,888 million, £8,461 million and £4,067 million respectively. The average

effective rate which has been fixed is 1.27%. The US dollar denominated

interest rate futures cover the period June 2010 to September 2010,

September 2010 to December 2010 and December 2010 to March 2011 for

amounts equal to £3,197 million, £2,582 million, and £1,119 million

respectively. The average effective rate which has been fixed is 0.86%.

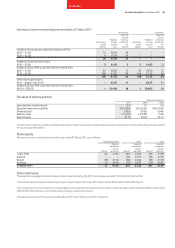

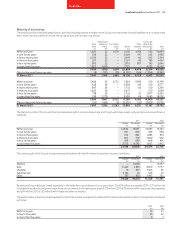

Borrowing facilities

At 31 March 2011 the Group’s most significant committed borrowing

facilities comprised two bank facilities which remained undrawn throughout

the period of €4,150 million (£3,666 million) and US$4,170 million (£2,596

million) both expiring between four and five years (2010: two bank facilities

of US$4,115 million (£2,709 million) and US$5,025 million (£3,308 million)),

a US$650 million (£405 million) bank facility which expires in more than five

years (2010: US$650 million (£428 million)), a ¥259 billion (2010: ¥259

billion (£1,821 million)) term credit facility expired during the period, two

loan facilities of €400 million (£353 million) and €350 million (£309 million)

both expiring between two and five years (2010: two loan facilities of €400

million (£356 million) and €350 million (£312 million) and a loan facility of

€410 million (£362 million) which expires in more than five years (2010:

€410 million (£365 million)). The €400 million and €350 million loan facilities

were fully drawn on 14 February 2007 and 12 August 2008 respectively and

the €410 million facility was drawn on 30 July 2010.

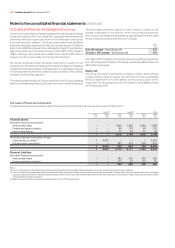

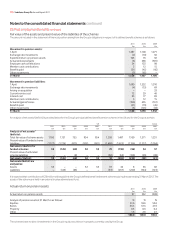

Under the terms and conditions of the €4,150 million and US$4,170 million

bank facilities, lenders have the right, but not the obligation, to cancel their

commitment 30 days from the date of notification of a change of control of

the Company and have outstanding advances repaid on the last day of the

current interest period.

The facility agreements provide for certain structural changes that do not

affect the obligations of the Company to be specifically excluded from the

definition of a change of control. This is in addition to the rights of lenders to

cancel their commitment if the Company has committed an event of default.

The terms and conditions of the €400 million loan facility are similar to those

of the US dollar bank facilities, with the addition that, should the Group’s

Turkish operating company spend less than the equivalent of US$800

million on capital expenditure, the Group will be required to repay the drawn

amount of the facility that exceeds 50% of the capital expenditure.

The terms and conditions of the €350 million loan facility are similar to those

of the US dollar bank facilities, with the addition that, should the Group’s

Italian operating company spend less than the equivalent of €1,500 million

on capital expenditure, the Group will be required to repay the drawn

amount of the facility that exceeds 18% of the capital expenditure.

The terms and conditions of the €410 million loan facility are similar to those

of the US dollar bank facilities, with the addition that, should the Group’s

German fixed line operation, spend less than the equivalent of €824 million

on capital expenditure, the Group will be required to repay the drawn

amount of the facility that exceeds 50% of the capital expenditure.