Vodafone 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Vodafone Group Plc Annual Report 2011

Financial position and resources continued

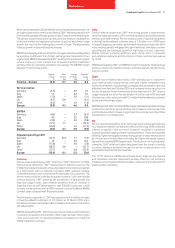

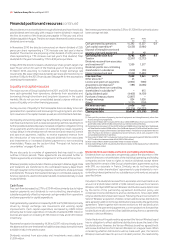

Net debt

Our consolidated net debt position at 31 March was as follows:

2011 2010

£m £m

Cash and cash equivalents(1) 6,252 4,423

Short-term borrowings:

Bonds (2,470) (1,174)

Commercial paper(2) (1,660) (2,563)

Put options over non-controlling interests (3,113) (3,274)

Bank loans (2,070) (3,460)

Other short-term borrowings(1) (593) (692)

(9,906) (11,163)

Long-term borrowings:

Put options over non-controlling interests (78) (131)

Bonds, loans and other long-term borrowings (28,297) (28,501)

(28,375) (28,632)

Other financial instruments(3) 2,171 2,056

Net debt (29,858) (33,316)

Notes:

(1) At 31 March 2011 the amount includes £531 million (2010: £604 million) in relation to cash

received under collateral support agreements.

(2) At 31 March 2011 US$551 million was drawn under the US commercial paper programme and

€1,490 million was drawn under the euro commercial paper programme.

(3) Comprises i) mark-to-market adjustments on derivative financial instruments which are included

as a component of trade and other receivables (2011: £2,045 million; 2010: £2,128 million) and

trade and other payables (2011: £548 million; 2010: £460 million) and ii) short-term investments

in index linked government bonds and collateral support agreements included as a component

of other investments (2011: £674 million; 2010: £388 million). These government bonds have

less than six years to maturity, can be readily converted into cash via the repurchase market and

are held on an effective floating rate basis.

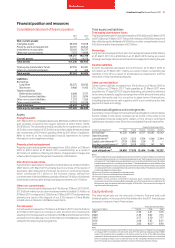

At 31 March 2011 we had £6,252 million of cash and cash equivalents which

are held in accordance with our treasury policy.

We hold cash and liquid investments in accordance with the counterparty

and settlement risk limits of the Board approved treasury policy. The main

forms of liquid investments at 31 March 2011 were money market funds, UK

index linked government bonds and bank deposits.

Net debt decreased by £3,458 million to £29,858 million primarily due to the

sale of our interests in SoftBank and the element of the proceeds from the sale

of our 3.2% interest in China Mobile Limited which was not committed to the

share buyback programme. The £7,049 million free cash flow generated

during the year was primarily used to fund £4,468 million of dividend

payments to shareholders as well as spectrum purchases in Germany and

India. Net debt represented 32.8% of our market capitalisation at 31 March

2011 compared with 41.6% at 31 March 2010. Average net debt at month end

accounting dates over the 12 month period ended 31 March 2011 was

£31.4 billion and ranged between £28.4 billion and £34.9 billion during the year.

The cash received from collateral support agreements mainly reflects the

value of our interest rate swap portfolio which is substantially net present

value positive. See note 21 to the consolidated financial statements for

further details on these agreements.

Commercial paper programmes

We currently have US and euro commercial paper programmes of

US$15 billion and £5 billion respectively which are available to be used to

meet short-term liquidity requirements. At 31 March 2011 an amount

external to the Group of €1,490 million (£1,317 million) was drawn under the

euro commercial paper programme and US$551 million (£343 million) was

drawn down under the US commercial paper programme, with such funds

being provided by counterparties external to the Group. At 31 March 2010

US$245 million (£161 million) was drawn under the US commercial paper

programme and €2,491 million (£2,219 million), £161 million and

US$33 million (£22 million) was drawn under the euro commercial paper

programme. The commercial paper facilities were supported by

US$4.2 billion (£2.6 billion) and €4.2 billion (£3.7 billion) of syndicated

committed bank facilities (see “Committed facilities”), which mature on

9 March 2016 and 1 July 2015 respectively. No amounts had been drawn

under either bank facility.

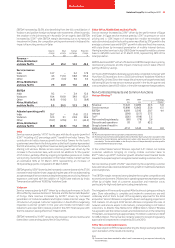

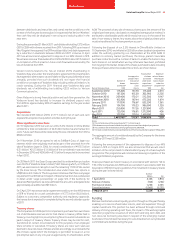

Bonds

We have a €30 billion euro medium-term note programme and a US shelf

programme which are used to meet medium to long-term funding

requirements. At 31 March 2011 the total amounts in issue under these

programmes split by currency were US$14.3 billion, £2.6 billion, €10.6 billion

and £0.2 billion sterling equivalent of other currencies.

In the year ended 31 March 2011 bonds with a nominal value equivalent of

£0.7 billion at the relevant 31 March 2011 foreign exchange rates were

issued under the US shelf and the euro medium-term note programme. The

bonds issued during the year were:

Nominal Sterling

amount equivalent

Date of bond issue Maturity of bond Million Million

August 2010 August 2011 US$100 64

March 2011 March 2016 US$600 374

March 2011 March 2021 US$500 311

At 31 March 2011 we had bonds outstanding with a nominal value of

£20,987 million (2010: £21,963 million).

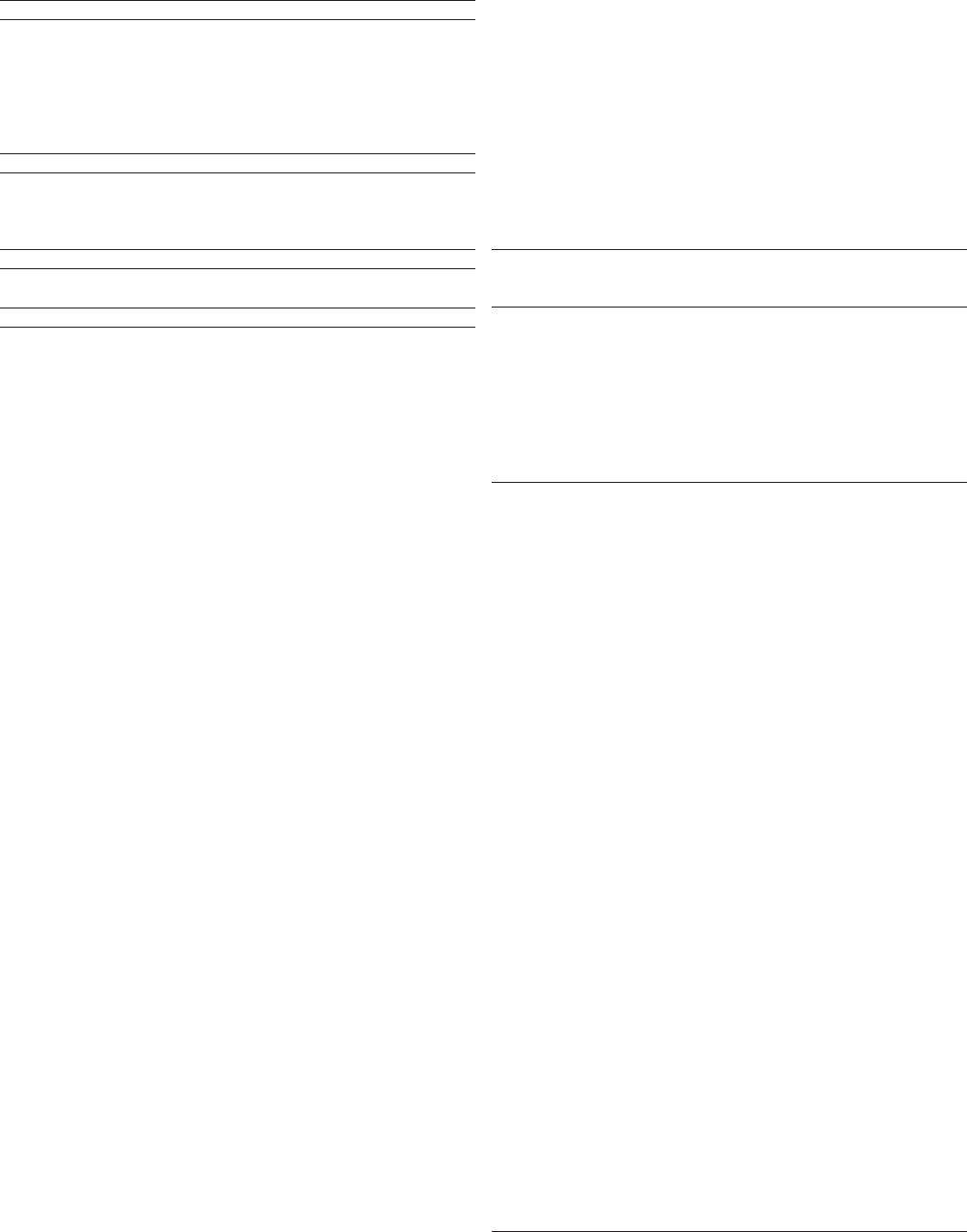

Committed facilities

The following table summarises the committed bank facilities available to

us at 31 March 2011.

Committed bank facilities Amounts drawn

1 July 2010

€4.2 billion syndicated

revolving credit facility,

maturing 1 July 2015

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

9 March 2011

US$4.2 billion syndicated

revolving credit facility,

maturing 9 March 2016

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

16 November 2006

€0.4 billion loan facility,

maturing 14 February 2014

This facility was drawn down in full

on 14 February 2007. The facility

is available for financing capital

expenditure in our Turkish

operating company.

28 July 2008

€0.4 billion loan facility,

maturing 12 August 2015

This facility was drawn down in full

on 12 August 2008. The facility is

available for financing the roll-out of

converged fixed mobile broadband

telecommunications network in Italy.

15 September 2009

€0.4 billion loan facility,

maturing 30 July 2017

This facility was drawn down in full

on 30 July 2010. The facility is available

for financing capital expenditure in our

German operations.

29 September 2009

US$0.7 billion export

credit agency loan facility,

final maturity date

19 September 2018

An initial drawing was made of

US$120 million on 3 November 2010.

The facility is available for financing

eligible Swedish goods and services.