Vodafone 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Vodafone Group Plc Annual Report 2011

Operating results continued

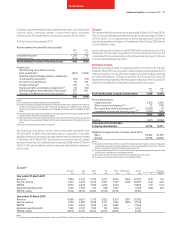

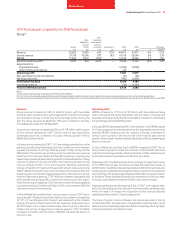

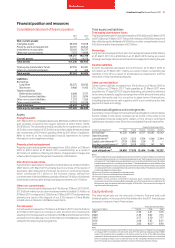

Net financing costs

2010 2009

£m £m

Investment income 716 795

Financing costs (1,512) (2,419)

Net financing costs (796) (1,624)

Analysed as:

Net financing costs before dividends

from investments (1,024) (1,480)

Potential interest charges arising on

settlement

of outstanding tax issues(1) (23) 81

Dividends from investments 145 110

Foreign exchange(2) (1) 235

Equity put rights and similar arrangements(3) (94) (570)

Interest on settlement of German tax claim(4) 201 –

(796) (1,624)

Notes:

(1) Excluding interest on settlement of German tax claim.

(2) Comprises foreign exchange differences reflected in the income statement in relation to certain

intercompany balances and the foreign exchange differences on financial instruments received

as consideration in the disposal of Vodafone Japan to SoftBank in April 2006.

(3) Primarily represents foreign exchange movements and accretion expense. Further details of

these options are provided on page 51.

(4) See “Taxation” below for further details.

Net financing costs before dividends from investments decreased from

£1,480 million to £1,024 million primarily due to the impact of significantly

lower interest rates given our preference for floating rate borrowing,

partially offset by the 13.4% increase in average net debt being offset by

changes in the currency mix of debt. At 31 March 2010 the provision for

potential interest charges arising on settlement of outstanding tax issues

was £1,312 million (31 March 2009: £1,635 million).

Taxation

The effective tax rate was 0.6% (2009: 26.5%). This rate was lower than our

weighted average statutory tax rate principally due to the impact of the

agreement of the German write down losses (see note 6 to the consolidated

financial statements) and also the ongoing benefits from our internal

capital structure.

Income tax expense includes a credit of £2,103 million arising from the

German tax authorities’ decision that €15 billion of losses booked by a

German subsidiary in 2001 are tax deductible. The credit includes benefits

claimed in respect of prior years as well as the recognition of a deferred tax

asset for the potential use of losses in future tax years.

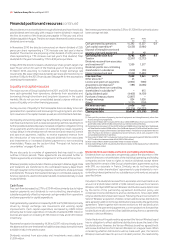

Earnings per share

Adjusted earnings per share decreased by 6.2% to 16.11 pence for the year

ended 31 March 2010 due the prior year tax benefit discussed above. Basic

earnings per share increased to 16.44 pence primarily due to the impairment

losses of £5,900 million in relation to Spain, Turkey and Ghana in the prior

year compared to net impairment losses of £2,100 million in 2010 and the

income tax credit arising from the German tax settlement discussed above.

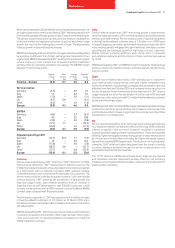

2010 2009

£m £m

Profit attributable to equity shareholders 8,645 3,078

Pre-tax adjustments:

Impairment losses, net 2,100 5,900

Other income and expense (114) –

Non-operating income and expense 10 44

Investment income and financing costs(1) (106) 335

1,890 6,279

Taxation (2,064) (300)

Adjusted profit attributable to equity

shareholders 8,471 9,057

Weighted average number of shares outstanding Million Million

Basic 52,595 52,737

Diluted 52,849 52,969

Note:

(1) See notes 1 and 2 in “Net financing costs” to the left.

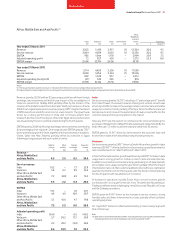

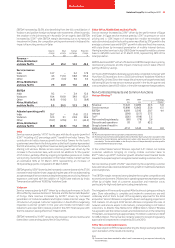

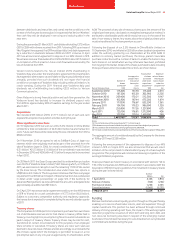

Europe

Germany Italy Spain UK Other Eliminations Europe % change

£m £m £m £m £m £m £m £ Organic

Year ended 31 March 2010

Revenue 8,008 6,027 5,713 5,025 8,357 (297) 32,833 0.2 (4.5)

Service revenue 7,722 5,780 5,298 4,711 7,943 (295) 31,159 0.9 (3.8)

EBITDA 3,122 2,843 1,956 1,141 2,582 – 11,644 (3.9) (8.9)

Adjusted operating profit 1,695 2,107 1,310 155 1,084 – 6,351 (7.0) (12.6)

EBITDA margin 39.0% 47.2% 34.2% 22.7% 30.9% 35.5%

Year ended 31 March 2009

Revenue 7,847 5,547 5,812 5,392 8,514 (343) 32,769

Service revenue 7,535 5,347 5,356 4,912 8,070 (343) 30,877

EBITDA 3,225 2,565 2,034 1,368 2,920 – 12,112

Adjusted operating profit 1,835 1,839 1,421 328 1,406 – 6,829

EBITDA margin 41.1% 46.2% 35.0% 25.4% 34.3% 37.0%